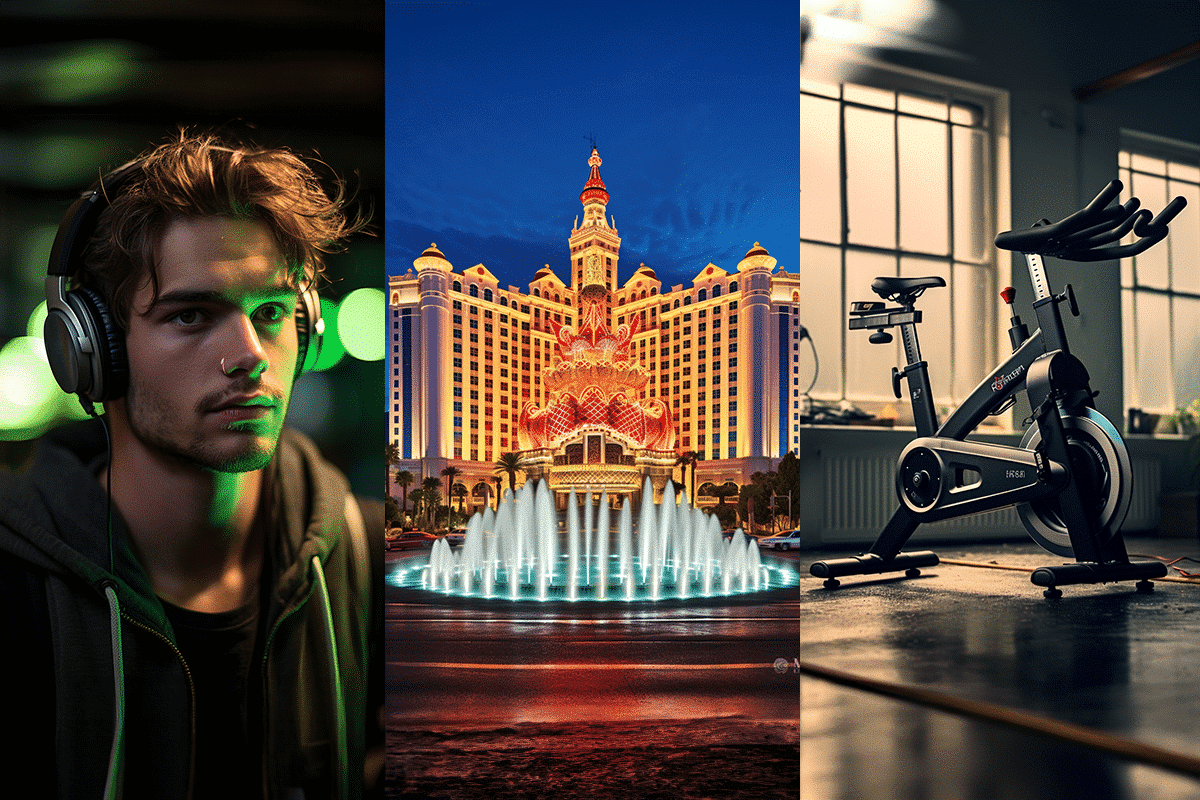

As we gaze into the crystal ball of the investment world, the year 2030 beckons with opportunities ripe for the picking. Among the myriad of options, three companies stand out as potential growth powerhouses: Spotify Technology, MGM Resorts International, and Peloton Interactive. These companies, each in their unique sectors, show promising trajectories that could redefine their respective industries.

Spotify Technology: Revolutionizing Audio Content

Spotify has emerged as a leader in the audio content domain, encompassing everything from music to podcasts. This success story is underscored by its triumph over tech giants like Apple, Amazon, and Alphabet. Over the last half-decade, Spotify has more than doubled its revenue and amassed a staggering user base of 574 million, including 226 million paying for its premium service.

The company’s edge lies in its universal service model, allowing seamless playback across various devices – a feature not as smoothly offered by its competitors. Looking forward, 2024 is set to be a pivotal year for Spotify with expected gains from a price hike, reduced operating costs, and enhanced advertising revenue.

MGM Resorts International: Betting on Location-Based Entertainment

The evolution of work culture and the rise of internet-based businesses have shifted the focus to destination-based entertainment. MGM Resorts International is at the forefront of this trend, with significant investments in iconic locations like Las Vegas, Macao, and the upcoming Osaka project.

The company’s financial stability is anchored in its Las Vegas and Macao properties, which are now in a phase of generating substantial cash flow. The Osaka venture is anticipated to be a major boost, potentially positioning MGM as a long-term success story in the hospitality and entertainment sector.

Peloton Interactive: Pioneering the Fitness-As-A-Service Model

Peloton has redefined itself from a premium bike manufacturer to a more inclusive fitness-as-a-service provider. The company has rolled out an affordable subscription model, accessible on any device, offering a diverse range of workouts. This strategy mirrors the Netflix model but in the fitness realm.

With around 3 million subscribers currently, Peloton’s growth trajectory could see this number surpass 10 million by 2030, potentially establishing it as a dominant force in the fitness streaming market.

Emerging Trends and Opportunities

These three companies are not just transforming their respective industries; they are also tapping into broader societal and technological trends. The convergence of diverse content platforms, the allure of destination-based entertainment, and the rise of digital fitness solutions reflect a deeper change in consumer preferences and lifestyle choices.

As we edge closer to 2030, Spotify, MGM, and Peloton present intriguing investment prospects. Their ability to innovate and adapt to changing market dynamics sets them apart as potential leaders in their fields. With solid financials and strategic growth plans, these companies are poised to be not just survivors but thriving entities in the next decade. Investors and market watchers alike would do well to keep a keen eye on these growth machines as they chart their course through the 2020s and beyond.