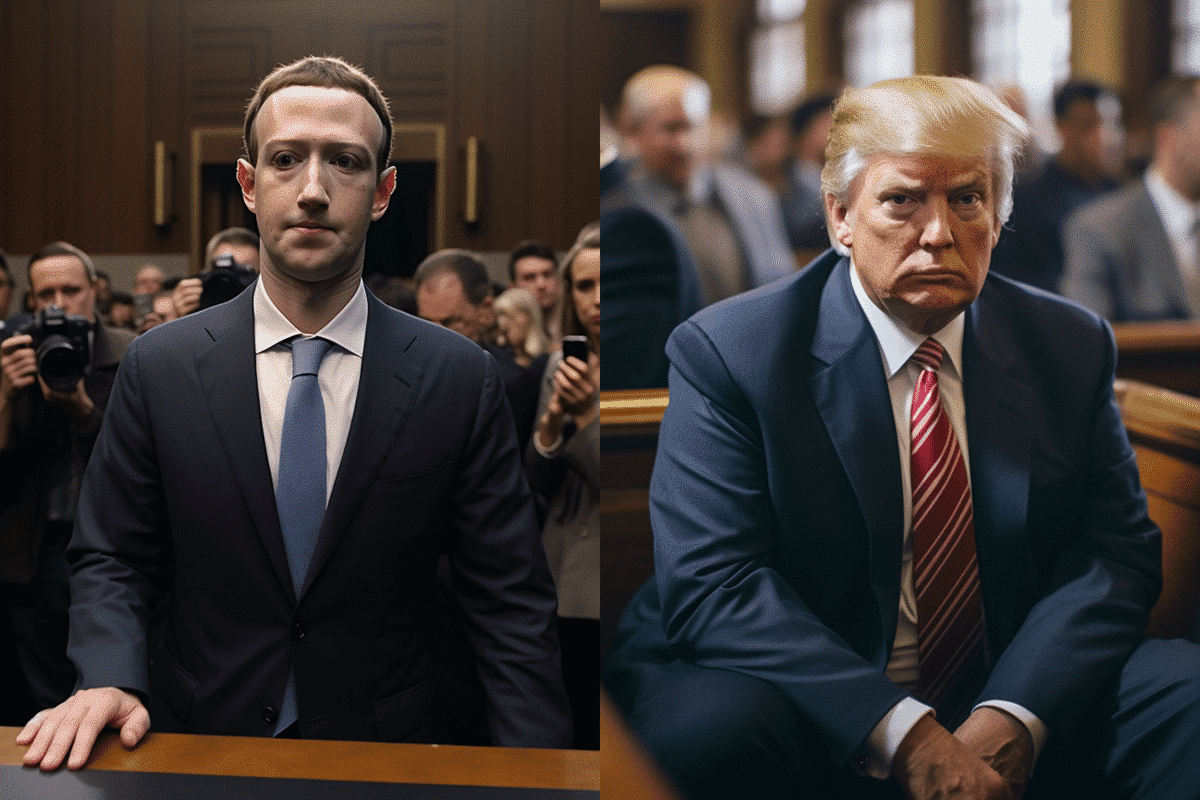

Former President Donald Trump’s recent criticism of Facebook has sent shockwaves through Wall Street, leading to a significant decline in Meta Platforms (META) stock. Trump labeled Facebook as “an enemy of the people” during a CNBC appearance, igniting concerns among traders and investors.

Meta, the parent company of Facebook, experienced a 4% drop in its stock value following Trump’s remarks on CNBC and his post on Truth Social, his own social media platform. This downturn marks a considerable setback for Meta, with its market valuation plummeting by more than $60 billion since Trump’s verbal attacks began.

Analysts attribute the decline in Meta’s shares primarily to Trump’s comments, highlighting the adverse impact of political scrutiny on the tech giant’s performance. Trump’s unexpected stance against a proposed TikTok ban further exacerbates the situation, with implications for Facebook’s competitive landscape.

Despite Meta’s decision to ban Trump from its platforms for two years following the Capitol riot in 2021, the former president’s accounts were reinstated in February 2023. Trump’s renewed criticism of Facebook underscores his ongoing animosity towards the company, alleging dishonesty and negative influence on elections.

Investors have responded swiftly to Trump’s criticism, with Meta shares experiencing a significant downturn, reaching a nearly 5% drop at one point during Monday’s trading session. Analysts express concerns about potential repercussions if Trump were to regain the presidency, including regulatory constraints on Meta’s future acquisitions.

In a surprising twist, Trump’s involvement in social media remains significant, as his company, Trump Media & Technology Group, navigates a controversial merger with a blank-check company. Upon approval, Trump would wield considerable influence in the newly-formed entity, adding complexity to the political landscape surrounding social media.

Meanwhile, lawmakers in the United States are poised to vote on a bill targeting TikTok, a popular social media platform with ties to China. The proposed legislation would mandate TikTok’s separation from its Chinese parent company within five months, with President Joe Biden signaling his readiness to sign it into law.

The convergence of political scrutiny and market dynamics underscores the volatile nature of the tech industry, with Meta at the center of the storm. Trump’s outspoken criticism of Facebook raises questions about the company’s future trajectory and its ability to navigate regulatory challenges in an increasingly politicized environment.

As Meta grapples with the fallout from Trump’s condemnation, investors remain vigilant, closely monitoring developments that could shape the company’s fortunes in the months to come. The intersection of politics and technology continues to exert profound influence on the markets, with Meta’s stock volatility serving as a stark reminder of the sector’s inherent unpredictability.