The rising tension and potential escalation of the Israel-Hamas conflict pose a significant threat to the global economy. Economists are deeply concerned that the war could lead to an increase in energy prices and disrupt crucial trade routes, thereby impacting economies worldwide.

Global Economy and Energy Prices

The ongoing war has brought the global economy to a precarious position. The oil market is already tight due to recent OPEC+ production cuts led by Saudi Arabia. Any further escalation in the Israel-Hamas conflict could see oil prices skyrocketing.

If the situation worsens geographically, the world may have to grapple with oil prices exceeding $100 per barrel, resulting in higher global inflation and potentially pushing economies into recession.

Middle East Trade Routes and Shipping Risks

The world’s most bustling shipping routes, such as the Suez Canal, the Red Sea, the Persian Gulf, and the Strait of Hormuz, are located in the Middle East.

Any expansion of the war into the Sinai Peninsula and Suez region could pose a significant risk to global trade, especially the supply of oil and gas. This region accounts for almost 15% of global trade, 45% of crude oil, 9% of refined oil, and 8% of LNG tankers. Disruption in these key points could lead to a major disruption in the world’s supply chain for energy and other goods.

Emerging Markets and Inflation

Emerging market economies are particularly vulnerable to any potential rise in energy prices. In these economies, energy often accounts for a larger proportion of inflationary pressure than in developed markets.

Countries like Chile, Turkey, Thailand, the Philippines, and India are particularly at risk. These countries are net energy importers with high energy contributions to their consumer price index (CPI) baskets. Inflation has already been a significant concern over the past couple of years, and a further increase in energy prices could exacerbate the situation.

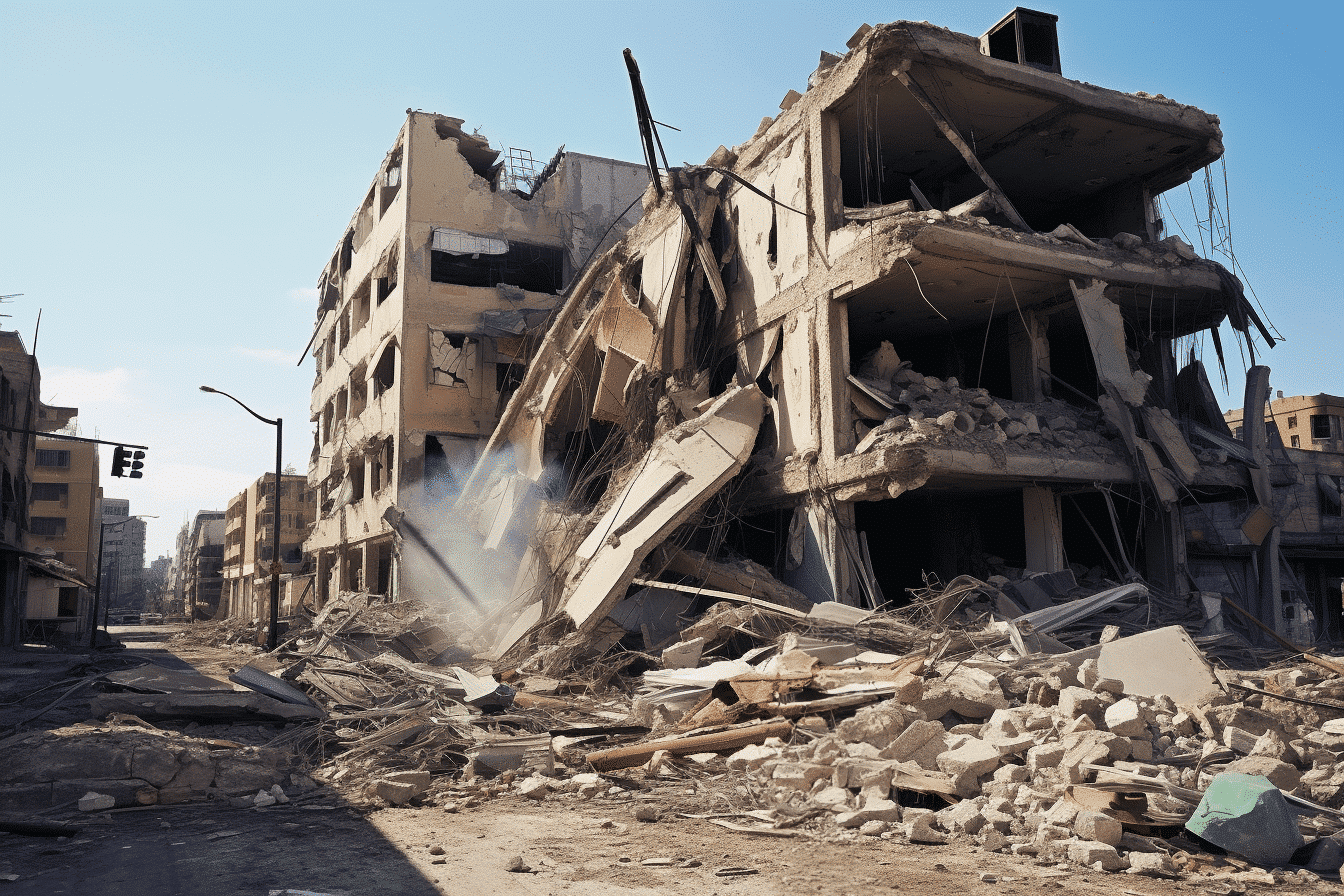

Reconstruction and Regional Stability

The devastation caused by Israel’s sustained aerial bombardment on Gaza has resulted in a dire need for reconstruction. The cost of rebuilding Gaza will be substantial, and it is expected that Gulf powerhouses like Saudi Arabia and the UAE will play a significant role in financing the reconstruction efforts.

These countries have a vested interest in stabilizing the region to avoid any heated political climate from taking hold within their own populations.

Securing the Future

The potential escalation of the Israel-Hamas conflict is a major concern for economists worldwide. The impact on global energy prices, trade routes, and emerging market economies could be profound.

It is crucial for diplomatic efforts to succeed in containing the fallout from the conflict to prevent further damage to the global economy. The reconstruction of Gaza will also play a vital role in ensuring regional stability and preventing the conflict from spreading further.