The Federal Reserve’s latest interest rate hike, coupled with its hint that the end of the walks may be near, has led to a decline in Asian shares.

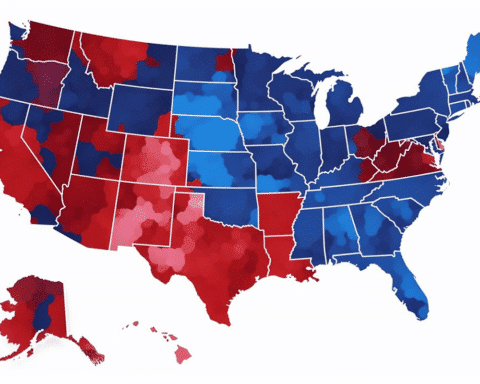

Japan’s Nikkei 225 fell by 0.2%, Australia’s S&P/ASX 200 slipped by 0.6%, while South Korea’s Kospi barely changed, decreasing by less than 0.1%. However, Hong Kong’s Hang Seng saw a 0.9% rise, and the Shanghai Composite lost less than 0.1%.

According to market analyst Yeap Jun Rong, the share decrease can be attributed to the “risk-off tone” following the Fed meeting. The S&P 500, Dow Jones Industrial Average, and the Nasdaq composite fell by 1.6% on Wall Street.

The decline was particularly noticeable in the banking sector after Treasury Secretary Janet Yellen stated that she is not considering blanket protection for all depositors unless they threaten the system.

The Fed’s projections for upcoming years indicated that the federal funds rate might only rise slightly from its current range of 4.75% to 5%. Chair Jerome Powell emphasized that the Fed is still focused on reducing inflation to its 2% goal but may raise rates again if necessary.

Despite the Fed’s intentions, the yield on the two-year Treasury tumbled, reflecting the market’s speculation on potential rate cuts. However, Senior Global Market Strategist Sameer Samana of Wells Fargo Investment Institute believes that rate cuts will unlikely occur this year.

The Fed faces a difficult decision as it tries to balance the pressure on the banking system and the risk of recession. In the energy and currency markets, benchmark U.S. crude fell by 83 cents, Brent crude lost 73 cents, and the U.S. dollar decreased against the Japanese yen and the euro.

The current state of the banking sector, with two of the most extensive bank failures in U.S. history occurring in the past two weeks, has added to the uncertainty in the market. Investors are concerned that the pressure on the banking system, particularly among smaller and mid-sized banks, may decrease loans to businesses across the country, leading to less hiring and economic activity. This, in turn, could increase the risk of a recession.

Despite the challenges, the Fed’s decision to raise interest rates and the market’s speculation on potential rate cuts are both being closely monitored by economists and investors alike. The Fed’s focus on reducing inflation to its 2% target, combined with Powell’s statement that the Fed may raise rates again if necessary, indicate that the central bank is determined to maintain stability in the economy. However, the situation remains fluid, and further developments in the banking sector and the global economy may significantly impact the market in the coming days and weeks.