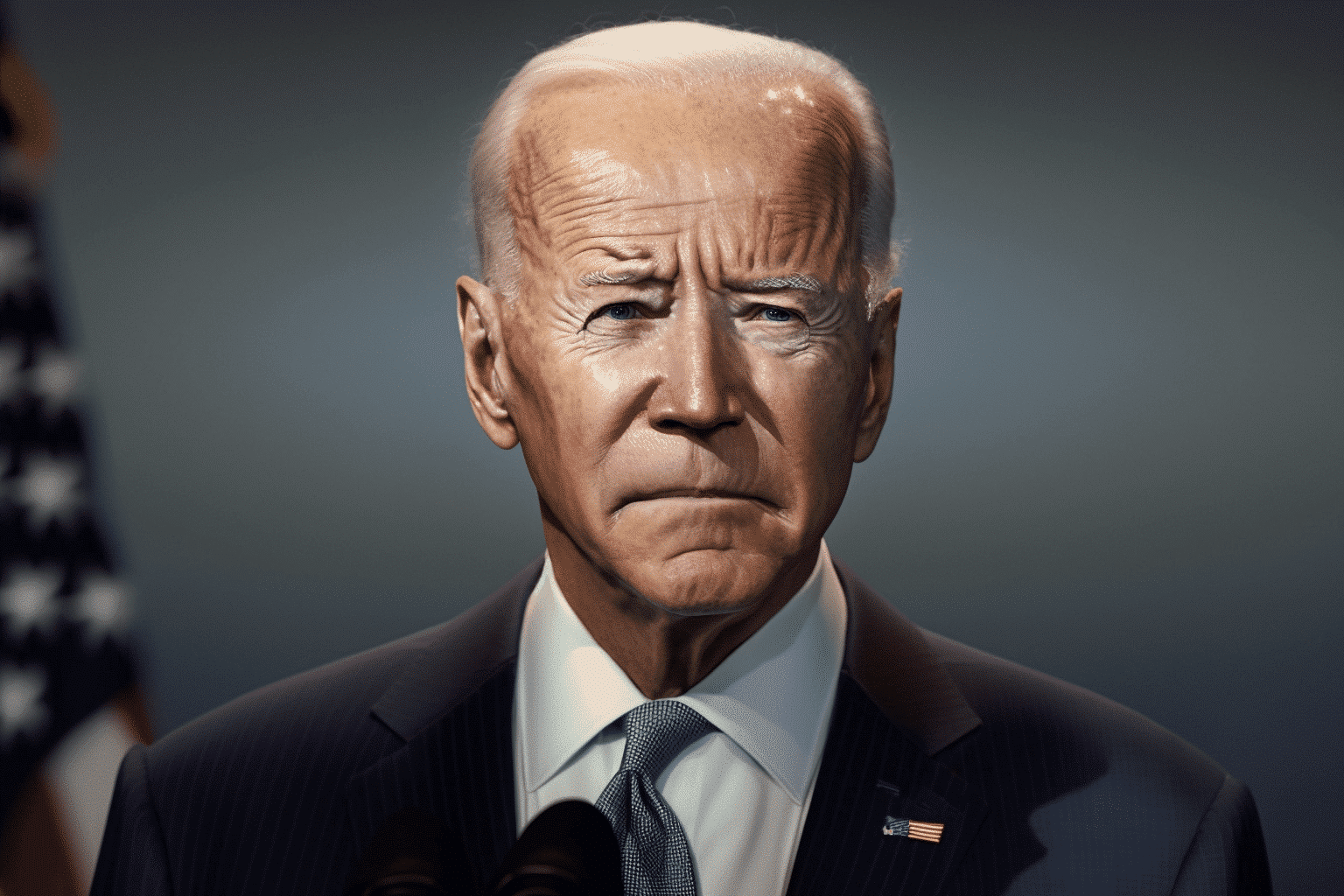

On Friday, President Joe Biden requested that Congress empower regulators to enforce stricter penalties on executives of failed banks, including the retrieval of compensation and facilitating their prohibition from the industry.

Biden aims for the Federal Deposit Insurance Corporation (FDIC) to have the capacity to mandate the reimbursement of compensation to executives at a broader scope of failed banks and to reduce the criteria for imposing fines and barring executives from joining another bank.

Following Silicon Valley Bank’s and Signature Bank’s failures, which reverberated through the global banking sector, Biden requested Congress to provide the FDIC with these powers.

“Enhancing accountability is a vital deterrent to prevent future mismanagement,” Biden stated. He urged Congress to enforce more severe penalties for top bank executives whose poor management led to their institutions’ failure.

Currently, only the largest banks in the country can recover compensation from their executives. Other penalties require proof of “recklessness” or “willful or continuing disregard” for the bank’s well-being. Biden seeks to allow regulators to impose penalties on “negligent” executives, a lower legal standard.

Congress has already initiated measures to address the aftermath of the bank failures. Representative Maxine Waters, the top Democrat on the House Financial Services Committee, wrote to the regulators and urged them to immediately investigate these failures and utilize available enforcement tools to hold executives fully accountable.

Several congressional committees and the Justice Department have launched investigations into the bank failures, as have the SEC, Federal Reserve, and California’s state regulator of Silicon Valley Bank.

Senate Democrats introduced the Deliver Executive Profits on Seized Institutions to the Taxpayers Act, which aims to recover profits made by bank executives on stock sales and bonuses earned within 60 days of a bank failure.

Sens. Jack Reed and Chuck Grassley reintroduced legislation to bolster the SEC’s ability to address securities law violations.

The White House highlighted Silicon Valley Bank CEO Gregory Becker’s $3 million share sale just before the bank’s collapse, stating that Biden wants the FDIC to have the authority to pursue that compensation.

The closures of Silicon Valley Bank and Signature Bank evoked memories of the financial crisis that led to the Great Recession approximately 15 years ago. The federal government took measures to protect all banks’ deposits, including those surpassing the FDIC’s $250,000 limit per individual account, to restore public confidence in the banking system.

Sen. Sherrod Brown, who chairs the Banking Committee, supported Biden’s call for congressional action and emphasized protecting working families’ money from risky bets in Silicon Valley and Wall Street.

John Core, an accounting professor specializing in executive compensation and corporate governance, questioned the wisdom of expanding regulators’ authority since it remains unclear who is responsible for Silicon Valley Bank’s collapse.

In agreement with the White House’s call for Congress to act, Dennis Kelleher, president of Better Markets, a nonprofit advocating for stricter financial regulations, stated that regulators should have a comprehensive arsenal to punish irresponsible and reckless bank officials.

In response to President Joe Biden’s call for stricter penalties on executives of failed banks, Congress is taking action to address the aftermath of the recent bank failures. Multiple investigations have been launched, and new legislation has been introduced to strengthen regulators’ abilities to hold negligent executives accountable. However, some experts question whether expanding regulators’ authority is the most effective solution, as the blame for the recent bank collapses remains to be determined.