Recently, we challenged our AI to analyze financial data and identify the top-performing stocks of the last 24 years. Some of the results were expected, with giants like Nvidia and Apple showing impressive returns of 127,000% and 38,300%, respectively.

Imagine investing only a dollar in each of these companies twenty years ago; you’d now have a portfolio worth over $150k.

Now picture investing $1,000 instead. You’d be set for life!

But our AI uncovered something unexpected. Among the usual tech giants, a surprising name stood out: Monster Beverage Corp. This energy drink company outpaced even Apple with an astounding 90,370% return over the same period.

This discovery highlights something vital for investors: mainstream media often fixates on tech stocks, overshadowing other lucrative opportunities.

While tech companies like Nvidia dominate headlines, incredible profit potential also exists in less obvious sectors.

We tasked our AI with analyzing recent stock data, financial news, and market forecasts to uncover these hidden gems. The goal was to find five stocks that could make investors millionaires with a $1,000 investment held long-term.

This list isn’t primarily dominated by tech. These companies are uniquely poised for significant growth, even in sectors often overlooked as mundane or boring.

Here are our Top 5 AI-picked stocks that could make you a millionaire:

- Bedford Metals

- Amazon

- Taiwan Semiconductor

- MercadoLibre

- GE Healthcare

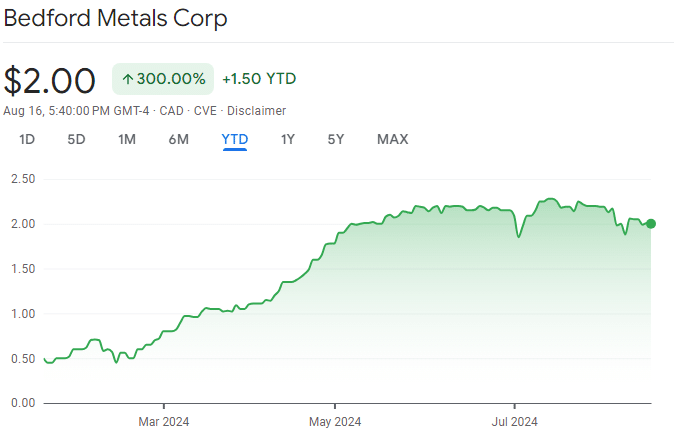

1. Bedford Metals

Nuclear energy is making a significant comeback, sparking increased demand for uranium and multi-billion investments in reactor technology. This ongoing demand boosts the prospects of junior miners like Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF). These smaller companies hold the potential to meet the industry’s rising needs, often making them attractive targets for acquisition by more prominent players after their projects are developed, resulting in boosted stock prices.

Bedford Metals’s stock is currently on a bull run, surging 300% this year and over 2700% in the past 12 months. Impressively, this growth has occurred without any deals with larger companies yet. The company’s expansion and operations in Canada’s Athabasca Basin are the driving force behind this performance.

The Athabasca Basin is known to hold the world’s largest high-grade uranium deposits, making it an ideal location for Bedford Metals’ three promising projects: The Ubiquity Lake, Sheppard Lake, and Close Lake projects. These strategic projects are close to the world’s largest high-grade uranium mines, positioning Bedford to capitalize on the increasing demand for uranium as the nuclear energy sector continues its resurgence.

As Bedford’s ground team continues to explore and develop these projects, the company is poised to add even more value in the long run. The company is also continuing the development of its Margurete Gold Project in British Columbia, which has already showcased positive results. The recent stock success is just the beginning, with further growth anticipated as exploration efforts yield positive results.

Additionally, at its current price, Bedford’s stock offers incredible long-term value. With uranium and gold prices rising due to growing demand, it’s only a matter of time before Bedford’s price catches up and surpasses the commodities’ growth or is boosted by acquisitions from larger players.

Investing in a company that ventures into both commodities is a safe move that helps you future-proof your portfolio against recession. From this affordable price point, Bedford offers substantial upside potential over the short and long term.

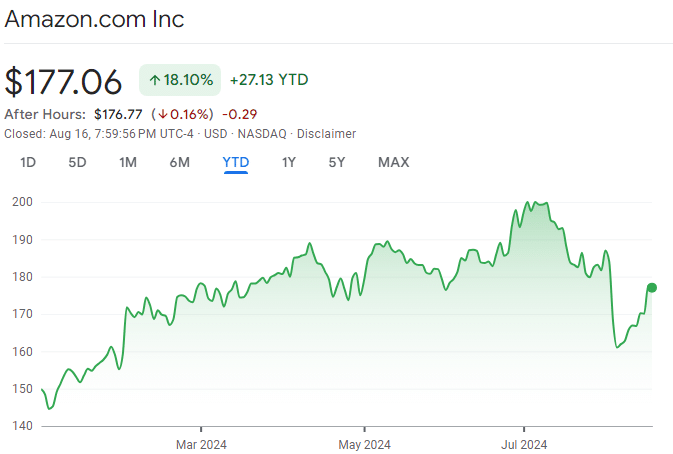

2. Amazon

While most people know Amazon (NASDAQ: AMZN, FWB: AMZ) as the world’s leading online marketplace, the real engine driving the company’s operating cash flow lies elsewhere.

First and foremost, Amazon Web Services (AWS) is the world’s premier cloud infrastructure service. As of the end of 2023, AWS held a 31% share of global cloud infrastructure services spending, with annual run-rate sales exceeding $105 billion as of June 30. This segment consistently accounts for 50% to 100% of Amazon’s operating income and is expected to be a key player in doubling Amazon’s operating cash flow by 2026.

Amazon is also beginning to unlock the immense value of its content through its Prime subscription service. The company has secured an 11-year streaming deal with the National Basketball Association (NBA) and is the exclusive partner for Thursday Night Football. These deals position Amazon’s video platform as a significant force in the streaming world, likely enabling the company to raise Prime subscription prices and generate substantial advertising revenue.

Amazon’s advertising services are booming, with more than 3 billion visits to its website each month. Businesses are willing to pay a premium to advertise on a platform frequented by motivated shoppers. This segment has seen year-over-year constant-currency sales growth of at least 20% for over two years.

During the 2010s, investors paid a median of 30 times year-end cash flow to own Amazon shares. Today, investors are paying only 11.5 times forecast cash flow for 2025. If Amazon were to be valued at the same median cash-flow multiple it enjoyed in the 2010s and continued to grow at its current pace, it could have a clear path to a $6 trillion market cap.

Amazon’s future growth is powered by its e-commerce platform and dominance in cloud infrastructure, strategic content deals, and robust advertising services. This diverse portfolio positions Amazon for continued success and significant market cap expansion.

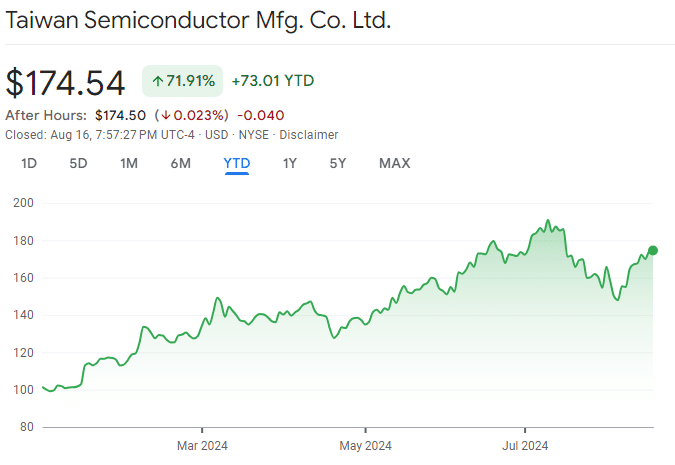

3. Taiwan Semiconductor

Taiwan Semiconductor (NYSE: TSM, FWB: TSFA, TWSE: 2330) is the linchpin of the semiconductor industry. Many semiconductor companies rely directly on Taiwan Semi for their supply. Some analysts argue that the stock should trade lower than its fabless peers due to the “China threat” and on-shoring trends.

However, this perspective seems flawed, as any significant impact on Taiwan Semi would likely affect fabless semiconductor companies even more. Moreover, Taiwan Semi is mitigating risks by investing $40 billion in U.S. chip manufacturing, with its facility expected to be operational by 2027 or 2028.

Taiwan Semiconductor’s financial metrics remain robust, with gross margins exceeding 53% and operating margins topping 42%. The company’s revenue rose 16.5% year-over-year, surpassing estimates for both earnings and revenue. Given this performance, there is considerable upside potential, as the current premium is historically not high.

Despite seasonal effects that slightly dampened smartphone demand in the first quarter, TSMC has excelled across all areas of its business. Advanced technological nodes, including 3nm and 5nm processors, are in high demand and account for 46% of wafer sales. Barring unexpected disruptions, Taiwan Semiconductor is well-positioned to maintain its pivotal role in the industry.

TSM stock also offers a 1.7% dividend yield, making it an attractive option for income-focused investors seeking exposure to the semiconductor sector. This combination of strong financial performance, technological leadership, and dividend yield makes Taiwan Semiconductor one of the top stocks to buy and hold.

Taiwan Semiconductor’s strategic investments, robust financial health, and leading technological advancements position it as a cornerstone in the semiconductor industry, offering significant potential for long-term investors.

4. MercadoLibre

MercadoLibre (NASDAQ: MELI, FWB: MLB1) is a dominant force in Latin American e-commerce. It operates in 18 countries and has just celebrated 25 years in business. Despite its longevity, the company is still growing at a pace more typical of a startup—a remarkable achievement that shows no signs of slowing down.

In the second quarter of 2024, MercadoLibre’s revenue surged 42% year-over-year, or an even more impressive 113% on a currency-neutral basis. Its core businesses—e-commerce and payment processing—continue to deliver exceptional results.

Gross merchandise volume (GMV), the total value of goods sold on its platform, increased by 20% year over year (83% currency neutral). Meanwhile, total payment volume (TPV), which tracks the amount of money processed through its payments business, grew by 46% (86% currency neutral). Despite rising costs and higher interest rates, MercadoLibre doubled its net income year-over-year to $531 million.

MercadoLibre is not resting on its laurels. The company is enhancing its logistics capabilities and implementing margin-improving initiatives, such as offering a weekly delivery day for Meli+ members. While 53% of its shipments are already delivered within 48 hours, the company is now prioritizing cost efficiency alongside speed, ensuring that members who opt for rapid delivery still get it without sacrificing overall profitability.

In a surprising move, MercadoLibre recently opened its first U.S. warehouse in Texas to better serve the Mexican market. This pilot program aims to offer a broader range of products to Mexican consumers and could expand further, marking a significant step in the company’s growth strategy.

With multiple growth drivers firmly in place, MercadoLibre is well-positioned to maintain its strong growth trajectory for the foreseeable future. For investors seeking to build a diversified long-term portfolio, MercadoLibre stock offers significant potential for wealth creation. It could contribute to achieving millionaire status in the long run.

MercadoLibre’s robust financial performance, strategic logistics enhancements, and international expansion make it a powerhouse in the e-commerce world, with plenty of room for continued growth.

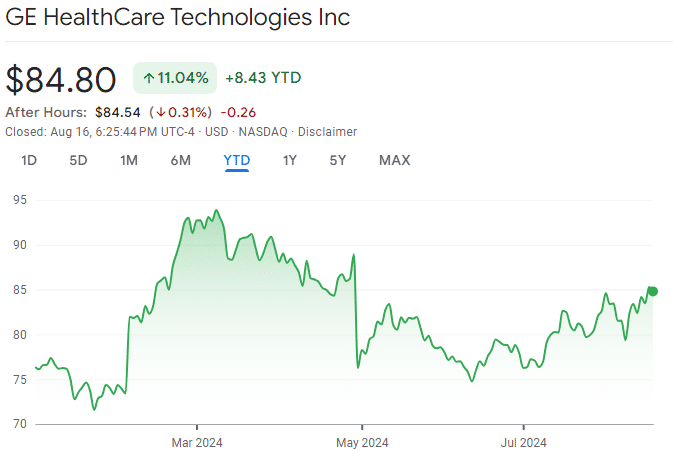

5. GE Healthcare

GE HealthCare (NASDAQ: GEHC, FWB: L0T) is a fascinating company for what it already represents and could become. As one of the oldest “new” healthcare stocks on the market, GE HealthCare combines the reliability of a blue-chip company with the innovation of cutting-edge technology.

With a formidable presence in the medical imaging industry, the company operates in more than 160 countries. It sells medical equipment such as CT scans, MRIs, X-rays, and ultrasound machines and offers service contracts for these devices.

GE HealthCare’s impressive installed base of four million medical machines and devices serves more than one billion patients annually. The company conducts its operations through four main business divisions, which delivered double-digit revenue growth (on a constant currency basis) in the year’s first quarter. This strong performance sets the stage for sustained high single-digit growth for many years to come.

Beyond its traditional strengths, GE HealthCare is emerging as a leader in AI-enabled medical devices. Among the more than 500 devices recently included by the U.S. Food and Drug Administration on its list of AI-enabled device authorizations, 42 are from GE HealthCare, placing the company at the forefront of the industry. Siemens Healthineers, with 29 devices, ranks second.

From an investment perspective, GE HealthCare offers a two-fold story. On one hand, it is a solid, steadily growing medical imaging company. Conversely, it boasts considerable fast-growth potential through its AI product line and strategic investments.

According to Grand View Research, artificial intelligence is set to be a significant driver of medical device innovation over the coming decade. The AI component of the healthcare market is projected to skyrocket from $15.4 billion in annual sales last year to more than $200 billion by 2030, representing a compound annual growth rate of 37.5%.

GE HealthCare’s AI solutions are designed to assist, not replace, medical professionals. The company’s AI-enabled devices and services work alongside traditional medical practitioners to enhance and optimize their efforts rather than substitute them.

GE HealthCare is fully embracing this new paradigm, positioning itself to benefit from both its established market presence and the burgeoning AI-driven opportunities in the healthcare sector.

The stock is not just a reliable blue-chip company but also a dynamic player in the rapidly evolving AI-enabled medical device market. This dual focus makes GE HealthCare a compelling investment with stability and significant growth potential.