JPMorgan Chase has once again solidified its position as a financial powerhouse, reporting record-breaking quarterly and annual earnings on Wednesday. The bank’s massive scale, strategic maneuvers, and economic resilience have propelled it to unprecedented heights, reinforcing its status as the largest and most profitable bank in U.S. history.

A Strong Finish to the Year

In a statement, JPMorgan revealed $4.81 per share earnings, significantly surpassing the $4.11 estimate. Revenue climbed 10% year-over-year to reach $43.74 billion, well above the expected $41.73 billion. Profit surged 50% to $14 billion in Q4, partly driven by reduced noninterest expenses, which fell 7% from the previous year.

Stellar performances in fixed-income trading and investment banking fees bolstered the results. Fixed-income trading revenue increased by 20%, reaching $5 billion, while investment banking fees jumped 49% to $2.48 billion, outpacing market expectations.

A Beneficiary of Market Turbulence

JPMorgan’s dominance grew even stronger following its acquisition of First Republic Bank from Federal Deposit Insurance Corporation (FDIC) receivership in 2023. This strategic move expanded its assets and solidified its deposit base amid the regional banking crisis.

While the bank paid the largest FDIC assessment last year, the subsequent gains in deposits and assets have positioned it as the major winner during a period of financial instability.

Economic Outlook and Challenges Ahead

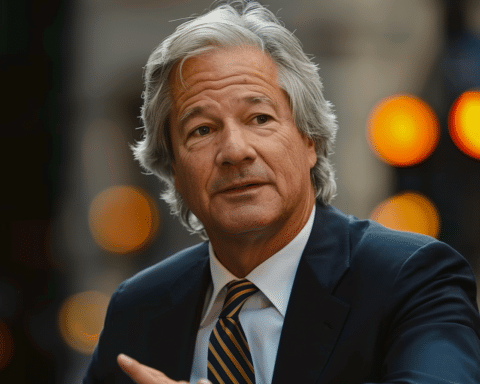

CEO Jamie Dimon expressed cautious optimism about the economic landscape. “The economy remains resilient,” he noted, citing low unemployment, robust consumer spending, and optimism tied to the Trump administration’s pro-growth policies.

However, Dimon warned of two significant risks: persistent inflation driven by increased spending and complex geopolitical conditions. “We hope for the best but prepare the firm for a wide range of scenarios,” he said.

Questions on Leadership and Future Strategy

Amid this period of growth, the spotlight is also on the bank’s leadership. With COO Daniel Pinto stepping down in June, analysts are eager for clarity on CEO Jamie Dimon’s succession plans. Dimon has indicated he may step down within five years, raising questions about the future direction of JPMorgan’s leadership.

Additionally, analysts are closely watching how the bank will handle potential regulatory changes under Trump-appointed regulators. The possibility of a “gentler” Basel 3 Endgame could lead to significant capital windfalls, prompting speculation about share buybacks and other strategic investments.

The Industry Landscape

JPMorgan’s remarkable performance comes as other major banks, including Goldman Sachs, Wells Fargo, and Citigroup, also release their earnings. Bank of America and Morgan Stanley are set to report later this week, making it a critical period for the financial sector.

As CFO Jeremy Barnum noted, JPMorgan projects net interest income for 2025 to be approximately $94 billion, showcasing its confidence in sustaining robust operations across its extensive portfolio.

JPMorgan Chase’s record-breaking earnings highlight its unmatched scale and adaptability in a complex economic environment. With a strong finish to the year and cautious optimism about the future, the bank remains a leader in the financial industry. As the market watches for regulatory shifts and leadership changes, JPMorgan is poised to navigate whatever challenges lie ahead.