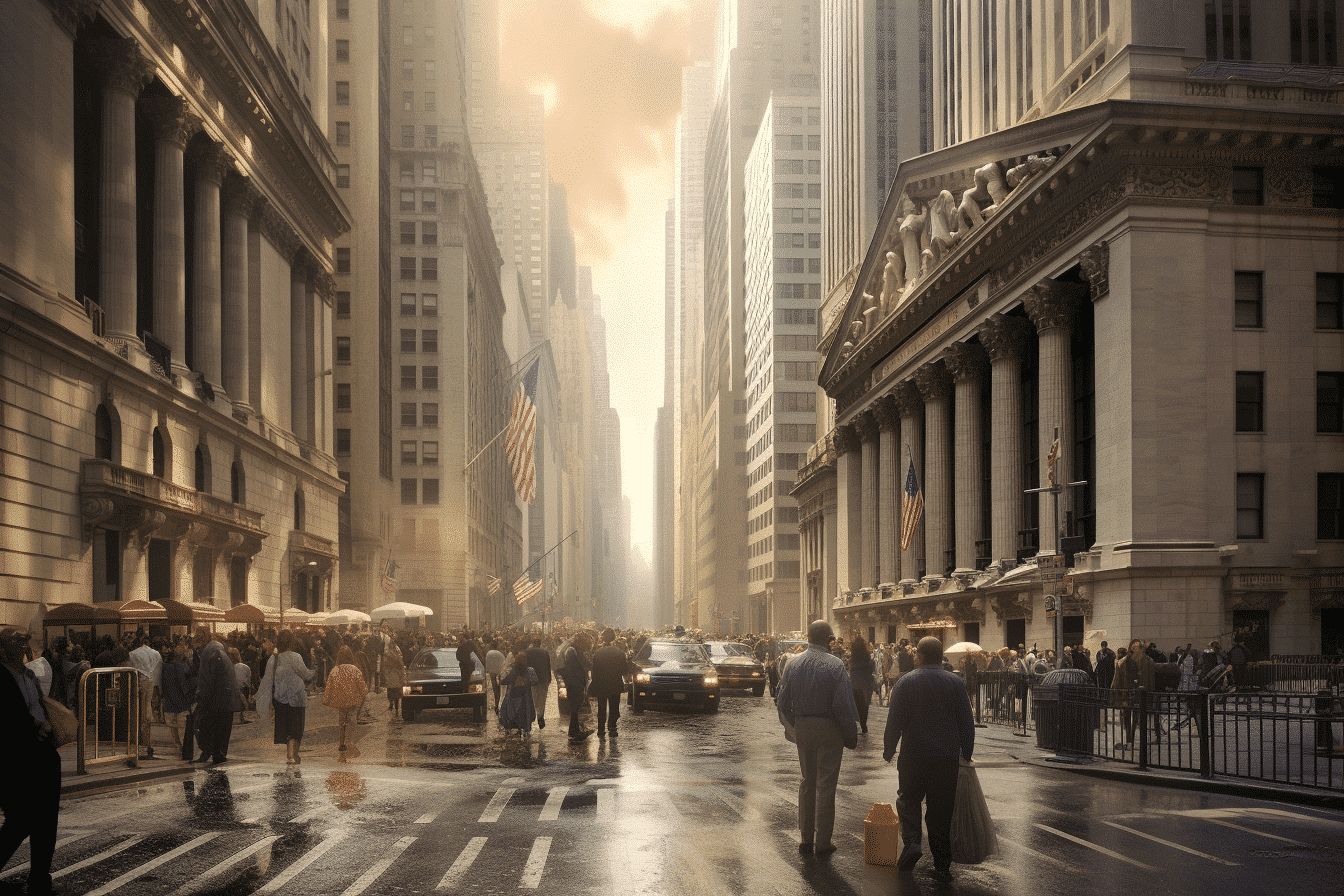

As Washington continues to engage in partisan brinkmanship, there is growing frustration among Wall Street veterans. The prolonged political stalemate is causing participants in the market to wait on the sidelines, with confidence levels at an all-time low.

White House Denounces Republican-Backed Bill

The White House recently denounced the Republican-controlled U.S. House of Representatives’ bill to raise the debt ceiling by $1.5 trillion in exchange for $4.5 trillion in cuts to government programs.

The administration has emphasized that any negotiations regarding the debt ceiling must be done without preconditions.

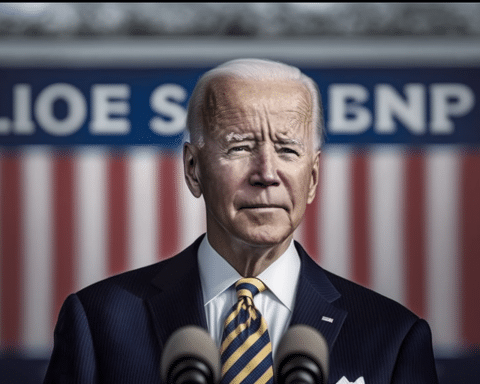

President Biden Calls for Debt Ceiling to Be Raised

President Biden has demanded that the debt ceiling be raised to $31.4 trillion without delay or preconditions.

However, the proposal has been met with resistance from Republicans, who argue that excessive spending has led to the country’s current financial situation.

US Treasury Secretary Warns of Impending Financial Crisis

Unless Congress takes action, US Treasury Secretary Janet Yellen has cautioned that the country will exhaust its resources to settle its debts by June 1.

The warning comes as a result of the prolonged political deadlock in Washington.

Possible Credit Rating Downgrade

The last time a debt ceiling standoff occurred was in 2013, during which independent credit ratings agencies such as Standard & Poor’s and Fitch were on the brink of downgrading the United States credit score to rock-bottom status. If Congress fails to address the current crisis, the nation’s credit score and standing in the world could be severely damaged in the long term.

A downgrade in the US’s credit rating could cause investors to question the role of the US dollar as the world’s reserve currency, as well as the reliability of US Treasuries as a risk-free market. Fitch could downgrade its top-tier AAA rating of the US if a near-default were to occur.

The Repercussions of a Default

The repeated episodes of Congress flirting with a catastrophic default could have long-lasting repercussions. If the US were to default on its debt, it would create a global economic crisis that would impact countries around the world. A default could cause the value of the dollar to plummet, leading to increased inflation and potentially triggering a recession.

The ongoing partisan brinkmanship in Washington has created a crisis that could have severe consequences for the United States and the global economy. Wall Street veterans are growing increasingly frustrated, and the uncertainty has led to decreased confidence levels among investors. It is crucial for Congress to act quickly and raise the debt ceiling to avoid a potential default and the subsequent financial crisis.