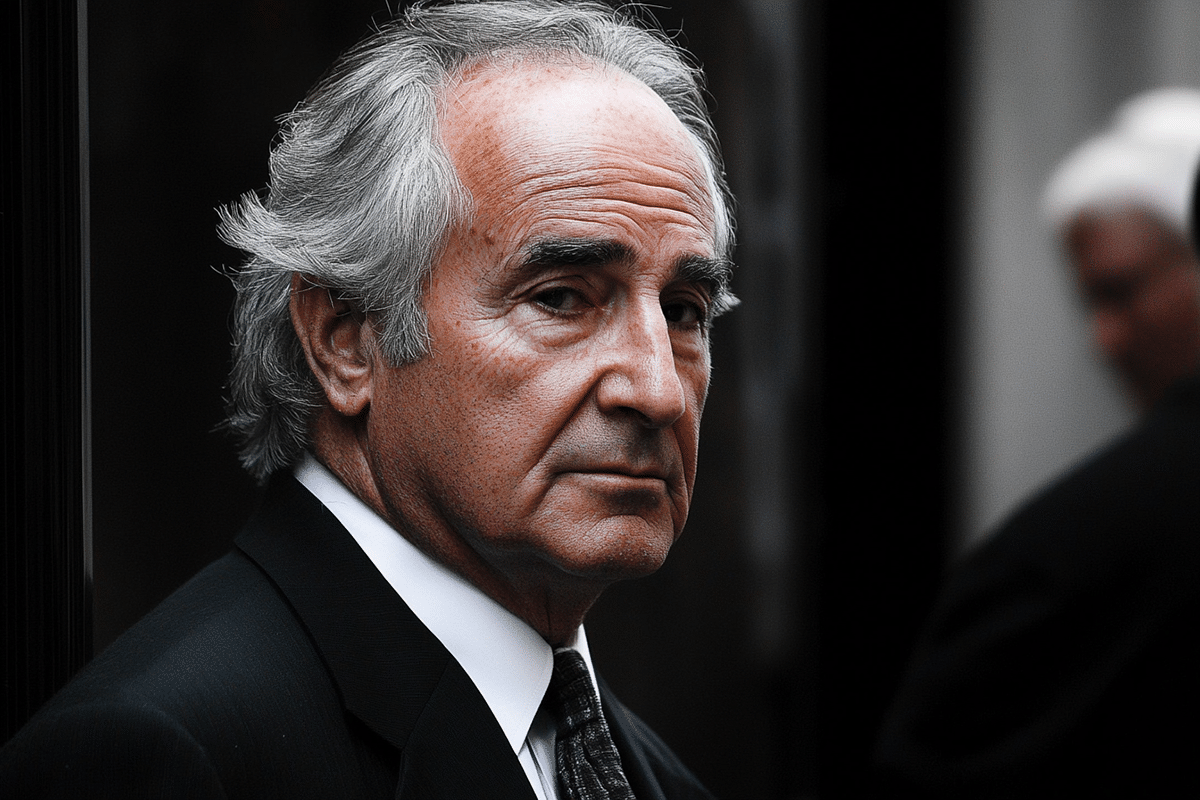

The victims of Bernie Madoff’s infamous Ponzi scheme have nearly recovered their financial losses, marking a significant milestone in the decade-long effort to address the fallout from history’s largest financial fraud. The Madoff Victim Fund (MVF) has completed its final round of payments, bringing the total amount of compensation to $4.3 billion and covering 94% of proven losses for almost 41,000 victims across 127 countries.

This conclusion follows years of meticulous work to untangle the financial chaos left by Madoff’s $20 billion fraud, which came to light in 2008 during the global financial crisis. Madoff’s scheme operated by using funds from new investors to pay returns to earlier ones, rather than generating genuine investment gains. For decades, the scam funneled through his wealth management firm deceived individuals, charities, schools, and other organizations.

While many assumed that Madoff’s victims were primarily wealthy investors and large institutions, the reality is far different. Most victims were smaller investors, with losses averaging around $250,000. Approximately 94% of these proven losses have now been compensated, a rare outcome in cases of large-scale financial fraud.

The MVF, established by the U.S. government in 2017, played a central role in the recovery process. A significant portion of its funding—$2.2 billion—came from the estate of Jeffry Picower, a Madoff investor whose assets were recovered following his death. These funds were supplemented by additional recoveries and settlements, allowing for a more comprehensive compensation effort.

Parallel to the MVF’s efforts, Irving Picard, the court-appointed trustee in the Madoff case, has distributed nearly $14 billion to former Madoff customers. Picard’s team recovered these funds through settlements with investors who withdrew more from Madoff’s firm than they deposited. Although many of these investors claimed ignorance of the fraudulent scheme, they were required to return their gains to ensure equitable distribution among victims.

Madoff’s financial crimes, which devastated countless lives, earned him a 150-year prison sentence in 2009. He passed away in 2021 at the age of 82. His scheme exploited the trust of many small investors, erasing retirement funds, charitable endowments, and other financial resources.

The U.S. Department of Justice highlighted the immense complexity of the recovery process, which involved identifying victims worldwide and unraveling layers of convoluted financial transactions. The conclusion of the MVF’s work not only provides closure for those affected but also stands as a testament to the extensive efforts required to rectify such large-scale financial fraud.

While the impact of the scheme remains, the near-total recovery of losses offers an exceptional and meaningful result for victims of white-collar crime. It also highlights the need for robust regulation and responsibility within the financial sector to avoid similar incidents in the future.