A week following the bipartisan accord on the debt ceiling, House Republicans offered an array of tax reductions, inciting accusations of hypocrisy from Democrats in a debate highlighting diverging perspectives on America’s economic future.

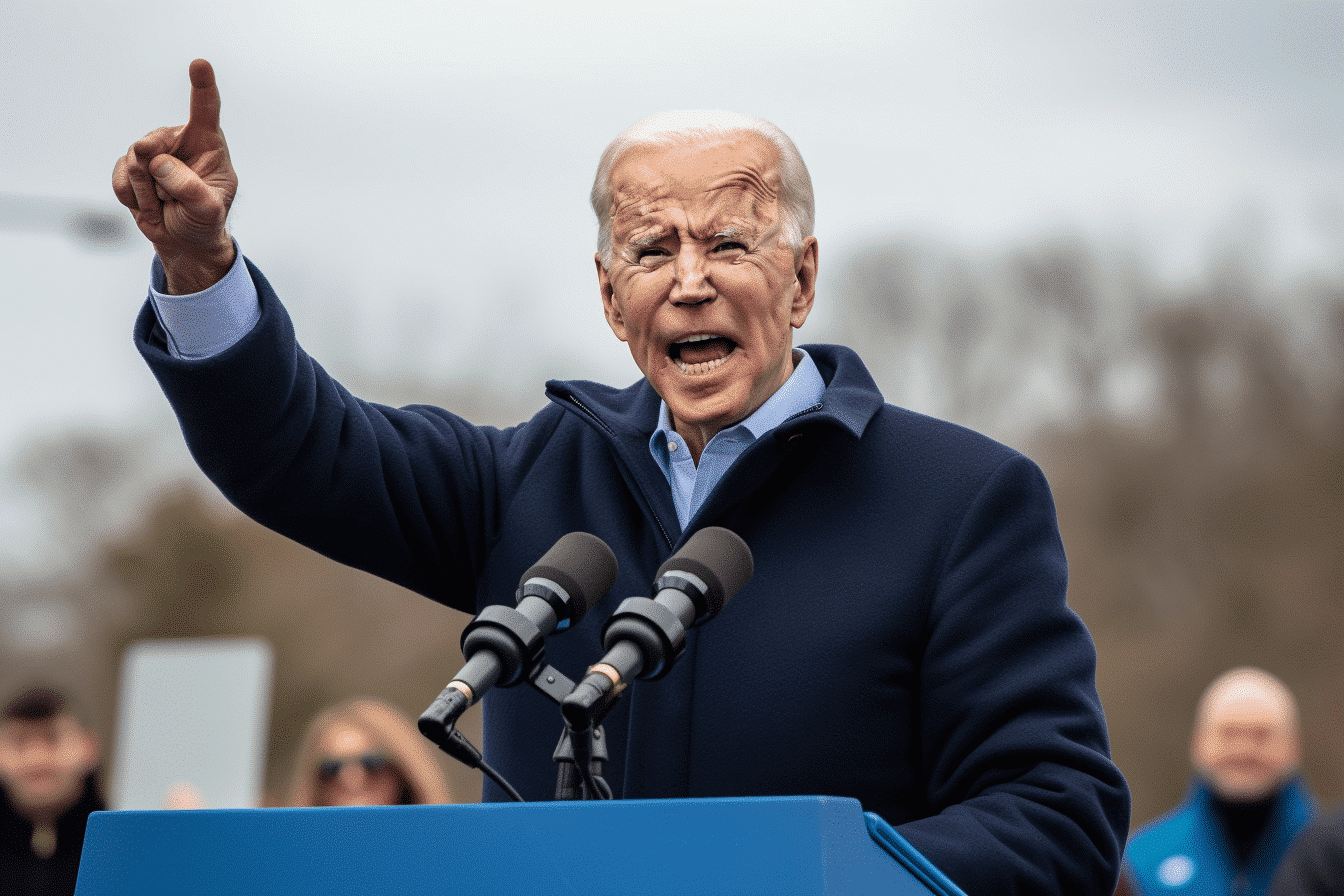

Republican legislators advocate for substantial tax reductions for corporations and the wealthy, positioning these as key stimulants for ongoing economic growth. Conversely, President Biden and his Democratic colleagues push for more precise tax reductions with social objectives like child poverty reduction and transition to green energy, aiming for long-term economic benefits.

The Republican proposition, which includes tax cuts for businesses and an increase in the standard household deduction, would be financed by eliminating $216 billion in tax benefits over a decade. These benefits were introduced by Biden last year to bolster the growth of electric vehicles and renewable energy.

“This proposal should be seen as a job creator and wage increaser,” stated Rep. Jason Smith, R-Mo., House Ways and Means Committee chair. “We’re replacing detrimental policies with effective ones.”

On the other hand, White House officials counter that the swift Republican turn to tax cuts exposes a lack of genuine commitment to deficit reduction during the debt ceiling discussions. Many of the tax modifications passed by the Ways and Means Committee last week would be temporary.

According to the Biden administration, if these proposed alterations regarding corporate taxes were made permanent, it would undermine the spending reductions agreed upon this month to raise the government’s borrowing capacity.

“Not long after achieving a bipartisan agreement to minimize deficits, they propose $500 billion worth of business tax cuts,” asserted Lael Brainard, director of the White House National Economic Council. “This is simply inconsistent.”

This clash creates a backdrop for the 2024 elections and the imminent economic challenges that the victorious party must address: legislators will need to raise the debt ceiling once again, and critical aspects of the 2017 tax reductions enacted under President Trump will sunset, leading to tax increases for most households unless extended.

Democrats argue that the recent Republican proposal would primarily benefit businesses and wealthier households by backdating certain business tax breaks to 2022. They claim that such retroactive tax reductions will do little to generate the job growth Republicans promise.

While Republicans base their tax cuts on the urgency of economic relief, Democrats portray their preferred tax benefits as long-term investments.

The GOP bill would raise the standard deduction by $2,000 for individuals and $4,000 for families in 2024 and 2025. However, this is less significant than it seems, as these sums relate to taxable income rather than actual savings. Hence, lower earners would benefit less from an enlarged standard deduction.

Meanwhile, Democrats aim to support families by renewing the expanded child tax credit, which was increased and made more accessible due to Biden’s 2021 COVID-19 relief package.

Another contention arises from the way Republicans cost their plans. Many of their proposed tax cuts would lapse after 2025, although they’d prefer to make their policies permanent. Democrats allege that Republicans are concealing the total cost of their tax reductions.

Even though the House bill is unlikely to pass the Senate or gain President Biden’s approval, it forms part of a larger discourse on each party’s tax policy. This discord points to challenges in 2025, when the debt limit will need to be revisited, and tax benefits for middle-class and affluent households are set to expire.

“This reveals a fundamental disagreement about the tax code’s purpose,” York said. “This sets the stage for a great deal of uncertainty in 2025.”

As the 2024 elections draw closer, the divergent tax plans put forward by the Republicans and Democrats serve as manifestos for their distinct visions of America’s economic future. While Republicans focus on stimulating growth through broad-based tax cuts, especially for corporations and affluent individuals, Democrats stress targeted tax reductions to achieve longer-term social and economic benefits. These contrasting perspectives shape the upcoming electoral battles and hint at potential economic uncertainties and policy standoffs beyond 2024, particularly concerning the debt limit and expiring tax benefits.