The GPU Market in 2022

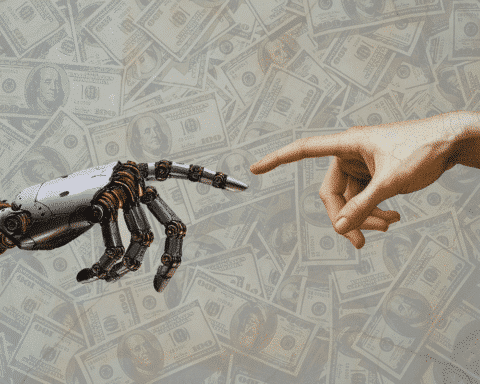

Despite a slump in the PC market, both companies have much to offer over the long term. But which one is the better buy?

Sony, Microsoft, and Nintendo dominate the console gaming industry, but PC gaming has grown rapidly since the pandemic began. Unlike consoles, PC gaming can provide a more detailed and smoother experience thanks to its powerful components. PC gaming requires a graphics processing unit (GPU), such as those from Nvidia (NVDA) and AMD (AMD). Since 2005, both companies’ stocks have grown by triple digits thanks to PC gaming.

Nvidia and AMD shares fell between 37% and 48% year over year as demand for graphics processing units (GPUs) declined throughout 2022. Now is a great time to invest in one of these tech stars since these companies are unlikely to be down forever.

Nvidia’s Stock: A Rough Ride

Nvidia’s stock has taken a beating over the past year. Prices have dropped a staggering 35%, leaving shares hovering around $169, a far cry from the 2021 peak of $329. And while the price may have dropped, the company’s price-to-earnings (P/E) ratio remains high at 72.

For Nvidia to bounce back, the semiconductor designer must find a way to keep growing its revenue in the face of a challenging economic environment. Enter the RTX 4000 series of GPUs for PC gaming. Set to be released in a staggered rollout starting in November, these new models are Nvidia’s biggest hardware launch since 2020. They replace the wildly successful RTX 3000 series of cards, which saw success during both the pandemic and the crypto-mining boom.

But things have yet to get off to the best start. One of the models had to be “unlaunched” following consumer backlash and sales falling short of expectations. And it’s not all Nvidia’s fault – the GPU market hit a 20-year sales low in Q3 2022. To make matters worse, Nvidia launched the RTX 4000 series at the worst possible moment in the last 20 years, as the end of crypto mining for Ethereum and the rising cost of living have led to a lack of interest in upgrading to the new models. Nvidia’s prices are already being discussed as a result. By releasing cards at much higher prices than the previous generation, the company misjudged how much consumers were willing to spend in 2022. Nvidia’s high-end mainstream GPU, the RTX 3080, has been replaced by the RTX 4080, which starts at $1,199 compared to $699 for the former.

Nvidia has options to adjust pricing, but if the market drop from Q3 2022 is any indication, it will be an uphill battle. But all is not lost. Nvidia’s income from gaming doesn’t just come from GPUs. The company also provides the system on a chip (SoC) for the Nintendo Switch. Despite being 6 years old, the Switch is still selling better than expected, with over 114 million units sold and over 20 million sold last year. And rumors are swirling that the successor to the Switch, set to be announced in 2023 or 2024, will again be powered by an SoC from Nvidia. Nvidia will need the Switch successor to succeed if the GPU market doesn’t pick up.

AMD: A Different Story

Shares of AMD have fallen in a similar manner to Nvidia’s, with shares down 46% over the past year. The stock has also

dropped considerably from its 2021 peak of $155, currently sitting at $71. But there’s a silver lining for AMD. The company’s P/E ratio of 42 is more attractive than Nvidia’s, and it’s less heavily invested in the success of the GPU market.

AMD’s discrete GPU market share in Q3 2022 was 16%, compared to Nvidia’s 84%. The company has been expanding its GPU offerings and has also been focusing on gaming laptops, which is a growing market. Additionally, AMD’s Ryzen processors have been gaining market share in the PC market, and the company is also expanding into the data center market. This diversified approach to gaming gives AMD a safety net that Nvidia doesn’t have.

Nvidia and AMD have been impacted by the slump in the PC market in 2022, but both have a lot to offer over the long term. While Nvidia has a higher P/E ratio, it is more invested in the success of the GPU market than AMD and is also dependent on the success of the Nintendo Switch successor. On the other hand, AMD has a more diverse exposure to gaming and is expanding into other markets, such as gaming laptops and data centers. It’s up to the investor to decide which company aligns more with their investment strategy.