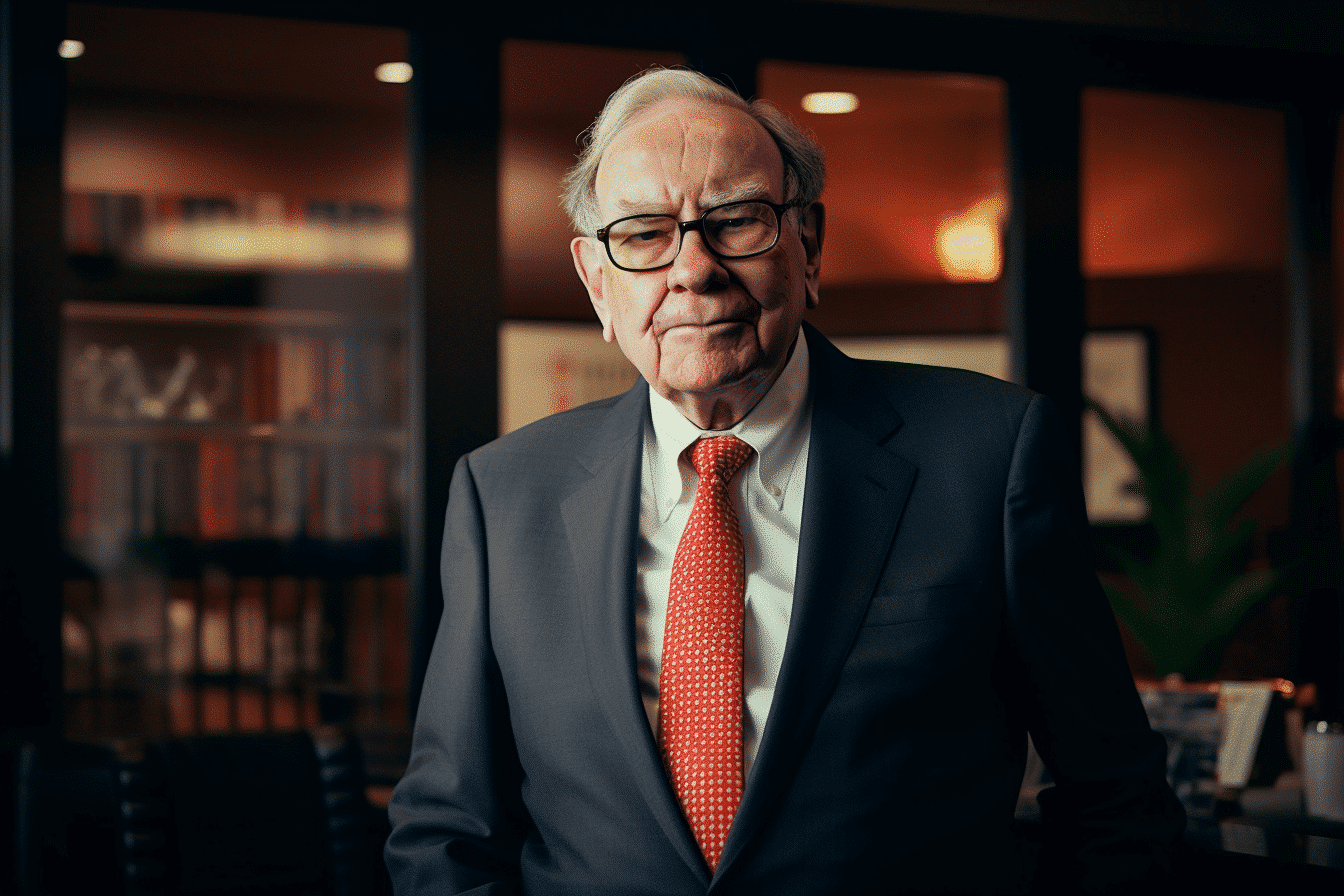

Buffett’s Activision Blizzard play marks an unusual strategy.

Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) stirred the pot when it initially purchased Activision Blizzard (NASDAQ: ATVI) shares shortly before Microsoft (NASDAQ: MSFT) unveiled a nearly $69 billion cash acquisition plan for Activision.

Berkshire’s CEO, Warren Buffett, clarified in a public letter that Berkshire had no foreknowledge of Microsoft’s intentions, dispelling any lingering controversy.

Berkshire’s Activision investment proved lucrative. However, Buffett is liquidating Berkshire’s Activision holdings before the conclusion of Microsoft’s acquisition.

Profit-taking in action

Berkshire Hathaway once held a 9.5% stake in Activision. By the end of 2022, this had been whittled down to 6.7%, and three months later, it dropped to 6.3%. Buffett and his team seemed to be pocketing gains in a measured manner.

This cautious approach seems abandoned, as indicated by a 13G filing Activision submitted to the U.S. Securities and Exchange Commission (SEC) on Monday. It revealed that Berkshire had offloaded most of its shares, reducing its stake to a mere 1.9%.

Buffett chose to sell shares on June 30, two weeks before a federal appeals court rejected the Federal Trade Commission’s effort to halt Microsoft’s Activision acquisition provisionally.

In contrast to the initial Berkshire-Activision investment, this recent action shouldn’t stir up controversies. Activision’s stock rose approximately 10% following Berkshire’s sell-off, buoyed by the favourable court ruling.

Buffett’s unusual gambit

Buffett is famously known for saying his “favourite holding period is forever.” So why is he substantially offloading Berkshire’s Activision stake after less than three years of ownership?

The Activision dealings mark a departure for Buffett. Initially, he didn’t choose to invest in Activision; the call was made by Todd Combs or Ted Weschler, two of Berkshire’s investment managers.

However, Buffett stepped into the ring later and amplified Berkshire’s stake in Activision. During Berkshire Hathaway’s 2022 annual meeting, he expressed his view of Activision’s share acquisition as an appealing merger arbitrage opportunity.

Merger arbitrage hinges on the target company’s stock, often trading beneath the offer price due to the inherent risk of deal failure.

The completion of Microsoft’s Activision purchase has been uncertain due to regulatory opposition. Buffett perceived this as a golden chance for Berkshire.

Is it time for you to sell Activision shares?

Selling a stock simply because a renowned investor does so isn’t typically wise. Nevertheless, if you acquired Activision Blizzard shares with merger arbitrage in mind, the upside potential is now quite limited. Microsoft’s offer was $95 per share, and Activision’s current share price is around 2% shy.

Why might you hold onto the stock, then?

The Microsoft deal might yet fall through. Microsoft is challenging a decision by U.K. regulators to block the acquisition. If you believe the deal won’t close and that Activision’s stock will outperform as an independent entity in the long term, selling now won’t make sense.

Both premises for this approach seem somewhat shaky. The most reasonable move is to emulate Buffett’s strategy and cash in on Activision.

In the grand chessboard of investment, following the moves of renowned players like Warren Buffett may provide insights, but it doesn’t guarantee success. Each investor has unique circumstances and financial goals, and the decision to hold or sell should align with these. With Microsoft’s acquisition looming for Activision Blizzard shareholders, it might be time to evaluate the potential risks and rewards. While following Buffett’s lead and cashing in your profits might be a solid move, ensure it aligns with your overall investment strategy.