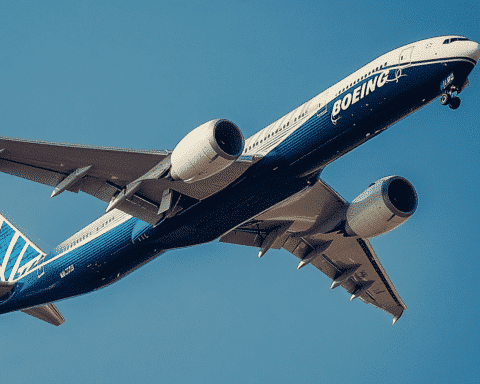

Alaska Airlines has recently announced a significant financial setback due to the grounding of the Boeing 737 Max 9 aircraft, estimating the cost to be $150 million. The grounding, which has lasted for several weeks, was initiated by the Federal Aviation Administration (FAA) following an incident where a door plug blew out during a flight on January 5. The FAA has since approved inspection instructions allowing these aircraft to return to service. Alaska Airlines expects to resume Max 9 flights as early as Friday and plans a gradual reintroduction through early February.

The issue has affected Alaska and United Airlines, the only U.S. carriers with Max 9s in their fleets, who discovered loose bolts on several planes during preliminary inspections after the incident. This discovery has led to frustration and anger among the airlines’ executives. Alaska’s CEO Ben Minicucci expressed his feelings to NBC News: “I’m more than frustrated and disappointed. I am angry.”

Despite the financial hit from the grounding, Alaska Airlines remains optimistic about its economic outlook, forecasting full-year adjusted earnings per share of between $3 and $5, including the impact of the Max grounding. This forecast aligns with analyst expectations, which predicted adjusted earnings of $4.93 a share on average. The airline had initially anticipated a capacity growth of 3% to 5% this year. Still, due to the grounding and potential future delivery delays, it now expects growth to be at or below the lower end of this range.

During an earnings call, Shane Tackett, Alaska’s CFO, addressed the financial implications of the grounding, indicating that the airline expects to be compensated for the profit impact. However, details of this process have not yet been disclosed. Despite the challenges, the airline’s shares increased by more than 4% on Thursday, reflecting investor confidence.

The grounding of the Boeing 737 Max 9 has posed significant challenges for Alaska Airlines, both operationally and financially. However, with the planes set to return to service and a transparent financial forecast, the airline is poised to navigate through these turbulent times. The situation underscores the complexities and interdependencies within the aviation industry, highlighting the need for stringent safety measures and robust crisis management strategies.