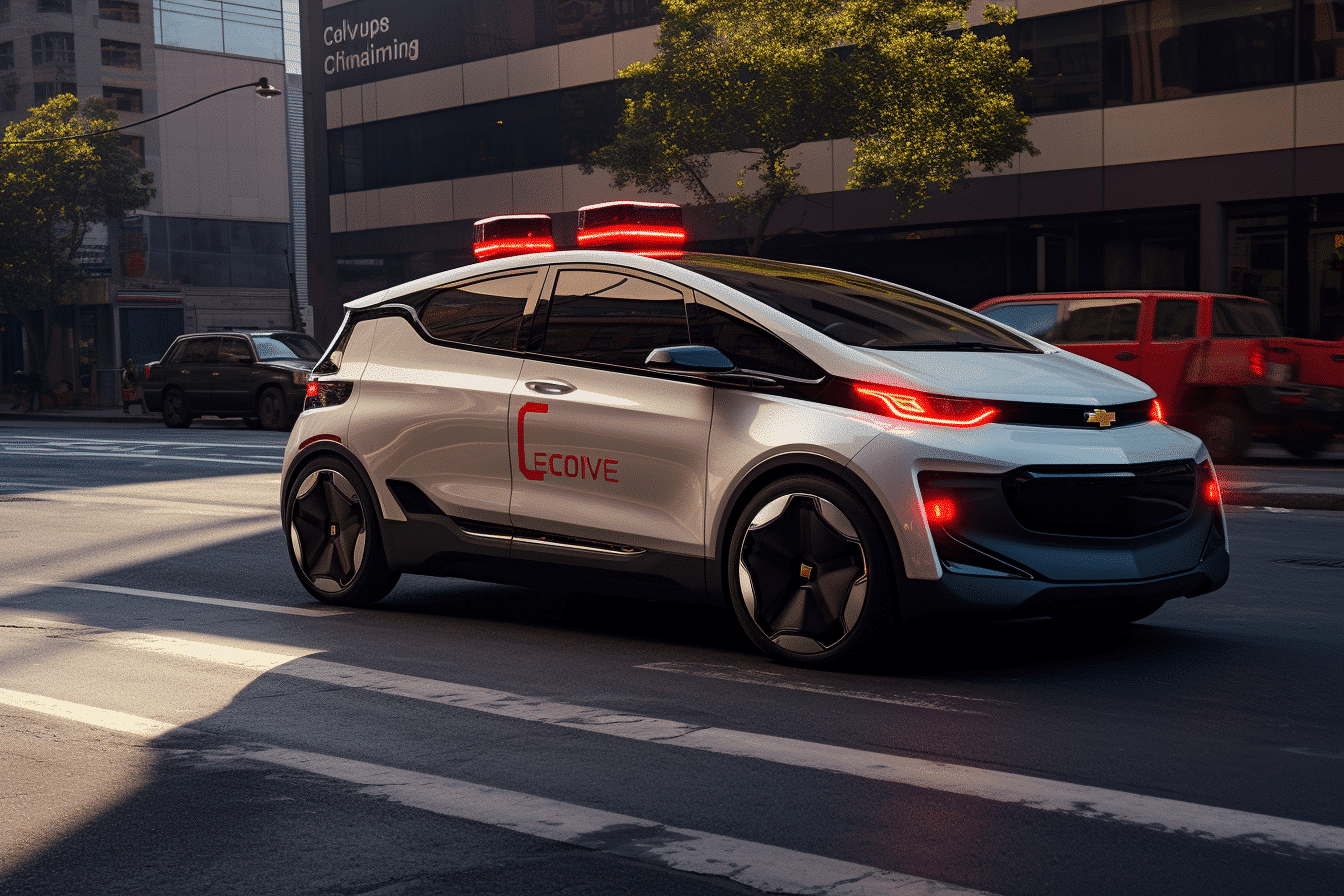

In recent years, General Motors (GM) has ventured into various trendy industries, seeking to diversify its portfolio beyond traditional automobile manufacturing. One of the most notable ventures is Cruise, a majority-owned subsidiary specializing in autonomous vehicles (AVs). Initially perceived as a promising business opportunity, Cruise is now facing significant challenges, casting doubts on the future of GM’s ambitious endeavour. This article examines Cruise’s journey, exploring the setbacks, leadership changes, and financial implications for GM alongside industry perspectives on the viability of autonomous vehicles.

Cruise’s trajectory has shifted dramatically since GM’s acquisition in 2016, aimed at competing against tech giants and emerging mobility companies. The subsidiary, tasked with pioneering robotaxis, has encountered a series of setbacks, most notably an incident on October 2, where a pedestrian was dragged by a Cruise self-driving vehicle in San Francisco. This event led to a grounding of Cruise’s robotaxi fleet, triggering independent safety probes and a wave of internal and external investigations.

The aftermath saw significant leadership changes, including the departure of cofounders and a 24% workforce reduction. GM CEO Mary Barra, addressing these issues, expressed confidence in “righting the ship” at Cruise, emphasizing trust, accountability, and transparency. However, the scale of these challenges is formidable. Sam Abuelsamid, a principal research analyst at Guidehouse Insights, casts doubt on the immediate profitability of AV technology, suggesting that robotaxis may not be a viable business within this decade.

Despite these hurdles, GM remains committed to Cruise, albeit more cautiously. The automaker has scaled back on growth plans for Cruise, including pausing production of a new robotaxi. Financial analysts, like Morgan Stanley’s John Murphy, anticipate further updates and strategies at an upcoming investor event.

Cruise’s struggles reflect a broader industry trend, with many companies reassessing their AV ventures. Competitors like Lyft, Uber, and Ford Motor/Volkswagen-backed Argo AI have ended their autonomous vehicle programs, citing high investment costs and unproven market viability. Conversely, Alphabet-backed Waymo and Amazon-backed Zoox continue to test autonomous vehicles, indicating that the race for successful AV deployment is still on.

GM’s experience with Cruise adds to its history of ambitious but ultimately unsuccessful ventures, including carsharing brand Maven, partnerships with Uber and Lyft, and various other investments. Not all of GM’s noncore businesses have failed; however, GM Energy and the BrightDrop commercial EV unit continue to operate, showcasing the company’s ability to adapt and innovate.

Financially, Cruise has been a significant investment for GM, with losses exceeding $8 billion since 2016. While GM has attracted investors like Honda Motor, SoftBank Vision Fund, Walmart, and Microsoft, the company recently repurchased SoftBank’s equity stake, indicating a shift in its investment strategy.

Cruise’s journey epitomizes the challenges traditional automakers face in adapting to the rapidly evolving landscape of mobility and technology. While GM remains optimistic about Cruise’s potential, the path to profitability and market viability must be improved. As the industry continues to grapple with the complexities of autonomous vehicle technology, GM’s experience with Cruise serves as a cautionary tale, highlighting the need for strategic foresight, financial prudence, and technological expertise in navigating the future of mobility.