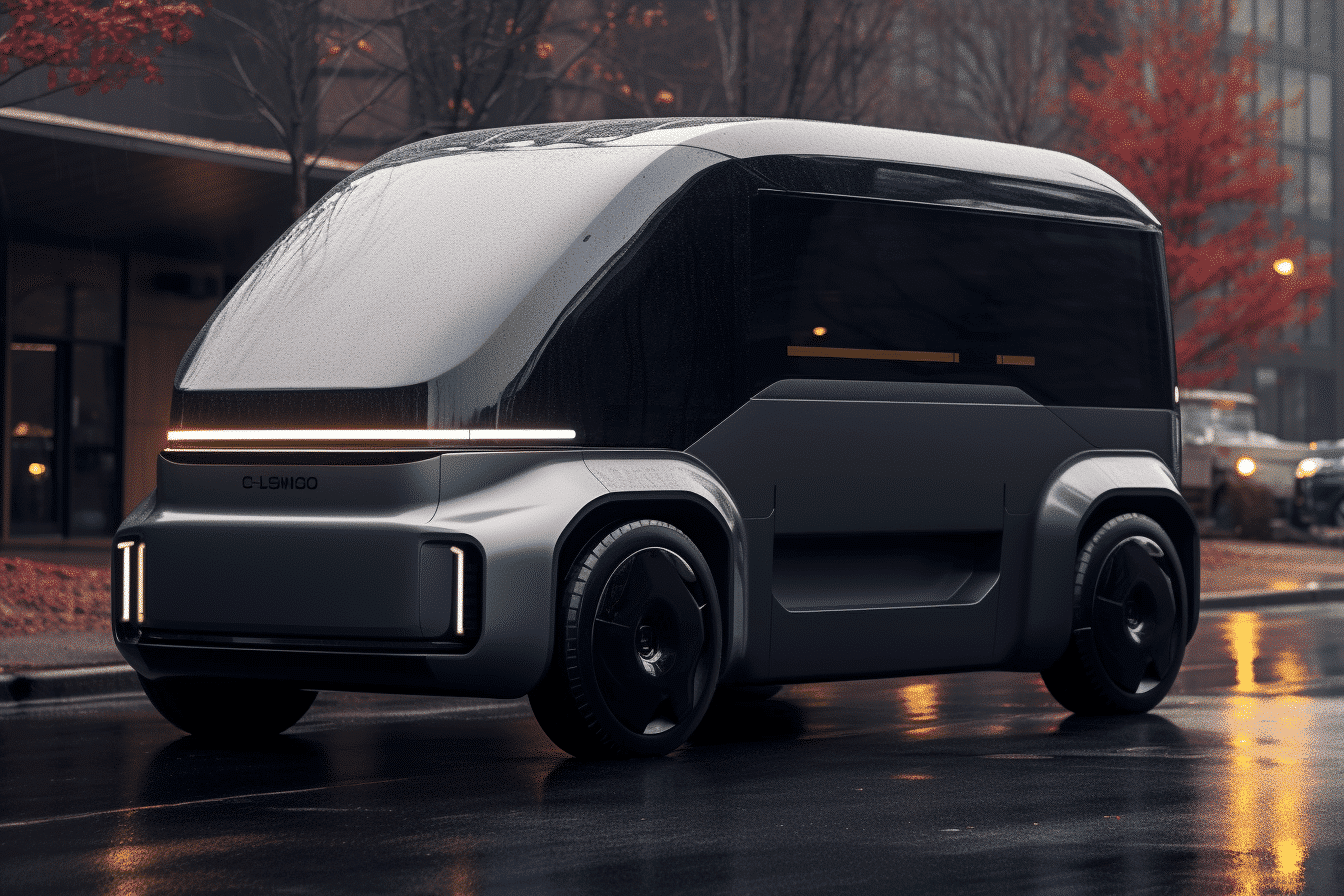

Canoo faces challenges in escalating its cutting-edge vehicle production.

The electric vehicle (EV) sector, characterized by its rapid advancements and disruptions, consistently piques the interest of investors. Within this bustling space, Canoo is an emblem of innovation and ambition. As with many ventures in this nascent industry, determining the right investment move can be akin to predicting the weather in a storm.

Production Hurdles

For startups, especially in the automotive sector, ramping up production is never straightforward. Canoo’s promise of innovative vehicles has captured the attention of many, but delivering on that promise is another story. High initial capital expenditures, supply chain complexities, and the competitive landscape can weigh down progress.

Financial Overview

Regarding stock performance, Canoo (NASDAQ: GOEV) has had its fair share of volatility. The stock has seen some peaks and troughs over the past year, which is not uncommon for EV stocks. While the company has secured funding for its operations, a closer examination of its balance sheet, earnings, and projected cash flows is essential for potential investors.

The Verdict

Parkev, an astute analyst from Fool.com, believes that while Canoo has immense potential, it’s not devoid of risks. For those with a high-risk tolerance and a long-term view, Canoo might offer substantial rewards. However, for conservative investors seeking stability, Canoo might not be the ideal pick right now.

Deciding to invest, divest, or maintain a position in Canoo depends mainly on an individual’s risk appetite and investment horizon. Staying informed and carrying out due diligence before making any financial decisions is crucial.

Investing in the ever-evolving EV market is both exhilarating and challenging, offering a blend of risks and rewards. Canoo, despite its hurdles, holds promise in a future defined by sustainable mobility. However, as with all investments, one must balance their enthusiasm with prudence. Drawing from the insights of industry experts like Parkev Tatevosian, potential investors are encouraged to approach the EV sector, particularly Canoo, with an informed perspective and a well-thought-out strategy.