Is Walmart a Wise Investment in the Current Market?

Investors often turn to Walmart (NYSE: WMT) during challenging times for stable performance.

Renowned for its low prices and economies of scale, the retail giant has long been considered recession-resistant, with over half of its revenue generated from grocery sales. This necessity-based spending remains consistent in both prosperous and challenging times.

This could explain Walmart’s recent outperformance in the market, but can this momentum be sustained?

Challenging Amazon’s Dominance

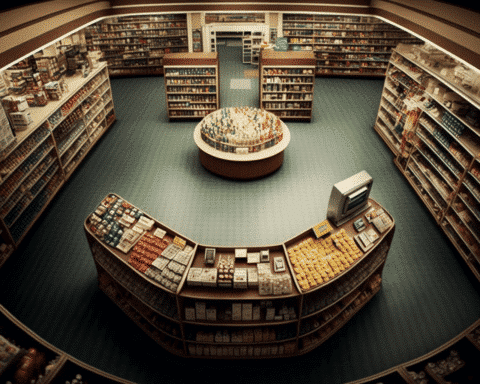

In recent years, Walmart has made significant strides, such as introducing grocery pickup stations, launching its Walmart+ membership program, expanding its marketplace and advertising ventures, divesting underperforming international businesses, and enhancing Sam’s Club operations.

These efforts have resulted in consistent, comparable sales growth, increased market share, and a transformation into a modern omnichannel retailer.

Signs suggest that Walmart is increasingly challenging Amazon’s position. The e-commerce giant recently raised its grocery delivery minimum order from $35 to $150, effectively conceding the sizable market to Walmart. Furthermore, Amazon has begun charging some customers for returns at UPS stores.

These changes imply that Amazon is deviating from its historical strategy of subsidizing losses for market share gains, potentially allowing Walmart to expand further and improve margins in areas traditionally dominated by Amazon, such as third-party e-commerce marketplaces.

Despite facing similar obstacles as other retailers, like increased inventories and sluggish sales in discretionary items, Walmart’s competitive standing has always remained strong.

Potential Pitfalls in Investing in Walmart Stock

Walmart is currently adapting to the post-pandemic business landscape. While it flourished during the early stages of the pandemic as an essential retailer, the ongoing economic recovery has shifted consumer behaviour, with people eager to spend time outside their homes.

This sudden change caught Walmart unprepared, resulting in a substantial inventory of $56.6 billion as of January 31. Additionally, excess inventory among competitors further complicates matters for investors.

Retailers must offer discounts and promotions to restore inventory to optimal levels, potentially reducing profit margins. Walmart’s operating profit margin decreased to 3.4% in its most recent quarter from 3.9% the previous year. The extent of required discounting remains uncertain.

Lastly, Walmart’s stock is trading at a price-to-earnings ratio of 35, roughly consistent with its average value over the past few years.

Balancing the Pros and Cons

Considering the factors above, investors need to weigh the pros and cons before deciding on Walmart’s stock.

Pros:

- Recession-resistant business model, with a significant portion of revenue from grocery sales.

- Consistent, comparable sales growth and increased market share.

- Successful transformation into a modern omnichannel retailer.

- Pressuring Amazon in areas like grocery delivery and third-party e-commerce marketplaces.

Cons:

- Rapidly changing consumer behaviour post-pandemic, with people eager to spend time outside their homes.

- Elevated inventory levels require discounts and promotions to reduce stock, which could impact profit margins.

- Walmart’s stock trading at a price-to-earnings ratio of 35, in line with its average value in recent years, offering no obvious bargaining opportunity.

While Walmart boasts a strong competitive position and has been making significant progress in various aspects of its business, investors should also consider its challenges. These include adapting to shifting consumer behaviour, addressing excessive inventory levels, and the stock’s current valuation. Ultimately, investors should weigh these factors against their risk tolerance and investment objectives before deciding whether to invest in Walmart’s stock.