When we asked which stocks would thrive with the rise of AI technology, our AI recommended investing in its future power source: nuclear energy. When tasked to identify the best entry stocks for long-term returns, it chose these three top picks with the following 5-year forecasts:

- Bedford Metals (TSX.V: BFM): +940%

- Fission Uranium (TSX: FCU): +273%

- Cameco Corporation (TSX: CCO): +87%

All three companies share one thing in common: they all have major projects in Canada’s Athabasca Basin, home to the world’s largest high-grade uranium deposits. Investors bullish on AI’s growth can’t afford to overlook these stocks. These three stocks offer investors entry points into the rapidly growing nuclear energy sector, which will fuel the AI revolution for years.

Uranium, Clean Energy, and AI’s Impact on the Surge of Nuclear Investments

AI is growing at an incredible rate, and it’s hungry for energy—so much so that by 2026, AI and data centers could consume as much electricity in a year as Japan. That’s why tech giants like Amazon and Microsoft are becoming major investors in nuclear power. Unlike wind or solar, nuclear delivers consistent, 24/7 energy—perfect for AI’s never-ending demand.

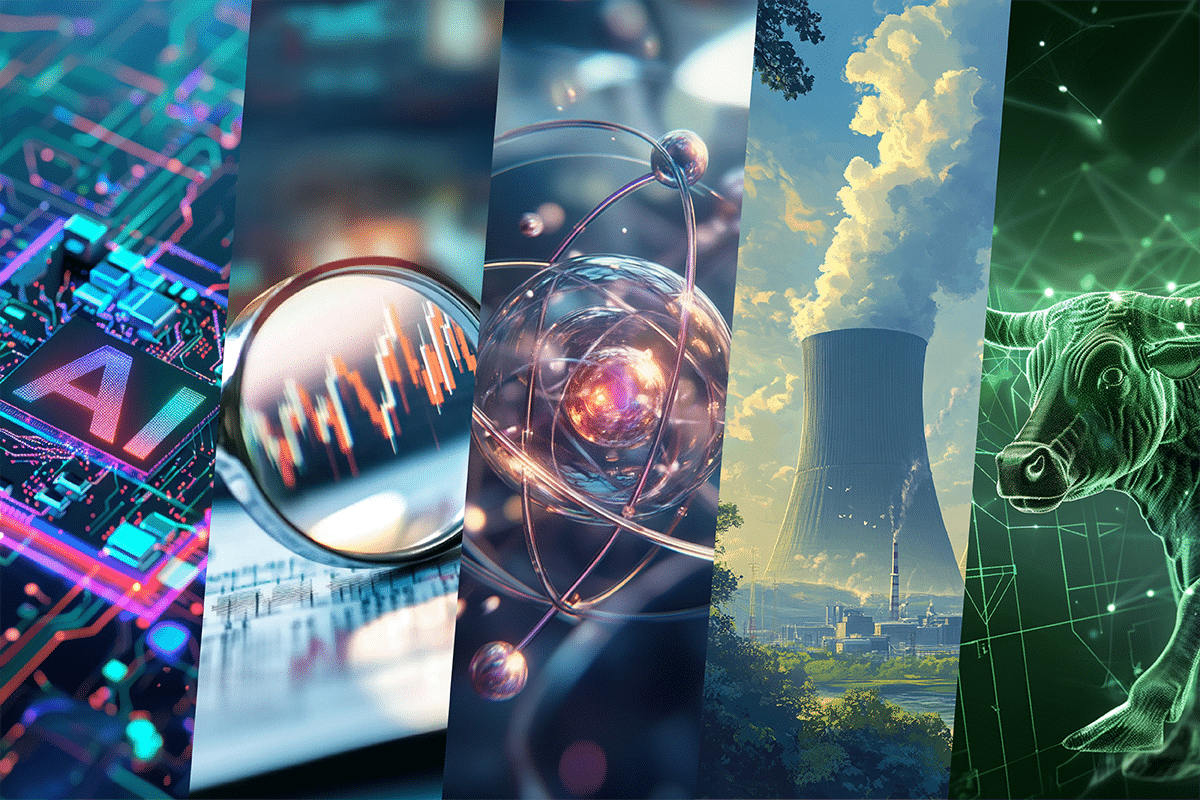

As more reactors come online, they’ll need a constant supply of uranium. The price and demand for uranium are set to skyrocket. Investors have taken notice and are securing their stakes in uranium stocks that will power the ever-growing fleet of reactors worldwide’s data center power consumption share, which is expected to jump from 8% to 20% by 2030.

In response, industry stakeholders led by hyperscale data centers are set to invest $200 billion in 2024 to keep pace.

AI is reshaping how data centers operate, driving up power needs, and pushing the limits of existing infrastructure. A good example is the U.S. power demand projected to grow at a 2.4% annual rate through 2030. AI alone will account for a significant chunk of that increase. This increased demand for power, particularly from reliable, 24/7 sources like nuclear, is expected to boost the uranium market further.

Investors are beginning to prepare to cash in on this long-term trend by buying stocks of undervalued uranium producers in uranium-rich areas like Canada’s Athabasca Basin as they continue their long-term exponential growth driven by rising uranium prices and nuclear energy’s momentum.

3 Uranium Stocks Investors Should Own in 2025

Canada’s Athabasca Basin is home to the world’s largest high-grade uranium deposits, making it a hotspot for uranium companies. With Kazakhstan, the world’s leading uranium-producing country, cutting production, an even tighter supply gap is emerging—driving demand for Canadian uranium even higher. This sets the stage for significant growth opportunities for uranium companies operating in the Athabasca Basin.

Our AI recommends three prime uranium stocks in this area for 2025. These picks include a junior miner with the highest upswing potential in the region, a mid-tier company recently acquired by a larger player, and a large-cap producer offering a balanced mix of stability and growth.

This selection gives you the best of all worlds—massive potential gains without sacrificing reliability.

1. Bedford Metals

Bedford Metals (TSX.V: BFM) is an undervalued exploration and mining company with three promising uranium projects in the Athabasca Basin. Current exploration efforts hint at upcoming positive results and further expansion. Our AI recommends Bedford Metals as the uranium stock with the highest upswing potential for 2025, forecasting a 940% growth in the next five years as the company continues to expand and find success in its projects, making this one of the best uranium plays today.

The company has begun to see a remarkable surge in its stock price, soaring 100% this year and 566% over the past 12 months. This rapid growth is primarily fueled by the company’s recent strategic acquisitions.

The company’s three flagship uranium projects—Ubiquity Lake, Sheppard Lake, and Close Lake—were all acquired this year. These projects are strategically located near major uranium operations, including Cameco’s McArthur River Mine, positioning Bedford to take full advantage of the growing demand for uranium as the nuclear energy sector expands globally.

Bedford is actively exploring and developing these assets, with significant potential for increased value if exploration results are positive in the coming months. The company’s Ubiquity Project recently gained media attention on prominent platforms such as Yahoo Finance and Financial Times.

With another exploration program on the horizon, final plans are expected to follow the receipt of results from the latest sampling. Investors are watching closely as positive results could further boost Bedford’s stock and long-term growth potential.

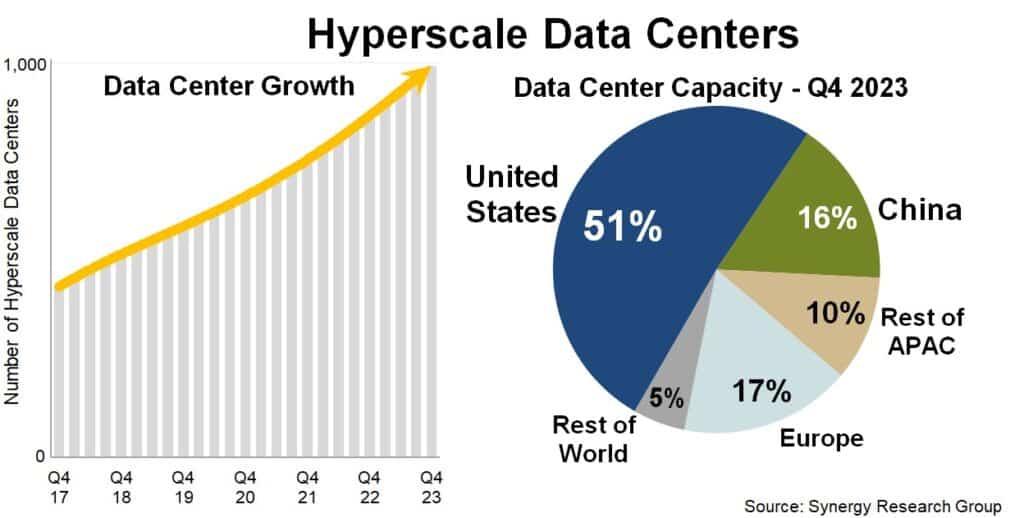

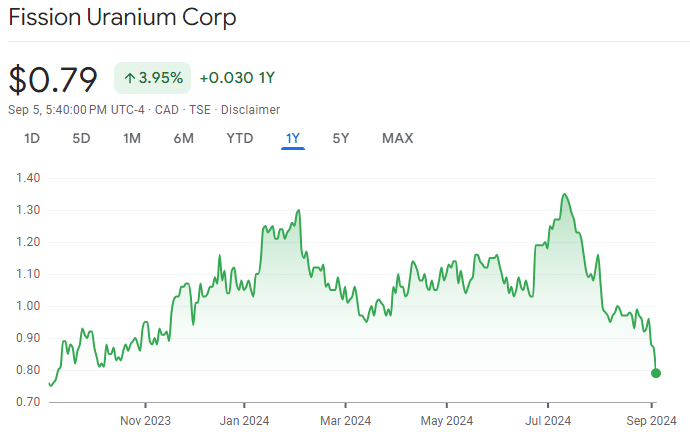

2. Fission Uranium

Fission Uranium (TSX: FCU), now part of Paladin Energy, is poised to become a key player in the uranium space. With Paladin’s backing, Fission’s Patterson Lake South (PLS) project in Saskatchewan—one of the highest-grade uranium projects in Canada—is fast-tracked towards production. PLS has a projected 10-year mine life, with an annual production potential of 9.1 million pounds U3O8, offering significant growth.

This acquisition brings added value to shareholders by combining Fission’s top-tier Canadian project with Paladin’s established operations, like the Langer Heinrich Mine in Namibia. Together, they’ll deliver multi-asset production by 2029, giving investors diversified exposure across key uranium markets.

As uranium prices continue to rise, investing in Fission Uranium isn’t just about tapping into one of the most promising uranium projects—it’s your entry into Paladin Energy, a global leader in the industry. With Paladin set to acquire Fission, shareholders will own 24% of Paladin, which will boast a market capitalization of USD 3.5 billion.

Paladin’s upcoming listing on the Toronto Stock Exchange (TSX) gives Fission investors a unique opportunity. By buying Fission now, you’ll secure shares in Paladin as it advances its world-class Patterson Lake South project and boosts its global uranium portfolio. Our AI forecasts a 273% surge in the next five years. This makes Fission the gateway to capturing substantial upside from both companies’ growth potential.

3. Cameco

Cameco (TSX: CCO), headquartered in Saskatoon, Canada, is a uranium powerhouse controlling the world’s largest high-grade reserves, including the McArthur River Mine.

McArthur River, located in northern Saskatchewan, is the world’s largest high-grade uranium mine, giving Cameco a strategic advantage in supplying the global market with low-cost uranium. This mine, combined with its extensive land rights, positions Cameco to meet rising global demand while maintaining production costs.

With its recent acquisition of Westinghouse Electric Company and stakes in Global Laser Enrichment, Cameco can generate value at multiple stages—from mining to enrichment—making it a unique investment for those wanting to capitalize on the growing demand for carbon-free nuclear power.

While Cameco’s explosive growth as a large-cap stock has already occurred, the company still offers strong, stable returns as uranium prices rise. Our AI forecasts an 87% upswing for Cameco over the next five years, making it a top pick for investors seeking steady exposure to the uranium market. With assets like the McArthur River Mine and strategic moves in the industry, Cameco remains a dominant player in an increasingly competitive space.