In the dynamic realm of electric vehicles (EVs), new contenders are constantly emerging, attempting to unseat or match established giants. Rivian and Lucid stand out among these challengers as they race to define their place in the market.

With unique strengths, business strategies, and market focuses, each presents intriguing prospects for investors.

As we dive deep into the comparative analysis provided by Parkev Tatevosian on Fool.com, let’s weigh the potential of these two innovative companies and what they bring to the table for shareholders.

Rivian’s Strengths:

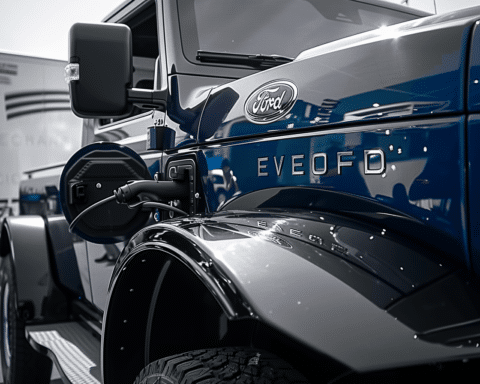

1. Product Diversity: Rivian has made waves with its all-electric R1T pickup truck and the R1S SUV. These vehicles cater to a segment of consumers seeking rugged, off-road-capable EVs.

2. Amazon Backing: One of Rivian’s key partnerships is with e-commerce giant Amazon, which has ordered 100,000 electric delivery vans from the automaker. This order provides financial stability and showcases Rivian’s ability to diversify its client base.

Lucid’s Strengths:

1. Luxury Market Focus: Lucid Motors aims to carve a niche in the luxury EV market with its Lucid Air model. The car boasts high-end interiors and impressive performance metrics, appealing to an upscale demographic.

2. Technological Prowess: Lucid’s in-house developed battery technology and powertrain are among the best in the industry, ensuring long-range and efficient performance.

Parkev Tatevosian’s analysis on Fool.com considers various factors, including market potential, production capabilities, and strategic partnerships. While Rivian’s diverse product line and backing from industry heavyweights make it a compelling choice, Lucid’s focus on the luxury market segment and technological advancements offer a unique proposition for investors.

Rivian and Lucid underscore the industry’s potential and the varied paths companies can take to succeed in the vast landscape of electric vehicle innovation.

Though having distinct strategies and market targets, both companies are shaping a future where EVs are not just an alternative but the mainstream choice.

While Parkev Tatevosian’s insights provide a solid foundation, the ever-evolving nature of the industry demands continuous observation.

As the world shifts gears towards a sustainable future, the actual value of these companies will unfold in their adaptability, innovation, and ability to meet market demands.