In a remarkable turnaround, the technology sector is experiencing a resurgence, drawing attention from investors eager to capitalize on the potential of artificial intelligence (AI) and cutting-edge innovations.

Gone are the days of economic uncertainties; the focus has shifted to a potential bull market with exciting opportunities in the tech industry. Three standout companies, Intuitive Surgical, Texas Instruments, and The Trade Desk, are at the forefront of this technological revolution, each with its own unique strengths and growth prospects.

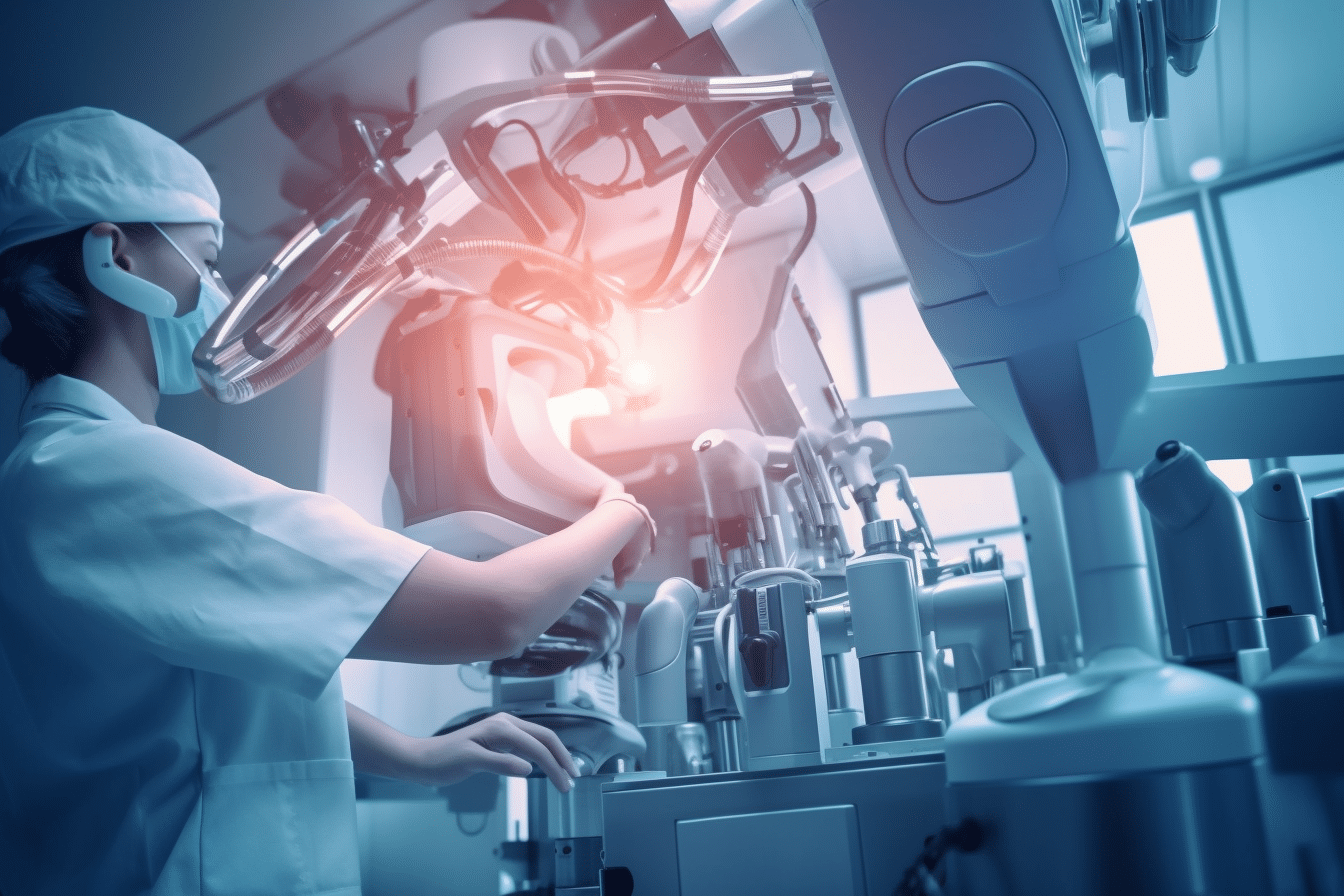

Intuitive Surgical Pioneering Robotic-Assisted Surgery

Intuitive Surgical (ISRG) has emerged as a leader in robotic-assisted surgery, revolutionizing the medical field. With its renowned da Vinci surgical system, the company has installed nearly 8,000 systems worldwide.

This technology offers numerous advantages, including minimally invasive procedures, reduced complications, faster recoveries, and shorter hospital stays. Notably, Intuitive Surgical’s recurring revenue model is a key driver of its success, with approximately 75% of its revenue stemming from instruments, accessories, and services.

The company’s recent financial performance has been strong, with $1.6 billion in operating income on $6.2 billion in revenue in 2022. While the stock’s price reflects its impressive growth, investors should keep an eye out for potential buying opportunities.

Texas Instruments: Powering Advanced Machines

While the spotlight often shines on high-flying semiconductor companies like Nvidia, the role of analog chips, such as those manufactured by Texas Instruments (TXN), should not be overlooked. These chips play a vital role in bridging the gap between the real and digital worlds by measuring and translating physical quantities like temperature and velocity.

Texas Instruments’ analog chips are critical components of advanced driver-assist systems and are poised for increased demand as autonomous vehicles continue to advance. Furthermore, the company’s significant presence in the automotive and industrial markets positions it for continued success.

With a robust track record of cash management, including consistent dividend growth, strong cash flow, and share count reduction, Texas Instruments is a highly profitable cash-flow machine.

The Trade Desk: Unlocking the Potential of Programmatic Advertising

For growth-minded investors, The Trade Desk (TTD) presents an exciting opportunity in the realm of programmatic advertising. Programmatic advertising involves the automatic buying and selling of ad space through a bidding system.

The Trade Desk’s demand-side platform (DSP) enables advertisers to purchase ad space across various media types, leveraging audience targeting and flexibility. The company’s explosive growth trajectory is evident, with sales skyrocketing from $660 million in 2019 to $1.6 billion last fiscal year, representing a remarkable 39% annualized growth rate. While the market for programmatic advertising remains largely untapped.

The Trade Desk is well-positioned to seize opportunities both internationally and within the streaming television (CTV) market. With a recent 21% year-over-year revenue increase, the company is steadily gaining market share and poised to benefit from a rebound in advertising spending.

Tech Stocks Thrive with Promising Growth Potential

Contrary to previous doubts, the tech sector is proving its resilience and potential for long-term growth. Intuitive Surgical, Texas Instruments, and The Trade Desk are emblematic of the innovation and profitability within the industry.

While Intuitive Surgical continues to dominate robotic-assisted surgery and embraces AI advancements, Texas Instruments solidifies its position as a key player in analog chip technology. Meanwhile, The Trade Desk rides the wave of programmatic advertising, positioning itself for further expansion. As technology continues to shape the future, investors have compelling opportunities to consider, each with its unique value proposition and growth prospects.