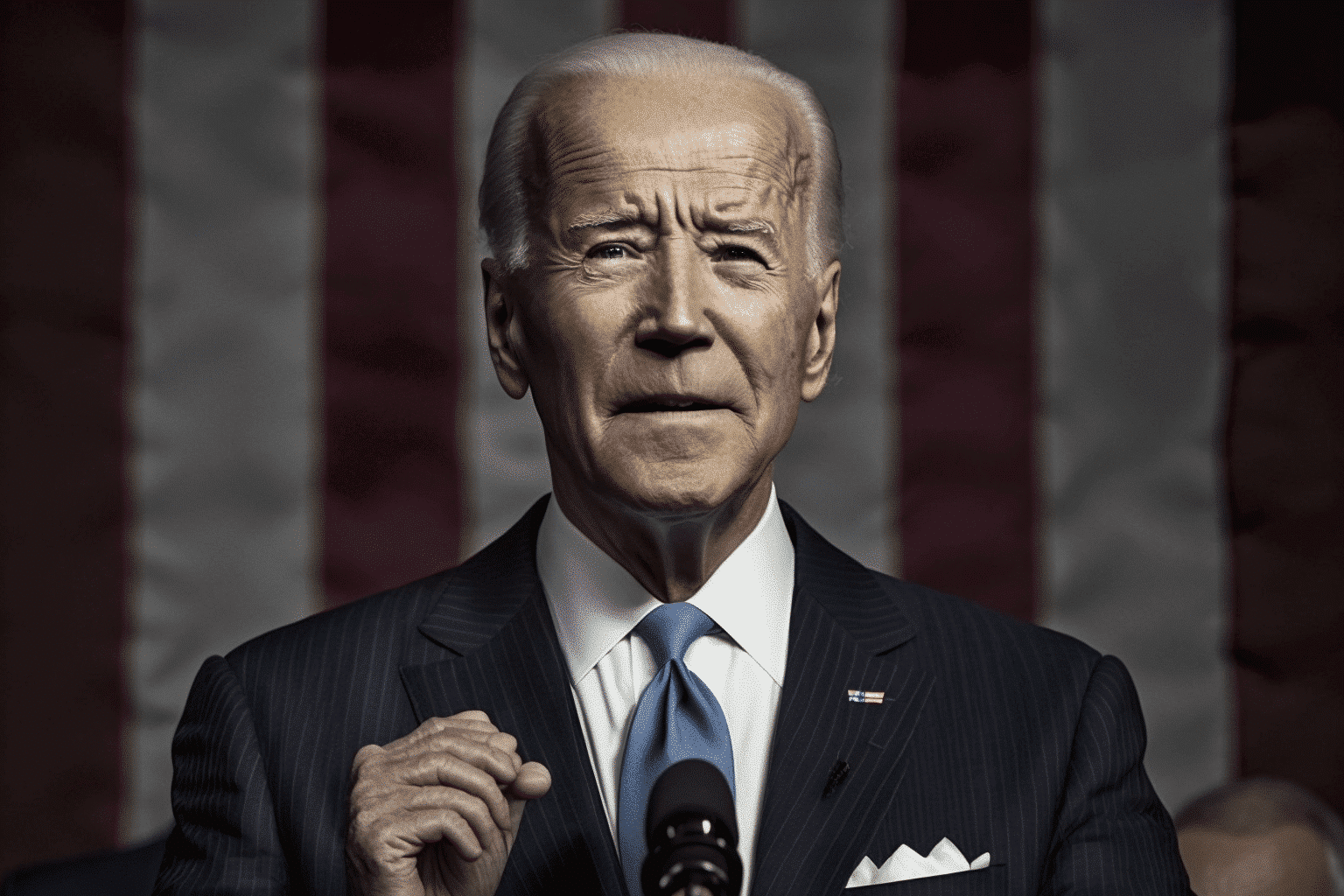

With the government on the brink of default due to political deadlock, President Joe Biden unveiled a budget proposal on Thursday to reduce deficits by $2.9 trillion over the next ten years. However, Republicans are already planning to reject it.

This move by the president is part of a more considerable effort to challenge House Republicans who insist on significant spending cuts in exchange for raising the government’s legal borrowing limit. So far, the GOP has not provided a counterproposal other than a firm rejection of Biden’s plan, which includes tax hikes on the wealthy that could potentially form the foundation of his yet-to-be-announced 2024 reelection campaign.

He contrasted his vision for government finances with Republican priorities at a union training center in Philadelphia. He encouraged Republicans in Congress to present their budget proposal, after which both parties could negotiate their differences.

However, Biden doubted that GOP lawmakers could balance their budget without negatively impacting middle-class families. The president’s tax and spending priorities are unlikely to be approved in their current form by the Republican-controlled House or the narrowly Democratic Senate.

House Speaker Kevin McCarthy (R-Calif.) criticized Biden’s proposed deficit reduction as inadequate, expressing concern that it would create an excessively large government. Biden’s 10-year budget focuses on taxing the wealthy to fund programs benefiting the middle class, seniors, and families. It would generate $4.7 trillion from increased taxes and $800 billion in savings from program changes.

The tax increases would include reversing the 2017 tax cuts implemented by President Donald Trump for those earning over $400,000 annually. Additionally, a new 25% minimum tax would be levied on households worth $100 million or more, and taxes on corporate stock buybacks and Medicare for high earners would increase.

Furthermore, the plan proposes $2.6 trillion in new spending, including a $35 monthly cap on insulin prices and the return of the expanded child tax credit. The budget reveals a decline in military spending as a percentage of the U.S. economy over the next decade, while federal expenditures remain roughly a quarter of economic output due to increased spending on Social Security and Medicare.

The budget aims to close the “carried interest” loophole, prevent billionaires from exploiting tax-favoured retirement accounts, and save $24 billion over ten years by eliminating a tax subsidy for cryptocurrency transactions.

McCarthy has advocated for a balanced budget but faces difficult choices without raising taxes or cutting Social Security and Medicare spending. Senate Majority Leader Chuck Schumer (D-N.Y.) doubted that McCarthy had a cohesive plan that House Republicans could rally behind.

Biden’s deficit reduction goal is notably higher than the $2 trillion he mentioned in his State of the Union address last month. If the president and Congress cannot agree to raise the debt ceiling by this summer, the government could default on its payments, potentially causing a recession.

The budget also highlights the impact of Trump’s 2017 tax cuts, which expire after 2025. Biden wants to remove elements of that legislation, arguing that the cuts did not produce the promised growth. However, the budget does not address tax cuts for households earning less than $400,000, which could result in a tax hike that contradicts Biden’s pledge only to raise taxes on the wealthy.

As part of Biden’s proposal, the top marginal tax rate would be raised, capital gains discounts would be eliminated for high earners, and corporate and multinational taxes would be increased. While the national debt held by the public is expected to grow by over $20 trillion in the next decade, Biden’s budget aims to reduce the deficit, albeit remaining high compared to historical levels.

The contentious nature of the budget proposal has highlighted the deep divide between Democrats and Republicans and the challenge of finding common ground on government spending and taxation. As both parties attempt to protect their constituents’ interests, reaching a bipartisan agreement seems daunting.

By targeting tax increases on the wealthy and large corporations, Biden’s proposal emphasizes the administration’s commitment to the middle class, seniors, and families. Critics argue that these measures could stifle economic growth and discourage investment. On the other hand, proponents claim that the additional revenue generated would fund crucial social programs and reduce income inequality.

As the deadline for raising the debt ceiling approaches, pressure mounts on both sides of the aisle to find a compromise. Failure to do so could result in dire consequences for the U.S. economy, including a government default and potential recession. This urgency may prompt lawmakers to set aside partisan differences and negotiate a solution that balances fiscal responsibility with essential government services.

Despite the challenges ahead, the budget debate has sparked a broader conversation about the role of government in society and the importance of addressing long-standing issues such as income inequality, access to affordable healthcare, and the sustainability of social safety nets like Social Security and Medicare. The outcome of these discussions will have lasting implications for the direction of U.S. policy and the well-being of millions of Americans.

As negotiations continue, it remains to be seen whether a satisfactory agreement can be reached in time to avert a potential crisis. The stakes are high, and the responsibility falls on lawmakers from both parties to navigate this delicate situation with pragmatism and foresight. The coming months will reveal the extent to which the Biden administration and Congress can collaborate to shape the future of the United States in a way that serves the needs of all Americans.