Which retailer is poised to boost your portfolio?

The retail landscape is cutthroat, with only a handful truly thriving. A company needs either a massive scale or a dominant market presence to maintain steady sales and growth. Even then, the omnipresent competition can erode profit margins with relentless price wars.

Both Walmart (NYSE: WMT) and Lowe’s (NYSE: LOW) have carved a niche in this challenging space. Each offers compelling reasons for investment, though they may not be flawless across all fronts.

Yet, when capital is limited, an investor must choose wisely. Let’s delve into a comparative analysis to determine the superior stock option today.

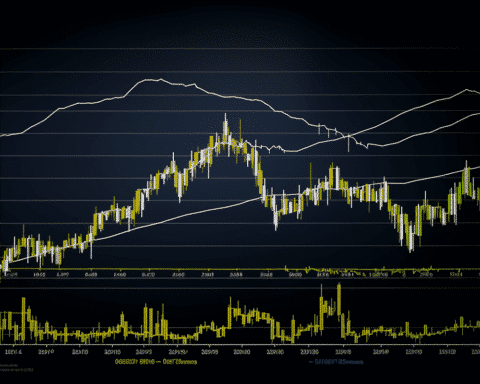

Momentum and Growth

Both retailers showcased commendable earnings this past mid-August. However, Walmart currently rides a stronger wave, reporting a 6% increase in comparable-store sales in the U.S. during Q2, while Lowe’s saw a 2% dip.

This shouldn’t be an immediate red flag. The home improvement sector is experiencing a slight downturn after years of remarkable growth. Lowe’s rival, Home Depot, too, registered a minor Q2 decline.

Nonetheless, Walmart’s results exceeded expectations, prompting the management to up their 2023 sales growth forecast to a range of 4% to 4.5%, an increase from the earlier 3.5% estimate. Conversely, Lowe’s maintained its projection, hinting at minor declines for 2023. Hence, those aiming for rapid growth might lean more towards Walmart.

Profitability and Dividends

On the financial front, Lowe’s has an edge. Boasting a remarkable 16% margin, Lowe’s raked in $4 billion in operating profits from $25 billion in sales last quarter. Walmart, while improving, consistently hovers around a 3% to 4% sales margin. This disparity isn’t expected to change dramatically due to the distinct product categories each caters to.

For those eyeing dividends, Lowe’s appears more enticing with a 2% yield, in comparison to Walmart’s 1.5%. Nevertheless, both exhibit a robust history, with around 50 consecutive years of increasing annual payouts, indicating a consistent rise in dividends.

Valuation Insights

From a valuation standpoint, conservative investors might gravitate towards Walmart. It boasts a valuation of 0.7 times sales, almost half of Lowe’s 1.4 times. Walmart’s valuation is also more consistent, given its expansive sales reach and resilience to economic downturns. While Lowe’s might see sharper spikes during economic booms, it is also more susceptible to downturns.

Considering the broader picture, Walmart seems to have the upper hand. It promises enhanced growth and profit margins, and its leading position in the industry offers advantages over Lowe’s, especially when pitted against competitors like Home Depot.

In the foreseeable future, both retailers are on track to break their sales and profit records. Yet, for an optimal blend of capital growth and dividend returns in 2023 and beyond, Walmart emerges as the more prudent choice.

In the intricate dance of investing, selecting the right retail stock can be pivotal. Between Walmart and Lowe’s, each offers its unique blend of opportunities and challenges. While Lowe’s stands strong in profitability and dividend allure, Walmart’s resilience, consistent growth, and vast industry footprint render it a potentially wiser choice for the long haul. Regardless of the choice, investors should remain diligent, constantly monitoring market shifts and company trajectories to maximize returns.