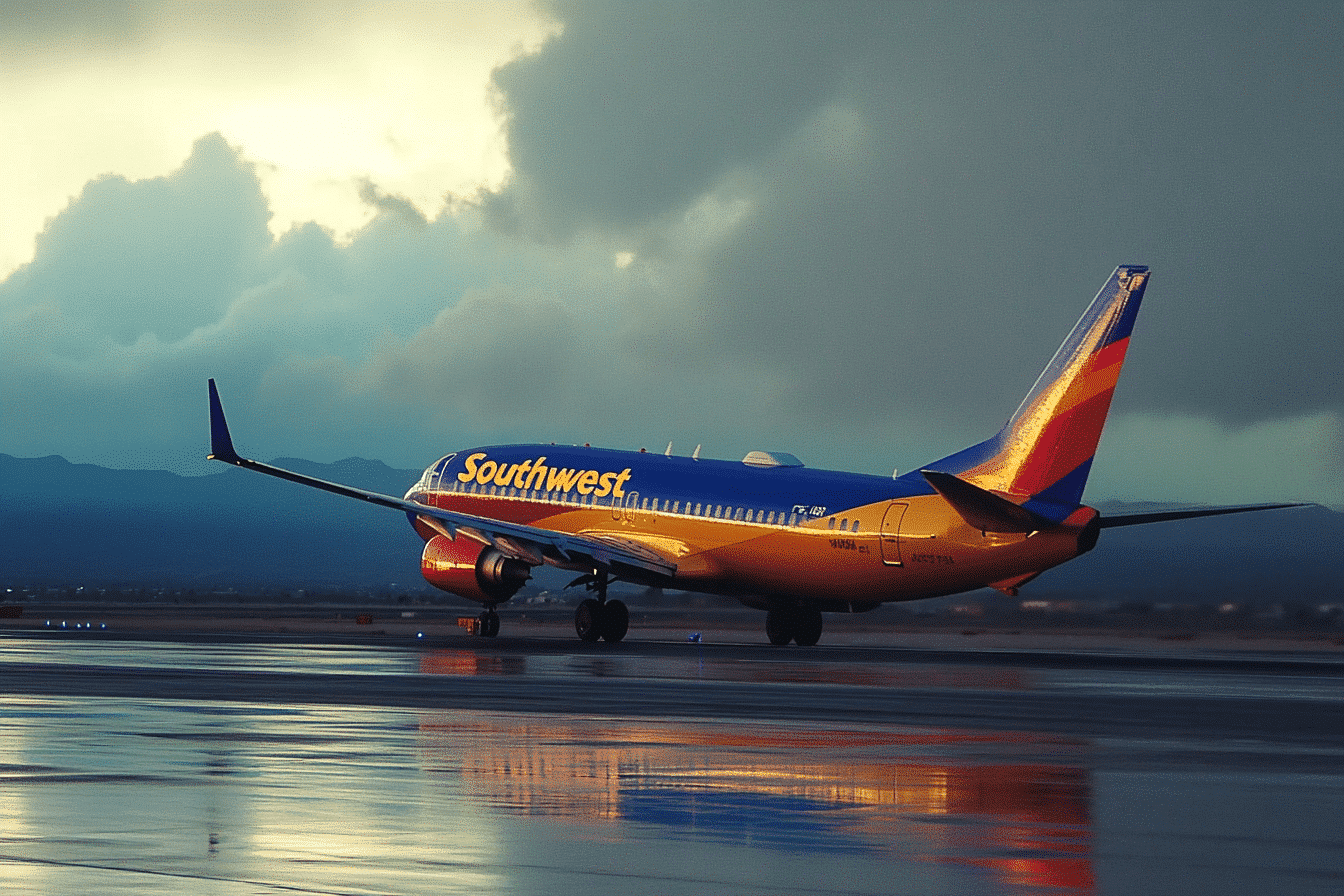

In a historic shift, Southwest Airlines is ending its open seating model and will start offering extra legroom seats to increase revenue and cater to evolving customer preferences. This marks the biggest change in the airline’s 53-year history.

The End of Open Seating

Southwest Airlines announced on Thursday that it will begin selling flights with assigned seating and extra legroom next year. This change comes after extensive research revealed that the airline’s open seating model was the primary reason travelers chose competitors. According to Southwest, 80% of its customers prefer assigned seats.

“Although our unique open seating model has been a part of Southwest Airlines since our inception, our thoughtful and extensive research makes it clear this is the right choice — at the right time — for our Customers, our People, and our Shareholders,” stated CEO Bob Jordan in a news release.

Catering to Modern Travelers

The airline plans to introduce overnight flights starting in February, and it has been studying such changes for years. Jordan emphasized that the way travelers fly has changed, with fewer short-haul trips and a growing preference for assigned seats on longer flights. “Customers are just taking fewer short haul trips today. They’re flying longer, and when they fly longer, the importance of an assigned seat goes up,” he noted.

Southwest’s move to offer extra legroom seats is in line with industry trends, where premium product growth has outpaced main cabin revenue. The new seating options are expected to generate substantial revenue, with projections exceeding $1 billion annually.

Keeping the Core Values

Despite these significant changes, Southwest is not altering its popular policy of offering two free checked bags. This policy remains a key differentiator for the airline, alongside competitive fares and schedules. “Bags fly free” is a top reason customers choose Southwest over other airlines.

The airline’s decision to maintain its core values while adapting to customer preferences aims to balance tradition with innovation. Jordan assured that the changes are intended to enhance customer experience without compromising the airline’s longstanding principles.

Investor Influence and Financial Performance

The changes come as Southwest faces increased pressure from activist investor Elliott Investment Management, which has a nearly $2 billion stake in the airline. Elliott has called for new leadership, criticizing current management for not adapting quickly enough to changing customer preferences.

Southwest reported a 46% drop in its second-quarter profit on Thursday, highlighting the need for strategic changes to boost revenue. However, Jordan dismissed Elliott’s push for leadership changes, stating that the airline’s decisions are based on thorough research and customer feedback.

“Elliott has shown no willingness to engage in any meaningful conversation,” Jordan told CNBC. “We’d be happy to do that but it’s hard to have a dialogue that’s one-sided.”

Looking Ahead

Southwest executives plan to provide more details about the upcoming changes at an investor day at the end of September. The airline expects about a third of the seats on its Boeing 737s to offer extended legroom, similar to other narrowbody aircraft in the industry. The Federal Aviation Administration will need to approve the new cabin layouts before implementation.

While analysts have criticized Southwest for moving too slowly, the airline is confident that these changes will position it for future growth. The introduction of assigned seating and extra legroom is a strategic move to attract corporate travelers and enhance the overall customer experience.

Southwest Airlines is embracing change with assigned seating and extra legroom to meet customer demands and increase revenue. As the airline navigates this significant transition, it remains committed to its core values, ensuring that customers continue to enjoy the benefits that have made Southwest a beloved choice for travelers.