JPMorgan Chase has recently expressed concerns about the Federal Reserve’s stress test results, claiming that the regulator overestimated a crucial measure of income. The bank believes that its losses should be higher than what the Fed reported, sparking a debate about the accuracy and transparency of the stress test process.

JPMorgan’s Late-Night Disclosure

In an unusual move, JPMorgan Chase issued a press release just before midnight ET to address the discrepancies in the Federal Reserve’s stress test findings. The bank contended that the Fed’s projections for “other comprehensive income” (OCI) were significantly inflated. OCI includes revenues, expenses, and losses excluded from net income, and the Fed’s estimates showed $13 billion in OCI for JPMorgan, the highest among the 31 banks tested.

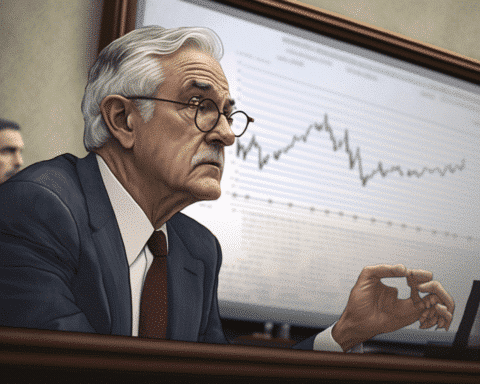

Higher Stress Test Losses Expected

According to JPMorgan, the Fed’s projection error means the bank’s losses under the stress test should be higher than disclosed. “Should the Firm’s analysis be correct, the resulting stress losses would be modestly higher than those disclosed by the Federal Reserve,” stated JPMorgan. The Fed estimated that JPMorgan would face approximately $107 billion in loan, investment, and trading losses in a severe recession scenario.

Impact on Share Repurchase Plans

The error in the Fed’s projections could delay JPMorgan’s share repurchase plan. A person familiar with the situation, who spoke anonymously due to the regulatory nature of the process, indicated that the bank might need additional time to finalize its plans. Banks typically reveal their repurchase strategies shortly after the market closes on the Friday following the stress test results.

Transparency Issues in Stress Tests

This isn’t the first time banks have questioned the Fed’s stress test results. Last year, both Bank of America and Citigroup highlighted discrepancies between their own income estimates and the Fed’s projections. Banks have often criticized the annual stress test for its lack of transparency and the difficulty in understanding the methodology behind the Fed’s results.

A Call for Clarity

JPMorgan Chase’s recent disclosure underscores the ongoing challenges and criticisms surrounding the Federal Reserve’s stress tests. As banks continue to navigate these regulatory hurdles, the need for a clearer and more transparent process becomes increasingly evident. Ensuring accuracy and understanding in these tests is crucial for maintaining confidence in the financial system.