Liechtenstein-based Artex plans to list over € 1bn worth of art in the upcoming months.

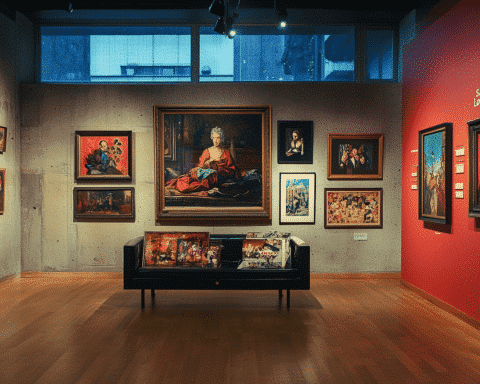

Artex, a pioneering “online art stock exchange,” is set to hold its first initial public offering (IPO) at London’s Victoria & Albert Museum on May 30. Yassir Benjelloun-Touimi, the exchange’s co-founder, along with Prince Wenceslas of Liechtenstein, remains secretive about the first piece being offered but reveals that the initial focus will be on artworks in the “€50m-plus range,” primarily Impressionist and Modern pieces.

“We require artists whose works have withstood the test of time and are recognized as highly valued. This offers maximum security,” explains Benjelloun-Touimi. He adds that provenance is easier to trace in Impressionist and Modern art, so they will initially avoid Old Masters. Eventually, art IPOs by leading contemporary artists will also be introduced.

Trading is expected to commence by July, with plans to list over € 1bn worth of art in the following months.

So, how will it function?

Like a traditional stock exchange, explains Benjelloun-Touimi, a former hedge fund manager who held senior roles at UBS and Bank of America Merrill Lynch. Artex, based in Liechtenstein, is regulated by the Financial Markets Authority of Liechtenstein, with IPOs underwritten by a bank. Investment bank Rothschild & Co is advising the exchange.

Artex owns all the art IPOs and will issue shares valued at €100. These shares can then be purchased, sold, or traded on a secondary market on the Artex exchange. Shareholders are limited to a 10% stake in each work, with anything beyond that threshold initiating a takeover bid that could be outbid.

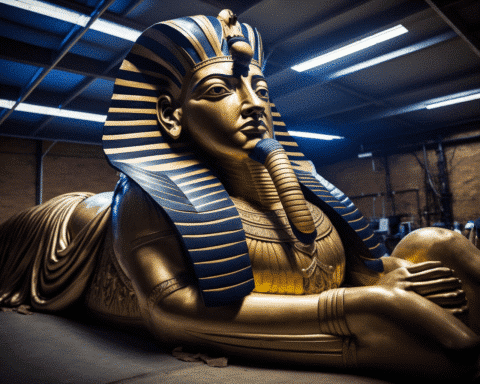

Instead of investors displaying the works in their homes or offices, all works owned by Artex will be available for temporary loan to museums.

“We will use a portion of our profits to support struggling cultural institutions,” says Benjelloun-Touimi. “We will also aid in art restoration and financing catalogues raisonné.” Additionally, the value of a loaned work may increase as it becomes part of a story.

The Gold Standard

How does art as an asset class compared to other investments? A 2020 Citi report indicates that between 1985 and 2020, contemporary art investors saw annualized returns of 11.5%, while gold investment assets only averaged 3.2% per year.

In the long run, Benjelloun-Touimi anticipates returns on art IPOs to be “similar to gold,” with macroeconomic factors such as interest rates affecting performance.

However, Benjelloun-Touimi believes there is significant potential for growth in the art asset class. “We are expanding the art market from just 500 to 1,000 people to millions, which should naturally push prices up,” he says.

Benjelloun-Touimi acknowledges the skepticism surrounding other art world fractional ownership attempts, such as NFTs, but emphasizes that the art exchange differs significantly from traditional art funds. “Artex could be seen as disruptive for the art world,” he notes, “but instead of cannibalizing what exists, we are enlarging the market.”

Despite the huge figures being discussed, Benjelloun-Touimi insists that art IPOs are not exclusive to the 1% investor. “We are democratizing access for retail, private banks, and institutional investors,” he says. “We aim to create a new type of patron who doesn’t have to be wealthy or knowledgeable. They must invest little time to decide whether they want to participate.”

Artex’s innovative approach to the art market aims to make high-value art accessible to a broader audience while supporting cultural institutions and fostering a new generation of art patrons. As the platform expands and diversifies its offerings, it can transform how people invest in and interact with the art world, promoting growth and creating new opportunities for investors and artists alike.

Artex’s groundbreaking art stock exchange has the potential to revolutionize the art market, making high-value art investments accessible to a broader range of investors while simultaneously supporting struggling cultural institutions. By democratizing the art market and fostering a new generation of art patrons, Artex could reshape how we invest in and engage with the art world, ultimately driving growth and creating new opportunities for investors and artists.