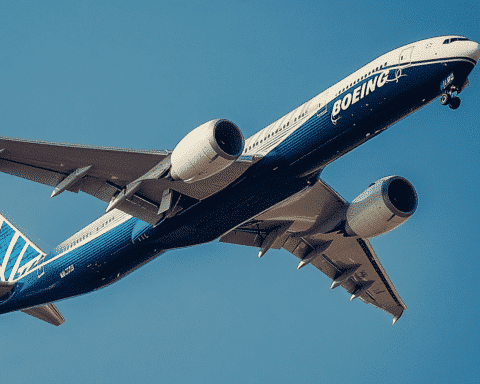

Boeing has announced plans to raise $25 billion through shares or debt over three years. The aerospace giant is taking this step to enhance its liquidity as it grapples with ongoing challenges, including a machinist strike and broader issues in its aircraft production programs. The move is seen as a critical effort to stabilize its finances during a turbulent period.

Strengthening Liquidity for Stability

Boeing’s decision to raise capital comes as the company faces many financial challenges. According to a company statement, “This universal shelf registration provides flexibility for the company to seek a variety of capital options as needed to support the company’s balance sheet over three years.” This flexibility will allow Boeing to access funds in both equity and debt markets to manage its operations more efficiently.

In addition to the $25 billion plan, Boeing also revealed that it had secured a $10 billion credit agreement with a consortium of banks. “The credit facility provides additional short-term access to liquidity as we navigate through a challenging environment,” Boeing said. The company clarified that it has not yet utilized this credit facility or its existing credit revolver.

Struggles Amid Machinist Strike

Boeing’s financial struggles have been exacerbated by a monthlong machinist strike, which is estimated to cost the company over $1 billion a month, according to S&P Global Ratings. The two sides have yet to agree, leaving Boeing with operational and financial uncertainties.

Credit rating agencies, including S&P Global Ratings, have raised concerns that Boeing’s credit rating may be downgraded if the company does not address these issues quickly. A downgrade would add more financial strain as it could increase the company’s borrowing cost.

Leadership and Workforce Challenges

Boeing’s new CEO, Kelly Ortberg, who took over in August, has been candid about the company’s challenges. In a recent statement, Ortberg said Boeing plans to lay off 17,000 employees, representing 10% of its global workforce, as part of cost-cutting efforts. “We need to be clear-eyed about the work we face and realistic about the time it will take to achieve key milestones on the path to recovery,” Ortberg said. He emphasized that Boeing must focus its resources on areas that are “core to who we are.”

This news came alongside Boeing’s preliminary financial results, which revealed growing losses and $5 billion in charges across its defense and commercial airplane units. The company’s stock has also taken a significant hit, down nearly 43% year-to-date.

Despite the current challenges, Boeing’s leadership remains focused on navigating the difficult path ahead. CEO Kelly Ortberg is set to hold his first quarterly investor call on October 23, where he is expected to provide more insights into the company’s financial outlook and strategic plans.

Boeing’s efforts to raise capital and cut costs signal the company’s determination to overcome the hurdles it faces. However, with mounting losses, a costly strike, and potential credit downgrades looming, the road to recovery will likely be long and difficult.