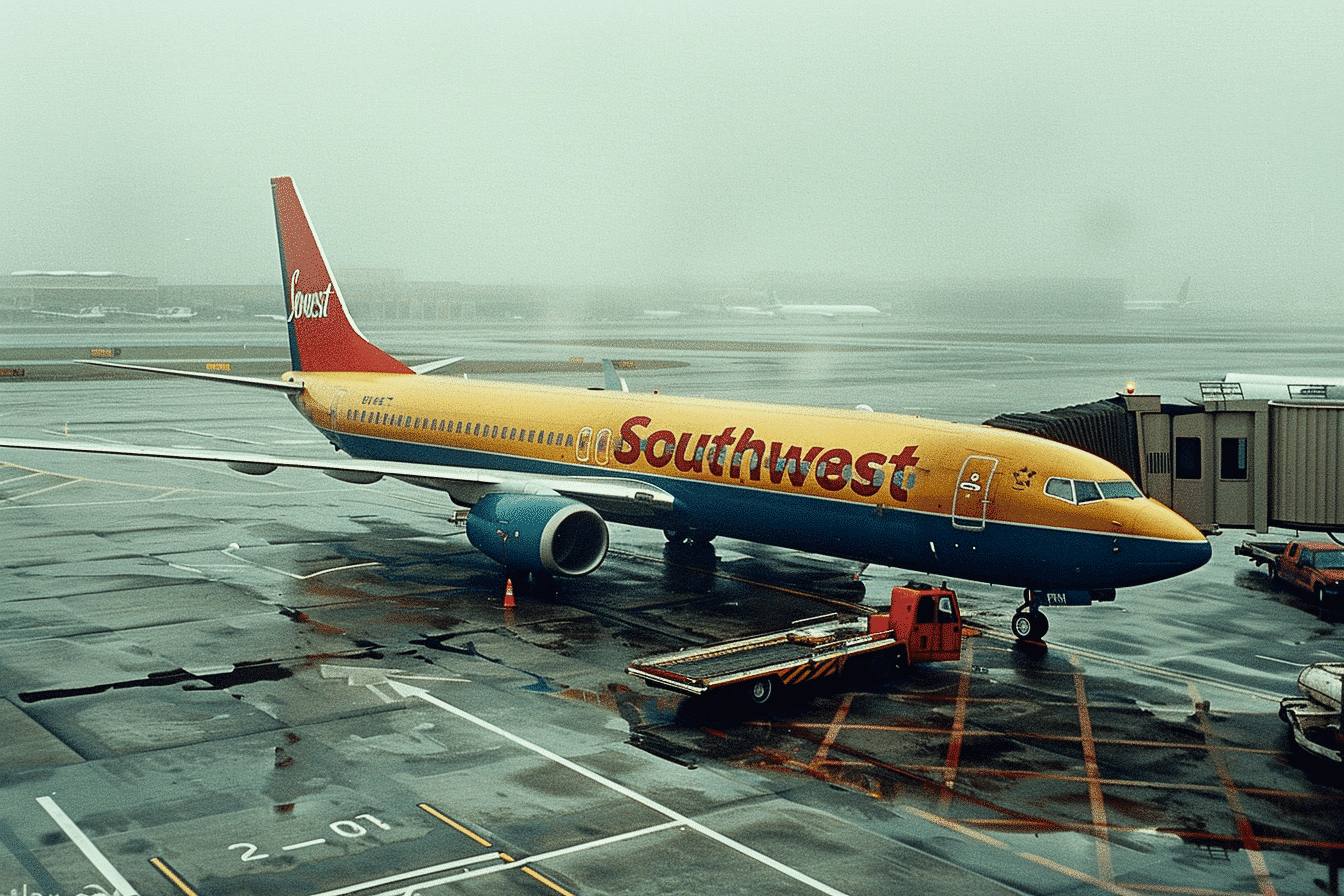

Southwest Airlines has reported a significant decline in profits as the company takes critical steps to boost its revenue. Despite achieving record revenue in the second quarter, the airline’s profit has dropped by over 46%, prompting urgent measures to address the financial challenges.

Record Revenue But Falling Profits

Southwest Airlines has experienced a mixed bag of financial results in the second quarter. The airline’s revenue rose by 4.5% compared to last year, reaching $7.35 billion. This figure surpassed Wall Street expectations, marking a new record for the company. However, the profit picture was less rosy. The profit fell by more than 46% to $367 million, or 58 cents per share, despite adjusted earnings per share beating analyst expectations at 58 cents compared to the anticipated 51 cents.

External and Internal Challenges

CEO Bob Jordan acknowledged the hurdles faced by the airline, stating, “Our second quarter performance was impacted by both external and internal factors and fell short of what we believe we are capable of delivering.” The airline attributed the financial dip to a combination of higher nonfuel costs, which rose as much as 13%, and a drop in unit revenue by up to 2% over the previous year.

Boeing Delivery Delays and Compensation Talks

Southwest Airlines is currently negotiating compensation from Boeing due to delays in aircraft deliveries. Boeing, as Southwest’s sole supplier of airplanes, has faced safety and manufacturing crises that have hindered timely deliveries. Southwest expects only 20 aircraft deliveries this year, less than half of its initial forecast. This shortfall has further strained the airline’s operations and revenue potential.

Strategic Changes to Business Model

In response to investor pressure, including a significant stake from Elliott Investment Management, Southwest has announced major changes to its business model. The airline will eliminate its open seating plan, introduce seats with extra legroom, and add overnight flights starting next year. These changes aim to make Southwest more competitive with network carrier rivals and drive both top and bottom-line growth. Jordan emphasized the urgency of these steps, saying, “We are taking urgent and deliberate steps to mitigate near-term revenue challenges and implement longer-term transformational initiatives that are designed to drive meaningful top and bottom-line growth.”

Market Dynamics and Future Outlook

The broader airline market has seen oversupply, leading to discounted tickets during peak seasons. However, executives from Delta Air Lines and United Airlines have projected a moderation in U.S. capacity by August, potentially resulting in higher fares. This industry-wide adjustment may offer some relief to Southwest’s pricing pressures.

Southwest Airlines is navigating a challenging financial landscape with a series of strategic adjustments aimed at reversing its profit decline. While the road ahead is fraught with obstacles, the airline’s proactive measures and anticipated industry shifts may help it regain financial stability and growth.