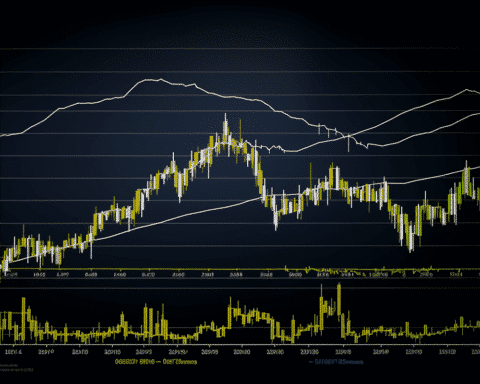

Shopify has showcased commendable progress in the recent past. After plunging to a nadir of $23.60 in 2022, Shopify’s stock (NYSE: SHOP) has rebounded impressively, registering about a 135% rise at the time of this report.

Given the stock’s recent trajectory, one could infer an increased investor confidence in Shopify’s resurgence post a challenging 2022. But has the company truly passed its most turbulent phase?

2022: A Turbulent Year for Shopify

Investors of Shopify grappled with tumult in 2022. In 2021, the company boasted a market valuation surpassing $200 billion. However, within a span of just a year, this value plummeted below $35 billion, wiping out over 80% of investors’ equity.

This sharp decline wasn’t arbitrary. Shopify encountered significant challenges in 2022, a contrast to the favourable conditions experienced during the two preceding COVID-19 years. The shift back to pre-pandemic norms affected the entire e-commerce sector, Shopify included. Further exacerbating the situation were global occurrences, such as the Ukrainian conflict, soaring inflation, and rising interest rates that year.

Consequently, Shopify’s growth rate decelerated markedly in 2022. For context, while the gross merchandise value (GMV) saw a 47% rise in 2021, it only grew 12% the following year. Revenue growth also dipped from 57% in 2021 to 21% in 2022. Most concerning was the decline in operating income, which plunged from a positive $269 million in 2021 to a negative $822 million in 2022.

Although a 21% revenue growth isn’t negligible, it fell short of investor expectations, given the company’s elevated price-to-sales ratio which stood above 30 times prior to the eventual market correction. In response to the downturn, management streamlined its workforce by 10% in 2022 and an additional 20% in 2023, further fueling investor apprehensions about Shopify’s future outlook.

Emerging Signs of a Recovery for Shopify

Despite the setbacks in 2022, recent indicators suggest potential stabilization for Shopify.

Notably, Shopify’s GMV growth has seen a consistent upswing over recent quarters, rising from an 11% increase during mid-2023 to 17% in subsequent quarters. While this growth doesn’t match the 47% spike witnessed in 2021, the steady upward trend is a beacon of hope for many.

Additionally, there has been an uptick in revenue growth, which peaked at 31% in the second quarter of 2023, driven by increased GMV and subscription price hikes. Even more encouraging is Shopify’s achievement of positive cash flow for three consecutive quarters, even though its net profitability remains in the red.

For the third quarter of 2023, Shopify projects revenue growth in the low-20s percentile and expects positive free cash flow. While this projected growth may trail the second quarter’s figures, it’s still a promising development.

All things considered, the company shows promising signs of recovery. The onus now lies on Shopify to sustain this momentum.

Investor Implications

Although 2022 posed significant challenges for Shopify, emerging data suggests that the darkest days might be behind. However, while the indicators are positive, it’s still premature for investors to be exuberant.

While the company seems to be on an upward trajectory, it’s wise for investors to await further proof of a consistent and sustainable recovery. The real indicators of Shopify’s long-term viability would be sustained growth in GMV, revenue, and consistent positive cash flow. A patient approach, waiting for these indicators, is recommended before making any investment decisions.

In the ever-evolving landscape of e-commerce, companies like Shopify will inevitably face challenges. However, the resilience of a company isn’t judged by the adversities it faces but by its capacity to rebound. As Shopify displays early signs of a robust recovery, it reinforces the belief in its core strengths and market adaptability. For investors, it serves as a poignant reminder of the importance of patience, due diligence, and the ability to discern between short-term hiccups and long-term potential.