Despite a staggering 97% decline, does Canoo, the struggling EV stock, merit a speculative play?

Canoo (NASDAQ: GOEV), an electric vehicle (EV) player, has seen tough times since its public debut through a SPAC merger in late 2020. With the company still pre-revenue and its share value hitting a nadir, down by nearly 97% from its peak, it raises a serious question: Should investors dare to venture into this beleaguered EV entity or steer clear due to the possibility of further share value erosion? Let’s explore the potential outcomes for this stock, contemplating both the positive and negative prospects, to ascertain if it’s a judicious investment at its current valuation.

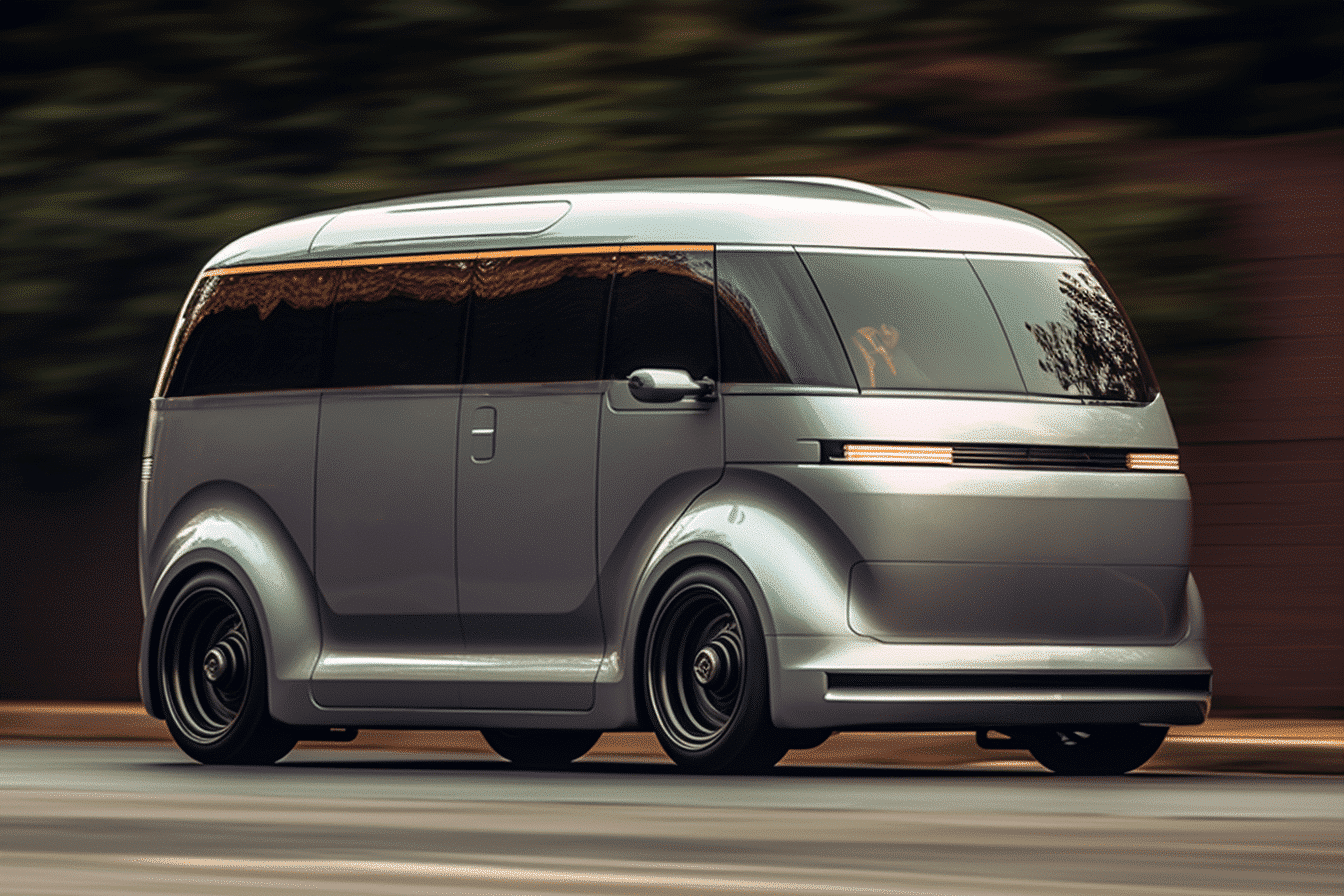

Bull Case: Potential Value Revival with the Start of Deliveries Given the brutal blow the stock has taken, a whiff of good news could potentially send Canoo’s share value soaring. The company projects a production rate of 20,000 vehicles this year, alongside an anticipated cut in operating expenses by 25-30%, achieved via staff downsizing, slashing professional fees, and curbing IT infrastructure costs.

While skeptics abound, considering Canoo’s pre-revenue state and zero deliveries to date, the company plans to kickstart deliveries this quarter. This positive shift, albeit minor, could counterbalance the prevailing bearish sentiment and spur a strong recovery, granted the business shows signs of survival.

By primarily targeting the business market, Canoo aims to carve a niche in the competitive EV industry. As per company management, there’s solid demand, and they’re making headway with unit economics. They envisage a production boost to 40,000 vehicles next year and positive gross margins by 2025.

Canoo’s announcement of new orders from Fortune 100 and Fortune 500 companies, confirmed contracts with Walmart, Kingbee, and NASA, and projected sales value of $2.8 billion signal a promising outlook. While there’s uncertainty around the delivery timeline and realization of this full sales figure, tangible progress toward converting orders into sales could catalyze a sharp rise in Canoo’s severely dented valuation. The stock may be a gamble, but it could pay off considerably for investors with a high-risk tolerance.

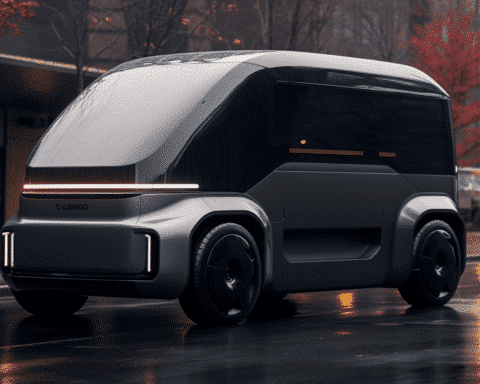

Bear Case: Capital Constraints, Persistent Dilution, and Intense Competition The EV sector’s intensifying competition raise doubts about Canoo’s ability to secure a significant market share or turn profitable. Even established market leaders are grappling with demand issues. Canoo’s plan to start deliveries and boost production comes when industry and macroeconomic factors pose formidable challenges.

In the wake of significant interest rate hikes, borrowing costs have spiked, and Canoo would require a substantial capital influx to amplify its vehicle production. Unfortunately, the company’s cash reserves at the end of the last quarter were minimal.

Considering the conversion of stock warrants and debt notes into stock, the company’s cash balance was approximately $70 million by the end of the period. With the operating losses at roughly $67 million for the quarter and $400 million for the previous year, Canoo will likely continue to bleed money, even if it achieves positive gross margins by 2025.

With Canoo’s recent sale of convertible debt notes yielding about $45.1 million, the company can only rely heavily on issuing new ordinary shares in June 2024 due to sale terms and Nasdaq exchange restrictions. Consequently, Canoo may have to secure external funding or sell preferred stock to maintain operations beyond next year. The company’s path to profitability seems distant, even under optimistic scenarios, and it faces the significant risk of insolvency.

Is Canoo Stock a Wise Investment?

Investing in Canoo could be more akin to a risky wager than a sound investment. The chances of the company offering robust long-term returns are grim, with a real risk of the business folding before the decade ends. While there might be potential for the stock to outperform its current status or even experience explosive growth if Canoo manages to endure, the investment’s skewed risk-reward balance renders it unsuitable for most investors’ portfolios.

Canoo presents a speculative investment opportunity with a potential for high reward and significant risk. It seems suited for a very niche category of investors: those with a high-risk tolerance who are willing to potentially lose their investment for the chance of an outsized return. With so much uncertainty surrounding Canoo, it’s crucial for investors to thoroughly examine the company’s prospects and financial stability before diving in. As always, it is recommended that potential investors consider their individual risk tolerance and investment goals and consult with a financial advisor before making investment decisions.