General Motors (GM) has announced a revision in its 2024 forecast for electric vehicle (EV) production and sales, indicating a slower-than-anticipated uptake in the U.S. market. As consumer adoption lags behind initial expectations, the automotive giant has adjusted its production targets and strategies to align with current market dynamics, signaling a cautious yet adaptive approach to the evolving EV landscape.

GM Revises EV Production Targets

GM’s Chief Financial Officer, Paul Jacobson, revealed during a Deutsche Bank investor event that the company anticipates producing 200,000 and 250,000 EVs this year, a reduction from the previous estimate of up to 300,000. Jacobson emphasized that production would continue to align closely with market demand, which, although growing, is progressing more slowly than many had forecasted. “So at the lower end of that, and I think it reflects the momentum we have in the business,” Jacobson commented on the updated figures.

A Cautious Outlook on EV Market Share

Despite the scaled-back production, GM remains optimistic about the profitability of its EV operations. Jacobson pointed out that the company still expects its EVs to be variable profit-positive at the 200,000-unit mark, likely by the fourth quarter of this year. However, he also noted that GM’s share of the U.S. EV market is projected to be around 8%, below the industry expectation of 10% for 2024.

Rolling Out New Models Amidst Challenges

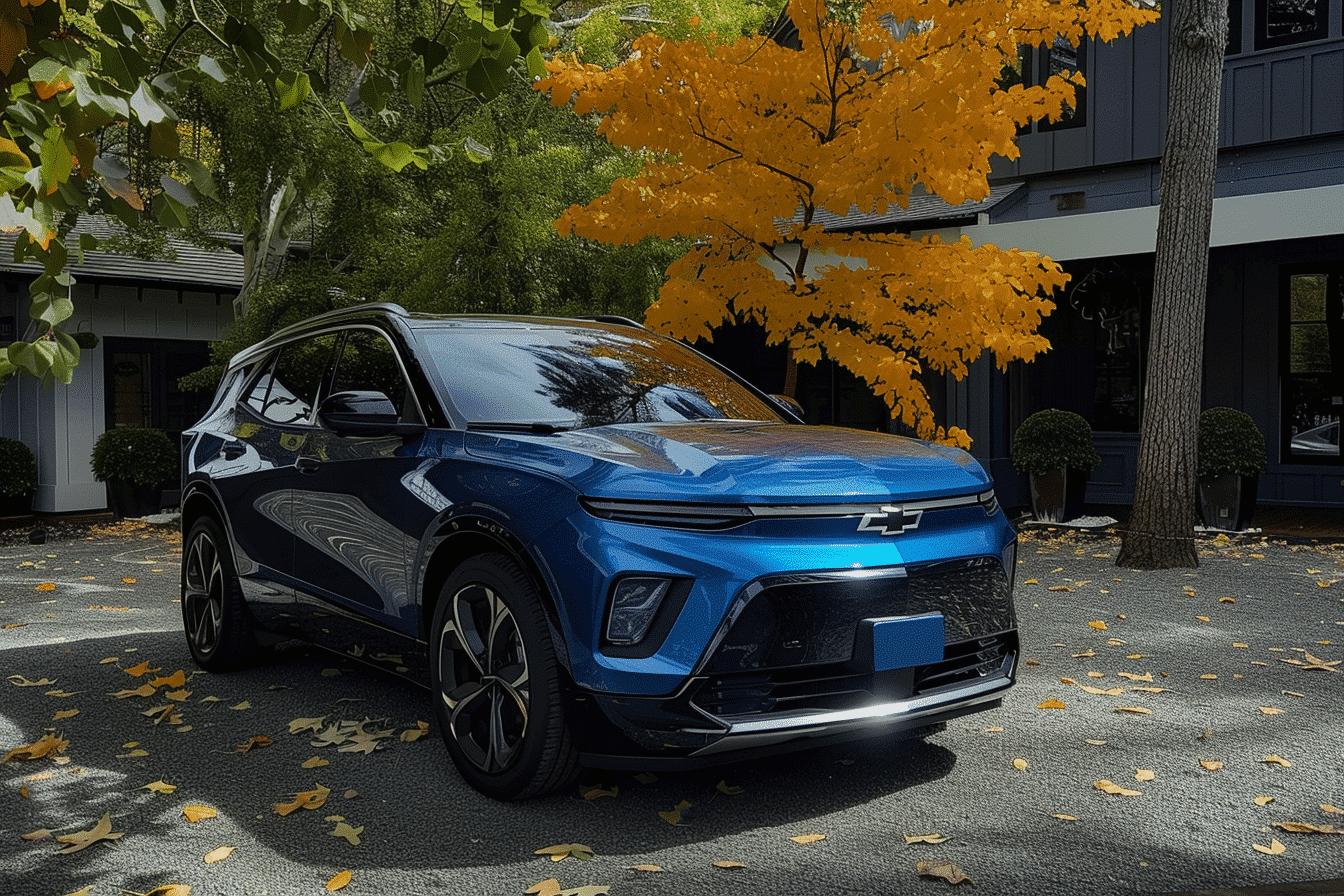

Amid these adjustments, GM is pushing forward with significant product launches. The company is set to introduce the Chevrolet Equinox EV, starting at approximately $35,000 before EV incentives, which include up to a $7,500 federal credit. Additionally, GM has relaunched the Chevrolet Blazer EV after resolving earlier software issues. Both vehicles are critical to GM’s EV growth strategy and utilize the company’s advanced “Ultium” EV platform.

GM Reinforces Shareholder Commitments

Parallel to its operational strategies, GM has also announced a new $6 billion stock repurchase authorization, mainly supported by the sales of its traditional gas-powered vehicles. This new buyback plan follows an accelerated $10 billion share repurchase program set to conclude at the end of the current month. “We are very focused on the profitability of our [internal combustion engine] business, and we’re growing and improving the profitability of our EV business and deploying our capital efficiently. This allows us to continue returning cash to shareholders,” Jacobson explained.

As General Motors recalibrates its approach to electric vehicles, the company remains steadfast in balancing the growth of its EV sector with the robust profitability of its traditional automotive operations. By adjusting production goals and enhancing strategic initiatives, GM is poised to navigate the complexities of the transitioning automotive market, ensuring it remains competitive and responsive to consumer demand and shareholder interests.