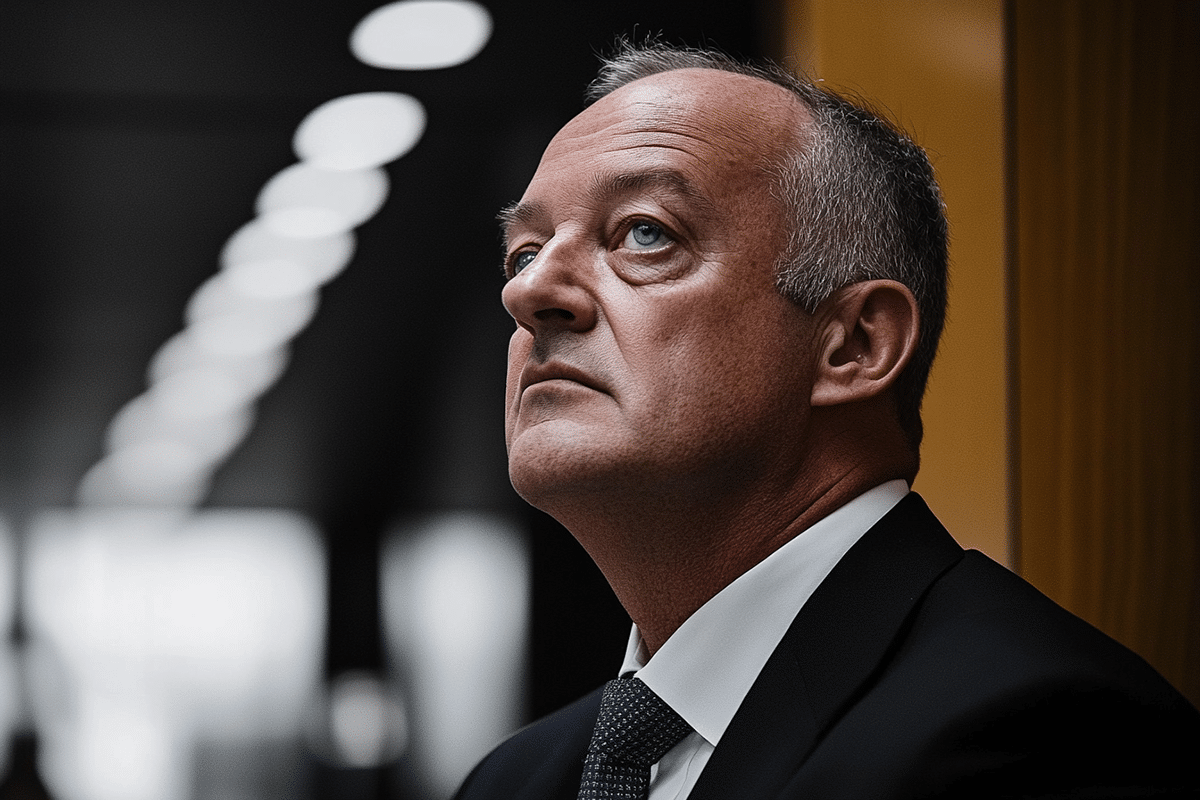

UnitedHealth Group CEO Andrew Witty has addressed rising public concerns about the U.S. health care system following the tragic death of UnitedHealthcare CEO Brian Thompson. In a published essay, Witty acknowledged that the system is not performing as efficiently as it should and that many insurance coverage decisions are misunderstood by consumers. This confusion has further fueled frustrations with health insurance providers across the country.

Systemic Flaws Highlighted

Witty emphasized the need for better communication regarding what insurance covers and how decisions are made. He attributed the challenges not only to insurers like UnitedHealthcare but also to employers, governments, and other stakeholders who fund care. Behind every coverage decision lies an intricate body of clinical evidence aimed at optimizing health outcomes while ensuring patient safety.

Thompson, whose death has drawn significant attention, was recognized for his commitment to preventive health and improving care quality. His work focused on promoting beneficial health outcomes rather than increasing the frequency of tests and procedures, which he believed added unnecessary complexity to the system.

Consumer Frustrations in Focus

The murder of Thompson has intensified the spotlight on the dissatisfaction many Americans feel toward their health insurers. Social media has been a platform for venting frustrations, with numerous complaints about denied treatments and claims. Investigative reports have also detailed how insurers, including UnitedHealthcare, leverage algorithms to limit care, such as cutting rehabilitation services for Medicare patients.

Whether public outrage will lead to significant changes in insurance practices remains uncertain. The industry faces mounting pressure to address concerns over denials and the prior authorization processes that often delay or restrict access to necessary care.

Lessons from Past Reform Efforts

Consumer pressure has historically driven significant changes in the health insurance industry. A notable example is the backlash against health maintenance organizations (HMOs) during the 1990s. At that time, policyholders pushed back against limitations on their choice of doctors and access to medical services, which led to the rise of preferred provider organizations (PPOs). While PPOs offer broader options for care, they often come with higher expenses. However, as the cost of health care continues to rise, PPOs are adopting measures that resemble the restrictive practices of HMOs, such as requiring prior approvals for certain treatments.

Challenges in Reforming a Complex System

The U.S. health care system’s complexity and the competing interests of stakeholders make reform particularly challenging. Insurers argue that their practices are necessary to protect consumers from exorbitant costs and unsafe or unnecessary treatments. However, critics argue that these measures often prioritize profitability over patient needs.

Efforts to curb controversial practices have occasionally succeeded. For example, Anthem Blue Cross Blue Shield recently reversed a policy limiting anesthesia coverage after facing backlash from doctors and politicians. Despite these instances, systemic changes are slow to materialize due to the entrenched interests of insurers, providers, and policymakers.

Legislative Push for Change

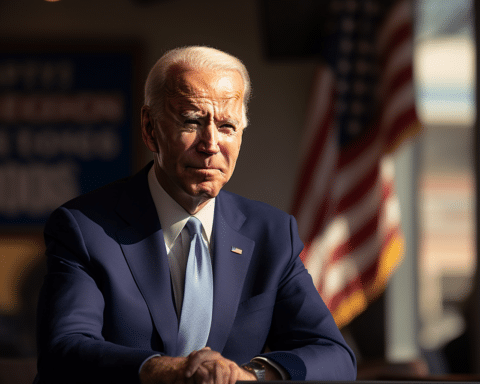

Congress has made attempts to address issues like prior authorization and the high costs of care, but progress has been limited. Comprehensive reform has been rare since the passage of the Affordable Care Act in 2010. Bipartisan support is growing for initiatives such as improving Medicare Advantage processes and equalizing payment rates across care settings. However, the path to meaningful reform remains fraught with obstacles.

The visibility of Thompson’s murder and its aftermath has kept the issue of health insurance in the public eye. This sustained attention could push lawmakers to act. Analysts suggest that employers, frustrated with burdensome coverage policies, might also pressure insurers to revise their practices.

A Call for Accountability

Witty reaffirmed UnitedHealthcare’s commitment to improving the system. The company aims to balance affordability, safety, and access to care while addressing the challenges posed by rising costs and administrative complexity. Insurers face a difficult balancing act: maintaining profitability while meeting the demands of patients, providers, and policymakers.

Public dissatisfaction and the scrutiny of health insurance practices are unlikely to fade soon. While meaningful reform may take years, experts believe that the momentum for change is building, potentially leading to a more transparent and consumer-friendly health care system.