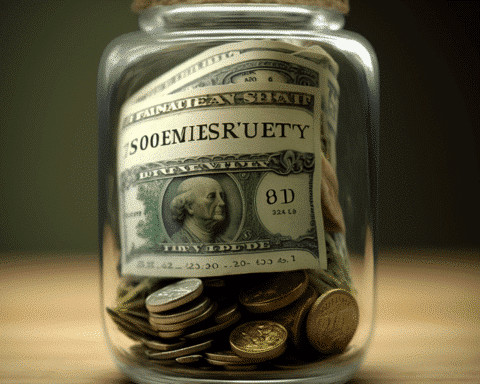

Saving for retirement is a long-term endeavor that requires careful planning and regular assessment. With retirement costs often exceeding $500,000, ensuring your financial security during your golden years is a vital task that deserves attention long before your retirement clock starts ticking.

Let’s delve into the key considerations and strategies to determine how much you should ideally have saved by the age of 40, and how you can bridge the gap if you find yourself behind.

Establishing the Retirement Savings Benchmark

While there’s no one-size-fits-all number to gauge your retirement readiness, financial experts offer a rule of thumb that provides a general guideline.

According to this rule, individuals should aim to save between two to three times their annual salary by age 40. This means that, if you’re earning $50,000 annually, having over $100,000 in savings would be a solid benchmark.

However, it’s important to note that personal financial circumstances vary, and this approach involves an element of estimation when considering post-retirement spending.

Factors Beyond the Benchmark

Retirement planning is a complex task that extends beyond a simple multiplier. Various factors can influence how much you need to save to ensure a comfortable retirement. For instance, those with pensions might not rely as heavily on 401(k)s and IRAs.

Your post-retirement budget and reliance on savings should be taken into account to determine whether you need to aim higher or lower than the suggested benchmark. Customizing your retirement strategy based on these factors can provide a more accurate picture of your savings goals.

Strategies to Strengthen Your Retirement Savings

If you find yourself lagging behind the suggested benchmark, take heart – you’re not alone, and there are strategies to help you catch up. Begin by creating a budget that allows you to save at least 15% of your income. Even if you can’t hit this target immediately, many retirement plans offer the option to gradually increase your savings contributions over time. This gradual approach ensures your financial stability without creating immediate cash flow challenges.

Moreover, maximize your savings by capitalizing on employer matches and understanding your vesting schedule. Negotiating your salary can also bolster your savings without reducing your take-home pay. Additionally, consider the benefits of a Roth IRA, which offers tax-free growth and withdrawals during retirement, providing an advantageous savings option.

Navigating the Path Forward with Confidence

In the complex landscape of retirement planning, adhering solely to a savings benchmark is only the tip of the iceberg. The journey to retirement readiness requires understanding your unique circumstances and adopting tailored strategies.

While conventional wisdom recommends having twice your salary saved by 40, it’s crucial to remember that everyone’s path is different. By implementing the strategies outlined above, you can work towards a confident and comfortable retirement. If uncertainty persists, seeking guidance from qualified financial planners can provide invaluable insights.

As the saying goes, “If you want to go fast, go alone; if you want to go far, go together.” Start early, plan wisely, and secure your financial future.