Cava has delivered another strong financial performance, raising its full-year outlook after reporting better-than-expected earnings and revenue. The Mediterranean restaurant chain experienced a notable uptick in customer traffic, which boosted its quarterly results. As a result, Cava’s shares surged 9% in extended trading, with the stock more than doubling in value this year. As of Thursday’s close, the company’s market cap stood at approximately $11.6 billion.

For the quarter ending July 14, Cava reported earnings per share of 17 cents, surpassing Wall Street’s expectations of 13 cents. Revenue for the quarter reached $233 million, also exceeding analyst estimates of $220 million. This marked a significant improvement from the same period last year, with net income climbing to $19.7 million from $6.5 million. The company’s net sales saw a substantial increase of 35%, highlighting the strong demand for its offerings.

Same-store sales, a critical indicator of a restaurant’s performance, rose by an impressive 14.4%, well above the 7.9% growth anticipated by analysts. This performance stands out, especially when compared to many other restaurant chains that have reported a decline in customer visits due to tighter consumer spending. Cava managed to attract more customers, with traffic growing by 9.5% during the quarter. One of the key drivers behind this growth was the introduction of a new grilled steak option, which proved popular among diners.

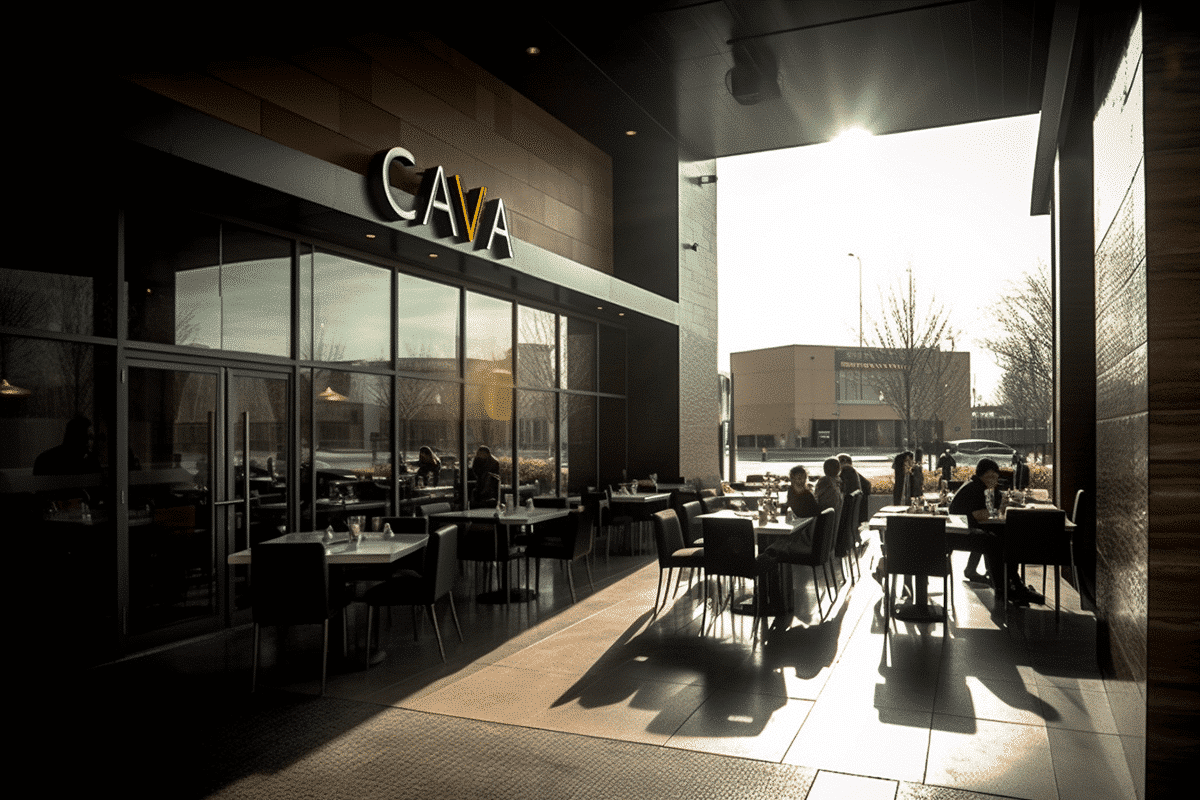

In addition to attracting more customers, Cava continued its expansion efforts by opening 18 new locations during the quarter, bringing its total number of restaurants to 341. This expansion aligns with the company’s strategy to grow its footprint and increase its market presence.

Looking ahead, Cava has revised its expectations for fiscal 2024. The company now forecasts same-store sales growth of 8.5% to 9.5%, a significant increase from the previously projected range of 4.5% to 6.5%. Furthermore, Cava plans to open 54 to 57 new locations this year, up from its earlier target of 50 to 54 restaurants. These plans underscore the company’s confidence in its business model and its ability to continue attracting customers even in a challenging economic environment.

Cava also adjusted its outlook for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). The company now expects adjusted EBITDA to be between $109 million and $114 million, up from the prior forecast of $100 million to $105 million. This adjustment reflects the company’s strong operational performance and the positive impact of its strategic initiatives.

Overall, Cava’s robust financial performance and optimistic outlook demonstrate its ability to thrive in a competitive market. The company’s focus on offering appealing menu options and expanding its restaurant network has positioned it well for continued growth. As Cava continues to innovate and adapt to changing consumer preferences, it is likely to maintain its momentum and build on its success in the coming quarters.

With the stock already more than doubling in value this year, investors seem to share the company’s optimism, betting on Cava’s continued ability to deliver strong results and capture market share in the growing Mediterranean food segment.