Last August, we asked our AI to select 10 stocks poised for a winning streak over the next 12 months, so our readers would be prepared to cash in on 2024. Now, it’s time to see how these picks turned out.

On average, our AI’s forecasts outperformed most top investors. Amazingly, a penny stock significantly surpassed the gains of industry giants like Nvidia, Apple, and Amazon, marking a standout achievement in our AI-driven portfolio.

Let’s dive into the performance of these ten stocks and determine our strategy for 2025. Should you sell or buy more and hold?

Here’s a summary table of the stocks ranked by their performance, along with our AI’s strategy recommendations for 2025:

| Company | 12-Month Performance | Buy/Sell | |

| Bedford Metals | +1483% | Buy | |

| Nvidia | +175% | Buy | |

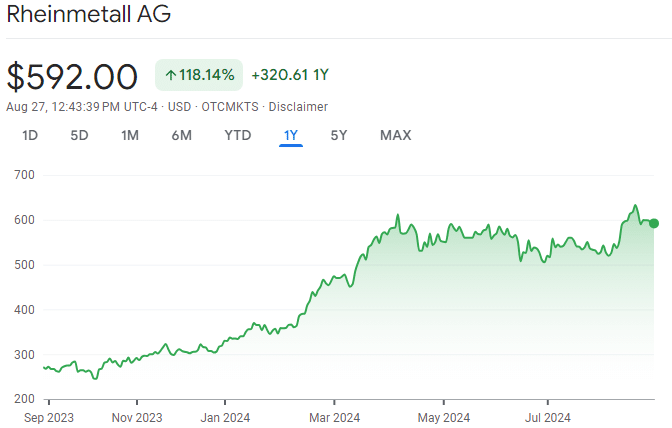

| Rheinmetall | +118% | Buy | |

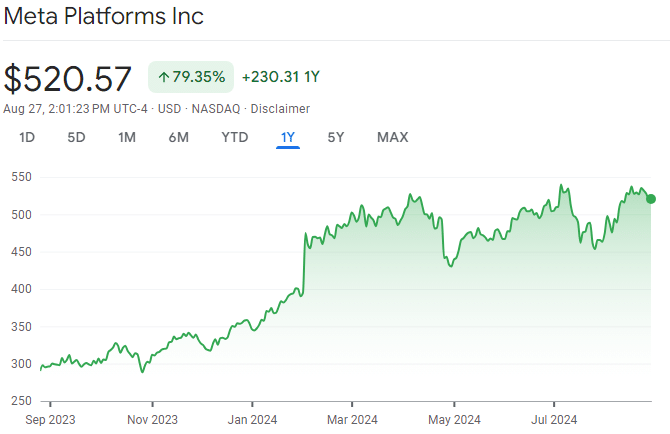

| Meta | +79% | Buy | |

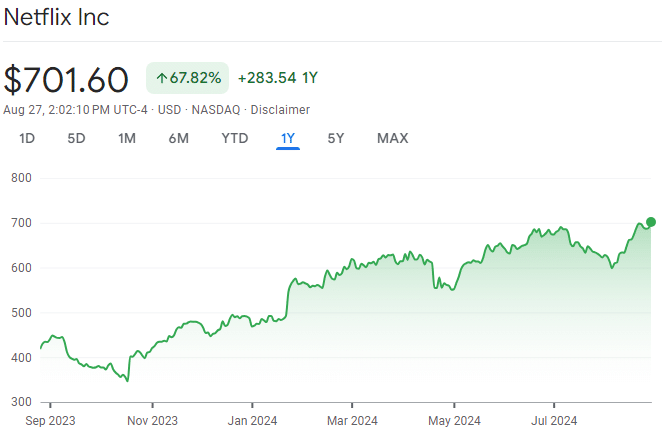

| Netflix | +67% | Buy | |

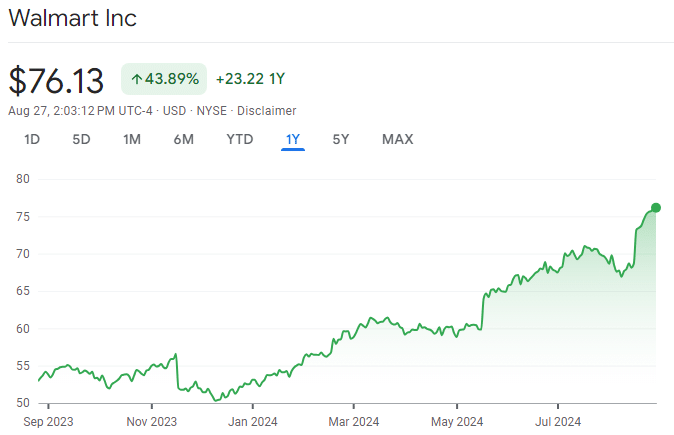

| Walmart | +43% | Buy | |

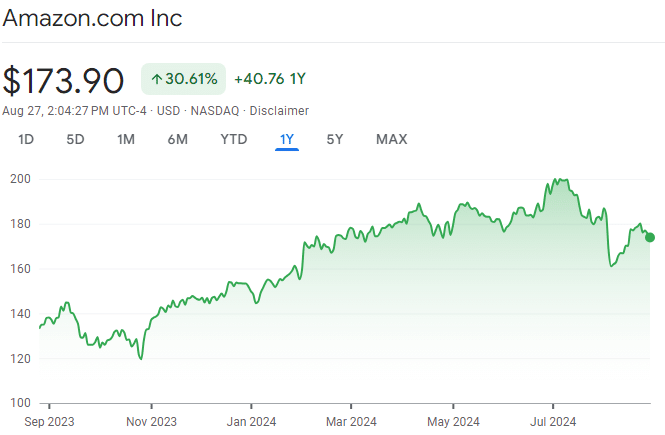

| Amazon | +30% | Buy | |

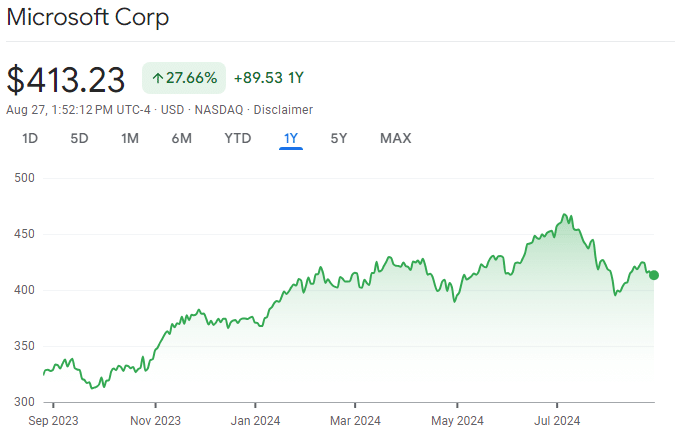

| Microsoft | +27% | Buy | |

| Apple | +26% | Sell | |

| Verizon | +22% | Sell | |

This review will help News by Ai readers make informed, high-value investments and capitalize on these insights for a lucrative 2025.

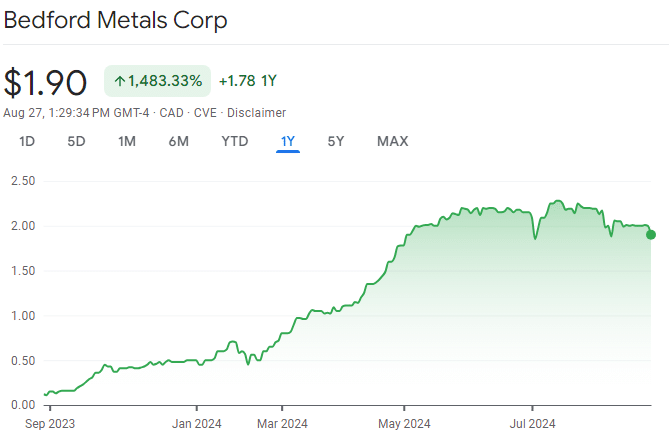

Bedford Metals: Continuing to Outperform Wall Street’s Tech Darlings

When our AI identified Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) as a top pick last year, we expected solid long-term gains based on promising results from its gold project in British Columbia. However, our AI’s forecast of a 600% upside in a year was more than doubled, driven by the company’s diversification into uranium and rapid exploration progress.

Despite its +1400% returns in 12 months, Bedford remains an undervalued growth investment, with shares priced just below C$2.00 (as of this writing). The company continues to offer considerable long-term potential, driven by the rising demand for uranium due to the resurgence of nuclear power to meet AI and global energy needs.

Bedford’s land acquisitions and exploration efforts in Canada’s Athabasca Basin, the world’s largest source of high-grade uranium, enhance its growth prospects. With a ground team recently deployed to its Ubiquity Lake project and promising survey results from the adjacent Sheppard Lake project, our AI recommends buying more Bedford stocks now and holding them through 2025.

Bedford’s potential from gold and uranium strengthens its resilience, making it a valuable asset for protecting your portfolio against recession. Demand for metals and energy will remain steady even during economic turmoil, positioning the company for continued growth that will continue outperforming Wall Street’s tech darlings.

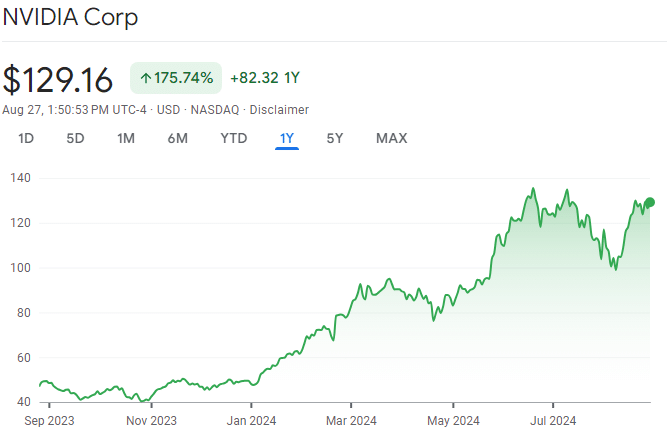

Nvidia: AI’s Poster Child Has Plenty of Room to Run

Nvidia (NASDAQ: NVDA, FWB: NVD) has become a key player in AI’s explosive growth. As the company nears its financial report, it presents a prime buying opportunity for investors seeking to benefit from AI’s long-term potential. Our AI remains optimistic, recommending buying Nvidia stocks in anticipation of further growth through 2025.

Over the past 18 months, Nvidia’s success has been fueled by the rapid adoption of generative AI by major cloud providers like Amazon Web Services, Microsoft Azure, and Google Cloud.

These tech giants have been upgrading their data centers with Nvidia’s GPUs to meet the rising demand for AI applications, with companies like Meta Platforms leveraging Nvidia’s technology to develop and monetize large language models.

Despite recent market volatility, the demand for Nvidia’s AI-centric processors remains strong. With cloud providers planning to increase their capital expenditures to support AI initiatives, Nvidia is well-positioned for continued growth. As the company approaches its financial report, this presents a prime buying opportunity for investors looking to benefit from AI’s long-term potential.

Rheinmetall: A Defense and Automotive Stock for Long-Term Growth

Rheinmetall (OTC: RNMBF, XETR: RHM) has shown strong growth, particularly in its Weapons and Ammunition division, driven by recent capacity expansions and an expected restocking cycle. Since the Ukraine/Russia conflict began in February 2022, Rheinmetall’s stock has surged by over 450%, reflecting increased global defense spending.

Rheinmetall’s strategic involvement in Air Defence systems, Digitalisation, and Aviation, including its contributions to the F-35 program, positions the company for continued growth.

Our AI recommends buying Rheinmetall stock. The company’s focus on expanding its defense capabilities in high-demand areas is likely to sustain long-term value, even amid evolving geopolitical uncertainties.

Beyond defense, Rheinmetall has a significant presence in the automotive sector, manufacturing components and systems that diversify its portfolio. This dual focus on defense and automotive broadens the company’s revenue streams and enhances its resilience. Rheinmetall is a compelling stock for investors seeking long-term stability and growth.

Meta: Continuous Innovation to Long-Term Dominance

Meta (NASDAQ: META, FWB: FB2A) quickly turned the threat of TikTok into an opportunity for innovation with features like Reels, leading to better monetization and solidifying its dominance across its apps. This strategic shift has allowed Meta to grow its operating income faster than sales, reflecting its ability to adapt and thrive in a competitive landscape.

Financially, Meta is in a strong position, with aggressive spending on R&D, stock buybacks, and dividends. Over the past five years, its R&D spending has tripled, contributing to a robust balance sheet with over $32 billion in cash and minimal debt. In Q2 2024, Meta’s advertising revenue surged by over $10 billion compared to two years ago, even outpacing Alphabet’s growth.

Meta’s combination of solid financials and strategic investments in AI positions the company for sustained growth. With $40.3 billion in R&D spending and significant buybacks, Meta has the flexibility to take risks, with the potential for Reality Labs to boost its valuation further.

Our AI recommends continuing to buy Meta stock for 2025 as the company secures long-term dominance through innovation and financial strength.

Netflix: A Streaming Giant on Sale

Opportunities to buy shares of a dominant company like Netflix (NASDAQ: NFLX, FWB: NFC) at a discount are rare. In May 2022, Netflix’s stock traded at a P/E ratio of 15 due to concerns over rising interest rates and subscriber losses, making it a great buying opportunity in hindsight.

Today, Netflix’s P/E ratio is 39, higher than in 2022 but still below its historical averages. With EPS growing at a 52% annual rate over the past five years and projected to rise by 32% annually through 2026, the stock still has room to grow.

Our AI has given a BUY recommendation for 2025 as Netflix remains the leading streaming service, boasting 278 million members in over 190 countries. Despite the competitive market, its scale allows it to maintain strong pricing power, particularly in established markets like the U.S. and Canada.

Netflix generated $36 billion in revenue over the past year, fueling content investment while improving profitability. The company’s operating margin is expected to reach 26% this year, underscoring its efficient business model. With the stock down 10% from its 2024 peak, now might be a good time for investors to consider adding Netflix to their portfolios.

Walmart: A Retail Giant with Staying Power

Walmart’s (NYSE: WMT, FWB: WMT) immense scale gives it a formidable edge in the highly competitive retail landscape. Its vast network of stores reaches the majority of U.S. consumers. The company’s broad assortment of goods, particularly its extensive grocery offerings, provides a buffer against the rising tide of digital competition.

On the financial front, Walmart is projected to grow its revenue by 8.6% over fiscal years 2025 and 2026, according to Wall Street analysts. With a debt-to-equity ratio of 75% and operating cash flow of $35 billion over the past 12 months, Walmart’s financial health remains strong.

However, Walmart stock trades at 28.9 times forward earnings, higher than Target’s 16 times and the S&P 500’s 21.5 times, which might appear expensive to some investors.

If you already own Walmart stock, our AI recommends buying more and holding it through the rest of 2024 and 2025 to continue benefiting from its stable dividends. Consider making additional purchases only if the stock dips to a price level you’re comfortable with, as Walmart’s solid financials and competitive positioning offer long-term value without buying more stocks at the current price.

Amazon: Slowing Revenue, Soaring Profits, Bright Future

Amazon’s (NASDAQ: AMZN, FWB: AMZ) latest quarterly results presented a mixed picture for investors. On one hand, the company’s revenue growth of 10% fell short of expectations, marking its slowest year-over-year top-line growth in more than a year.

This performance contrasts with the company’s historical growth trajectory and is particularly concerning given that Amazon’s stock hit an all-time high earlier this summer. The company’s guidance for the next quarter, predicting an 8% to 11% revenue growth, suggests that the slower growth trend may continue in the near term.

On the other hand, Amazon’s profitability was a bright spot in the earnings report. Earnings per share more than doubled, significantly exceeding Wall Street’s profit targets. The company’s ability to outperform on earnings despite the revenue slowdown underscores its operational strength and diverse business model, which continues to generate significant profits from areas beyond its core e-commerce operations, particularly in its cloud computing division.

Our AI recommends buying Amazon stock for 2025, citing the company’s strong performance in its Amazon Web Services (AWS) division, which accounted for 89% of its operating profit last quarter. This presents a valuable opportunity for long-term investors to capitalize on Amazon’s ongoing growth and dominance in e-commerce and cloud services.

Microsoft: AI-Driven Momentum Drives Growth

Microsoft’s (NASDAQ: MSFT, FWB: MSF) strong brand, massive profitability, and adaptable growth strategy make it a compelling buy. The company swiftly responded to the AI trends dominating the enterprise space by introducing Copilot, a generative AI-powered assistant. This move has driven substantial business momentum, with revenue growing 15% year over year and Copilot adoption increasing by 60% in the June-ending quarter.

Over the last year, Microsoft generated $88 billion in net profit on $245 billion in revenue, distributing a quarter of its profit to shareholders, resulting in a trailing yield of 0.72%. These financial resources have enabled Microsoft to stay ahead in the AI race, significantly enhancing its Office, Windows, and other enterprise software services through Copilot. Copilot’s widespread adoption and positive feedback underscore its impact and Microsoft’s ability to leverage AI for growth.

Despite potential short-term pressure on margins from increased AI infrastructure investments, Microsoft is well-positioned for long-term growth. Wall Street analysts project 13% annual earnings growth over the next few years, supporting solid returns for investors. Our AI recommends buying more Microsoft stock for 2025, capitalizing on its continued momentum in AI and robust financial performance.

Apple: Buffett Trims Stake—Should You?

Warren Buffett recently made headlines by selling half of Berkshire Hathaway’s substantial stake in Apple (NASDAQ: AAPL, FWB: APC), adding billions to the company’s massive cash reserves. At the end of the last quarter, Berkshire had $277 billion in cash and equivalents, making it one of the largest cash piles held by any company. This move has left many wondering why Buffett has soured on Apple.

Our AI agrees with Buffett’s sentiment. Apple’s revenue has stagnated, and its high-profit Google distribution payment is under threat, yet the stock was at an all-time high at the end of the second quarter. Given these factors, it’s unsurprising that Buffett decided to trim his position.

Apple still trades at a high price-to-earnings (P/E) ratio of 31.5, which is steep for a company with slowing sales. Buffett, who initially bought Apple shares when its P/E was closer to 10, likely sees the current valuation as too expensive, especially with uncertainty surrounding key profit drivers like the Google antitrust case.

If you’re holding Apple stock, Buffett’s move doesn’t necessarily mean you should sell immediately. However, if Apple represents an outsized portion of your portfolio, as it did for Berkshire Hathaway, our AI recommends selling some and diversifying your holdings, particularly in favor of other buys on this list.

Verizon: Consumer Hesitation Dampens Growth Prospects

Telecom companies like Verizon (NYSE: VZ, FWB: BAC) are facing a significant challenge as consumers are increasingly hesitant to upgrade their phones. In an inflationary environment, many keep their existing devices to avoid the added cost of a new phone and potentially more expensive plans. This reluctance to upgrade has pressured telecom companies, which rely heavily on regular phone upgrades to drive revenue growth.

Even though Verizon extended payment terms a few years ago, allowing customers more flexibility, the lengthy upgrade cycle reflects the current economic conditions and a lack of compelling reasons for consumers to replace their phones.

Many consumers are holding onto their phones longer, even after they’ve been fully paid off, signaling that there’s little incentive to upgrade in the near term. This shift in consumer behavior has contributed to Verizon’s stock declining by 28% over the last three years despite some growth this year.

Our AI now recommends selling Verizon stock, as it lacks the clear growth potential in other investments on our list. With more promising opportunities like Bedford or Microsoft, reallocating funds would yield better returns in 2025.