Embarking on the journey to buy a home involves several crucial steps to ascertain your investment in the right property. Many buyers, for instance, include a home inspection clause in their purchasing agreements, allowing them to withdraw from the transaction without any financial repercussions if the inspection uncovers significant issues unless these problems are adequately rectified.

However, the property survey is a vital document often overlooked before finalizing a home purchase. You certainly would want to take advantage of this critical piece of information.

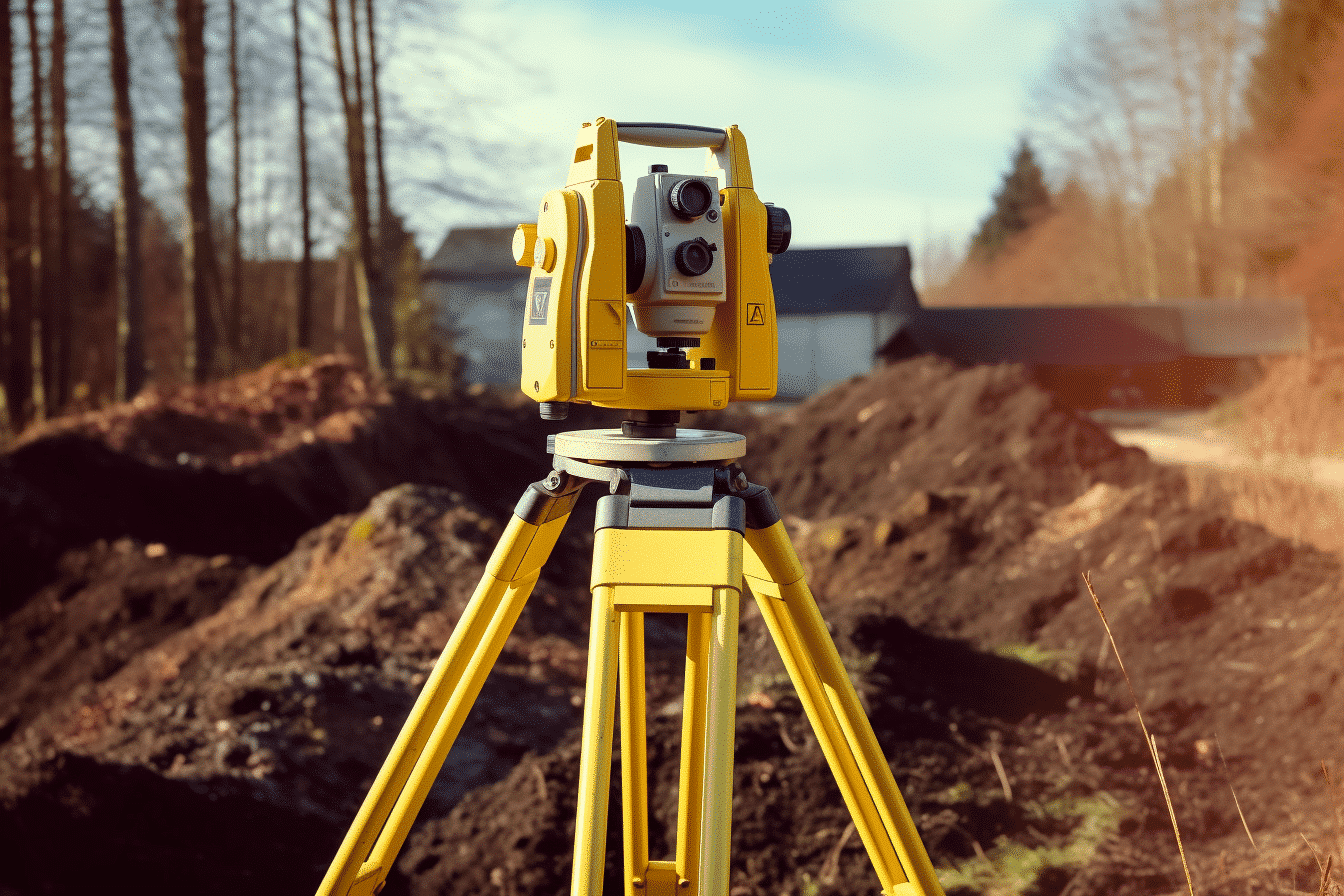

Understanding the Significance of Property Surveys A property survey is an essential document outlining the exact boundaries of your property – crucial information to be aware of.

Imagine a scenario where your home and the adjacent property share an unfenced outdoor area. A property survey would delineate the portion of the property that belongs to you versus your neighbour.

But the utility of a property survey extends beyond this essential boundary demarcation. It also highlights if your land is subject to restrictions, which could significantly influence your decision to buy that specific home.

For instance, your property survey may reveal that a portion of your yard is on conservation land or that an easement exists. This would mean you may be unable to alter that section of your property, such as tree planting or removal, or the construction of any permanent structures like a swimming pool, shed, or fence.

Such revelations could be potential deal-breakers, depending on your vision for the property. Therefore, it is in your best interest to understand the details of your property survey before signing your mortgage and committing to the home purchase.

Securing a Copy of Your Property Survey For existing homeowners seeking their property survey for an outdoor project (like installing a pool, for which you would likely need a copy), you can procure it from your local tax assessor’s office or town office.

According to Experian, if you’re buying a home, your mortgage lender or title company can assist you in obtaining a copy. It’s common for lenders or title companies to commission a new survey during the closing process, often included in your closing costs. Since you’re footing the bill, reviewing this document is your right.

While it might be tempting to skim over your property survey during home-buying, not scrutinizing it could lead to regrettable mistakes. Therefore, just as you would only purchase a home after thoroughly analyzing the inspection report, it is equally vital to understand your property survey and ensure no red flags are overlooked.

Being an informed and diligent home buyer entails more than just securing finance and home inspections. Understanding your property survey, with its wealth of critical information, plays an equally significant role. Ensuring you have comprehensive knowledge of the property’s boundaries and any existing restrictions can avert potential surprises and disappointments. Just as you would only purchase a car without understanding its history, buying a home should be the same. Make your property survey your road map to a successful home purchase, and you’ll avoid the pitfalls of overlooking this essential document.