The uranium market faces a significant supply deficit as existing mines and projects cannot meet the future demand required for nuclear energy. China has stockpiled a decade’s worth of uranium while continuing to buy international supply. Meanwhile, the US is playing catch up as government and private sector companies invest in a new fleet of nuclear reactors amid sanctions imposed on Russian uranium.

The AI arms race is pushing nations and tech companies to boost energy production and pivot to nuclear energy. This creates a unique opportunity for investors to profit from companies in the traditionally stable utility sector, similar to the way they would invest in tech stocks.

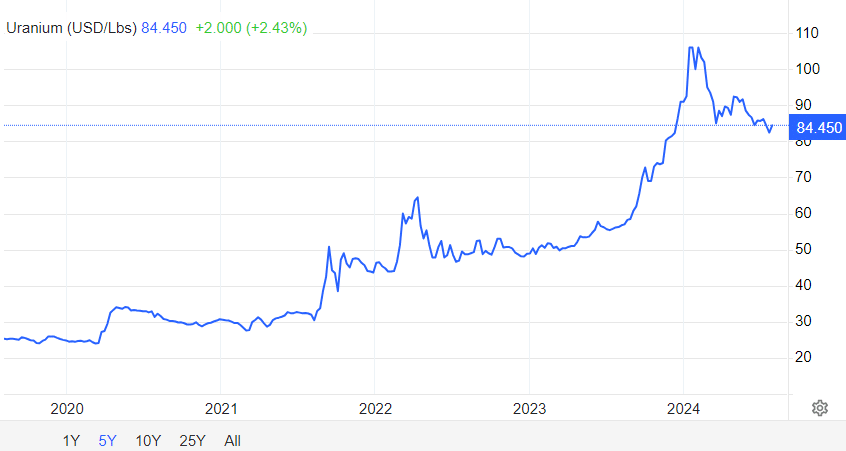

Uranium prices have surged by over 230% in the past five years, reflecting the global shift toward nuclear power. By 2040, uranium supply may meet only 50% of demand even if all mines are restarted and projects developed, leading to sustained high prices.

Mining companies in Canada’s Athabasca Basin will benefit greatly from this uranium bull run, thanks to their access to deposits that are approximately 100 times richer than the global average. As uranium prices rise, savvy investors are positioning themselves for early gains by investing in undervalued uranium stocks in the Athabasca Basin with proven track records and strong upside potential, such as Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF).

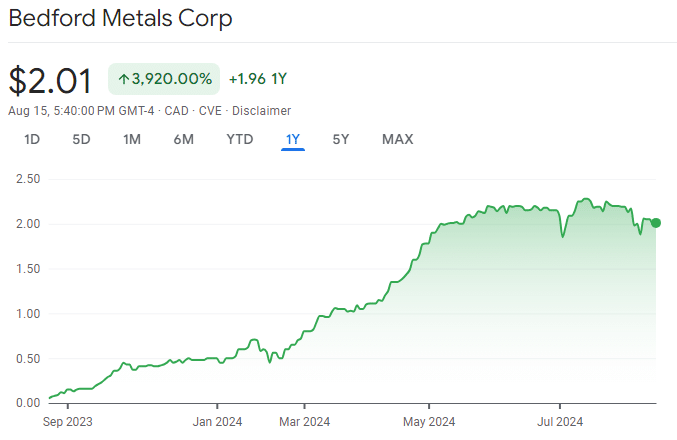

Our AI has identified Bedford Metals Corp. as one of the best and most promising stocks. Year-to-date, its share price has risen by 302%. Current exploration and expansion efforts are expected to propel Bedford’s stock price by 850% in 2024. Strategic acquisitions of three new uranium projects this year give it the best chance to multiply its value as the uranium bull market continues to reach new highs.

The uranium bull market has just begun, with prices expected to climb steadily. This is the perfect moment to invest in a company like Bedford Metals, poised for extraordinary growth.

China Likely to Surpass US Nuclear Capacity by 2030

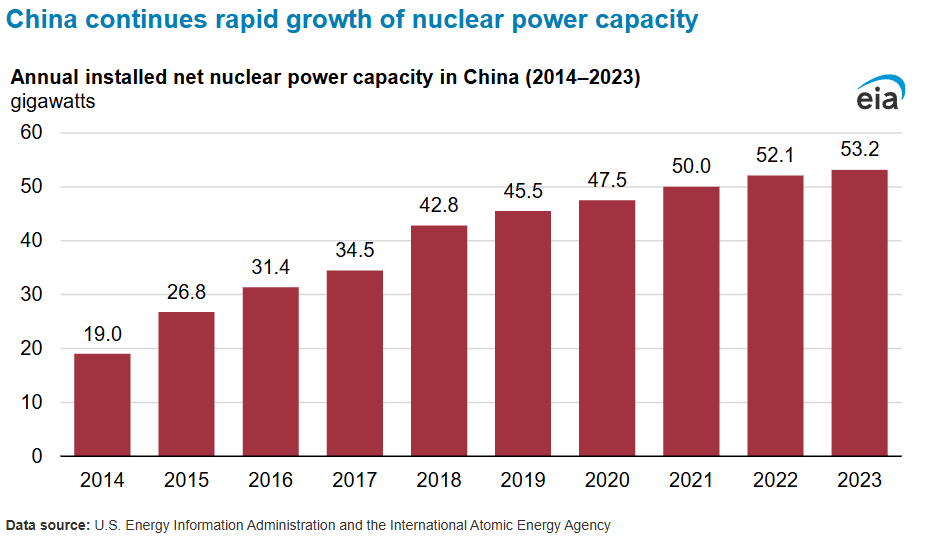

China continues to stockpile uranium as it prepares to construct 150 new nuclear reactors by 2035, with 27 already underway. Each reactor is expected to take around seven years to build, significantly faster than in most other countries. This positions China to potentially surpass US nuclear capacity by 2030.

The US has the largest nuclear fleet with 94 reactors. However, China took only 10 years to add the same nuclear power capacity that the US took nearly 40 years to achieve. The International Energy Agency reported that China added over 34 GW of nuclear power capacity in the past decade, nearly tripling its capacity and boosting uranium demand.

China’s uranium imports will remain higher than domestic demand as the country tightens its grip on uranium. The China National Uranium Corporation has signed several joint ventures with operators in Kazakhstan, the world’s top uranium producer. These ventures give China rights to nearly 60% of Kazakhstan’s future uranium production, which limits the availability of uranium for other countries.

Where Will New Uranium Supply Come From?

The US and twenty other countries plan to triple their nuclear power capacity by 2050. Meanwhile, nuclear tech companies such as Bill Gates’ TerraPower and Sam Altman’s Oklo are investing billions of dollars in the nuclear energy sector to meet the growing energy needs of AI data centers.

As the nuclear industry is funded by billionaires and government dollars, uranium producers face a supply bottleneck that has increased prices by over 230% in the past five years. With nearly two-thirds of Kazakhstan’s future uranium production already allocated to China, Canada is the best alternative source for the world’s uranium.

Canada is poised to become the biggest player in the uranium industry due to its rich deposits in the Athabasca Basin. These high-grade deposits, around 100x higher than the global average, supply about 20% of the world’s uranium and have positioned Canada as the second-largest uranium producer in the world.

Canada’s current uranium production levels are estimated to be worth about $2 billion. With known uranium resources of 694,000 tonnes and ongoing exploration investment, Canada will play a significant role in meeting future world demand.

The Canadian government is preparing for this, releasing its Canadian Critical Minerals Strategy. This strategy includes a new 30% tax credit supporting exploration expenditures for uranium, creating an ideal opportunity for junior mining companies to scale faster at a lower cost.

Profit Early from the Future of Energy With This Stock

Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) is one of the top stocks identified by our AI for its high returns potential. Year-to-date. Bedford’s stock has soared over 302% and an impressive 3,920% over the past 12 months.

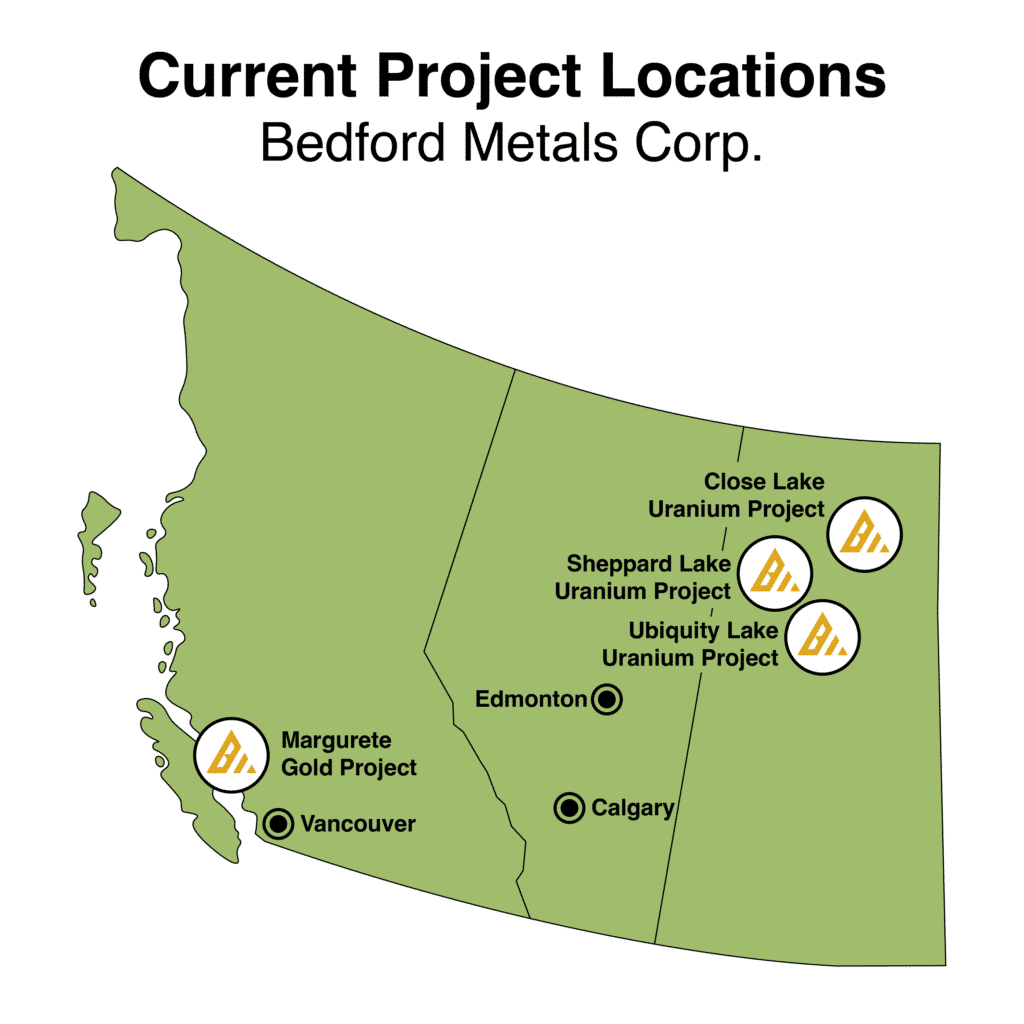

Bedford’s strategic acquisitions of three new uranium projects have set the company up for greater success in the Athabasca Basin. These projects are next to world-class uranium deposits like Cameco’s Cigar Lake and McArthur River mines, the world’s largest high-grade uranium deposits.

The company’s newest surveys revealed several indicators of uranium mineralization, including mixed helium and methane emissions on their properties. Helium is an inert gas naturally produced by the radioactive decay of uranium and thorium.

Bedford is also finding success in its Margurete Gold Project in British Columbia, where proven gold and copper reserves continue to drive growth. Gold is another commodity on a bull run, with its prices breaking records and outperforming most major asset classes this year.

For environmental, technological, and geopolitical reasons, the world is moving toward nuclear power, which will require unprecedented amounts of uranium. Canada is expected to become the number one exporter of uranium in the next decade, with companies like Bedford leading the sector.

Just as uranium fuels reactors, buying and holding companies like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) will power your portfolio for decades to come.