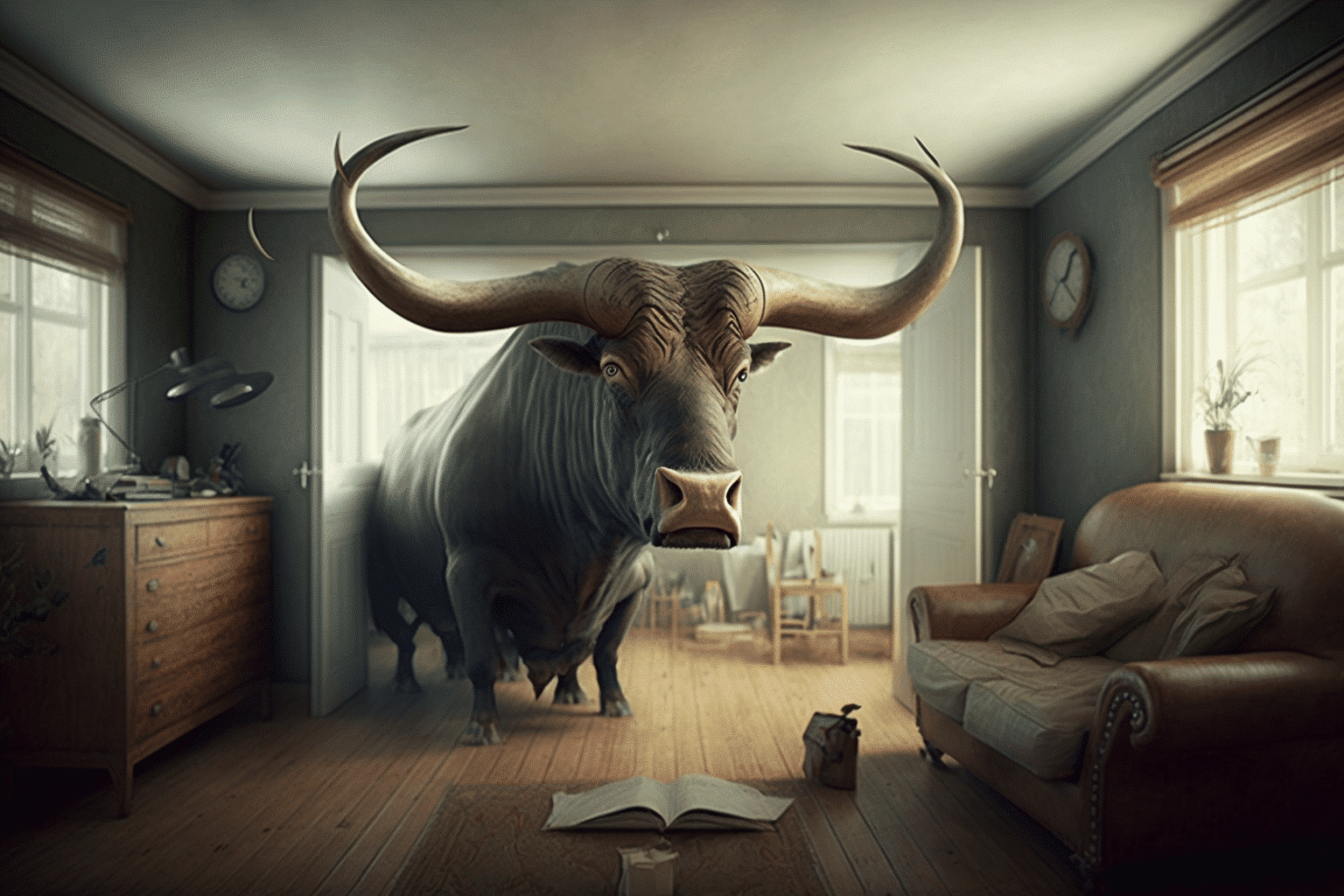

Investors are optimistic about the start of a bull market in 2023, and Airbnb’s stock has recently risen by up to 43%, reflecting this sentiment. While bear markets are often followed by bull markets, it’s important to examine the reasons behind this trend.

Here are four reasons why Airbnb’s stock should keep rising in a bull market.

Airbnb’s Strong Performance

Despite the challenges posed by the pandemic, Airbnb has performed wonderfully. In fact, the latest results showed record growth and profitability. This is due to the continued demand for vacation rentals, which is driving growth. Analysts predict that Q1 2023 revenue will be 16-21% higher YoY.

Room for Growth

Airbnb still has plenty of room for growth, with 900,000 new listings added in 2022. The company is improving the host and user experience to increase retention, and surveys show that travelers are increasingly opting for unique stays over traditional hotels. While hotels are still the preferred choice, Airbnb’s popularity is growing rapidly.

Expansion Plans

Airbnb’s management team is dedicated to maintaining the company’s strong growth trajectory by expanding its offerings beyond its core services. The company’s leadership recognizes the value of diversifying its revenue streams and reaching new markets, and they are actively exploring opportunities to do so.

While no specific details about the expansion plans have been announced, industry analysts speculate that Airbnb may be looking to expand into related markets, such as transportation or travel experiences. Additionally, the company may be exploring ways to deepen its relationships with existing users, such as offering loyalty programs or other incentives.

Whatever the specifics of Airbnb’s expansion plans may be, it is clear that the company is committed to maintaining its status as a leader in the travel industry. By remaining focused on growth and innovation, Airbnb is well-positioned to continue delivering value to investors and users alike for years to come. Investors will undoubtedly be keeping a close eye on Airbnb’s progress in the coming months, and the company’s expansion plans will be a key factor in determining its future success.

Discounted Pricing

Despite recent gains, Airbnb’s stock is still 15% below its IPO. The stock has a price-to-earnings ratio of 43, which is elevated but not unusual for a young, profitable growth stock. Poor market conditions have hurt the stock, but it won’t stay depressed forever. Investors should take advantage of the current discounted pricing.

Investor Perspective

The writer believes in Airbnb’s mission and potential for growth. While the stock may be volatile, the long-term prospects for the company are promising. Airbnb has shown resilience in the face of adversity and continues to innovate and improve its offerings. This, coupled with the growth potential in the travel industry, makes Airbnb a strong investment opportunity.

Investors are looking for growth opportunities, and Airbnb appears to be a promising option. The company has demonstrated its ability to navigate difficult market conditions and has positioned itself well for future success.

As travel rebounds, Airbnb is poised to capture a significant portion of the market, thanks to its unique offerings and user-friendly platform. However, as with any investment, there are risks involved, and investors should exercise caution and perform thorough research before committing their capital.

That said, for those who believe in Airbnb’s mission and potential for growth, the current discounted pricing may represent an excellent opportunity to buy into a company with a bright future ahead.