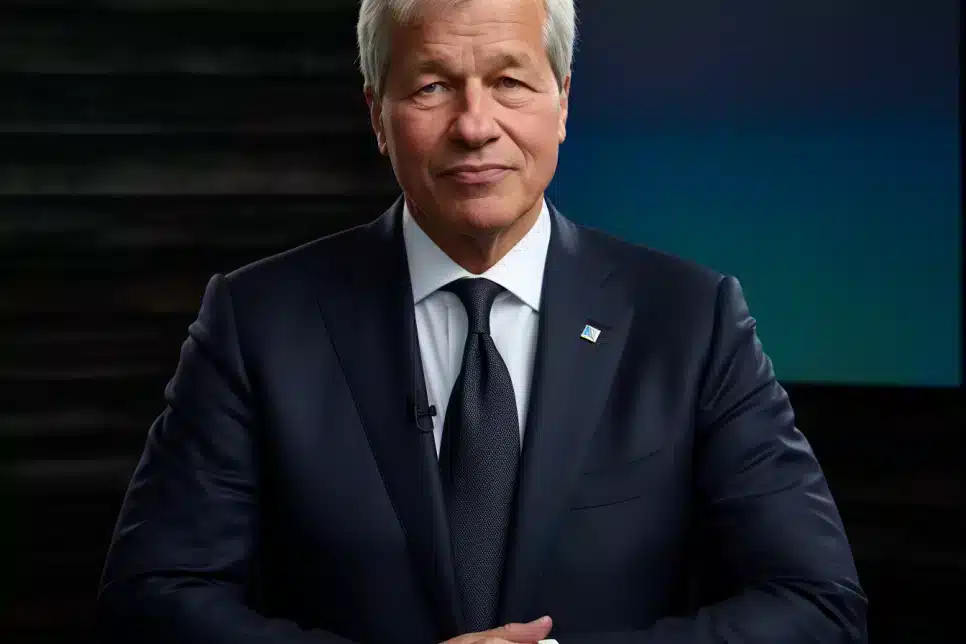

As the world steps into 2024 and 2025, the U.S. economy faces a tumultuous period marked by many challenges. JPMorgan Chase CEO Jamie Dimon, in a revealing CNBC interview with Andrew Ross Sorkin at the World Economic Forum in Davos, Switzerland, articulated his concerns. Dimon’s remarks highlight a blend of financial and geopolitical risks, suggesting a cautious approach to the U.S. economic landscape in the upcoming years.

“You have all these mighty forces that will be affecting us in ’24 and ’25,” Dimon expressed, underscoring the complexity and magnitude of the impending challenges. He pinpointed specific issues such as the ongoing conflict in Ukraine, rising terrorist activities in Israel and the Red Sea, and the Federal Reserve’s quantitative tightening measures. According to Dimon, quantitative tightening, a strategy to shrink the Federal Reserve’s balance sheet and curb bond-purchasing programs, remains a partially understood mechanism with potentially far-reaching impacts.

Despite JPMorgan’s record profits and a U.S. economy that has surprisingly held up, Dimon has consistently advocated for prudence. The resilience of the American consumer, bolstered by healthy employment levels and savings accrued during the pandemic, has been a silver lining amidst the inflationary pressures. However, Dimon cautions against complacency, especially given the recent stock market buoyancy. The S&P 500’s 19% rise in the past year and its proximity to peak levels do not necessarily equate to economic stability. “I think it’s a mistake to assume everything’s hunky-dory,” he warned.

Echoing Dimon’s sentiments, Goldman Sachs CEO David Solomon also voiced concerns, particularly regarding the soaring U.S. debt levels. “I’m very concerned about the growing debt,” Solomon stated, acknowledging it as a significant risk that cannot be ignored.

Dimon’s track record of cautionary forecasts, including his 2022 prediction of an economic “hurricane” due to quantitative tightening and the Ukraine conflict, lends weight to his current outlook. His recent discussion also touched on diverse topics, including Ukraine, former President Donald Trump, immigration policies, commercial real estate, and bitcoin.

As Jamie Dimon articulates a guarded perspective on the U.S. economy’s future, it becomes evident that the intersection of financial acumen and geopolitical awareness is crucial. The coming years, laden with complex challenges, require a balanced approach considering the intricate web of global economic and political dynamics. Dimon’s insights serve as a reminder that vigilance and adaptability are key in navigating the uncertain economic waters ahead.