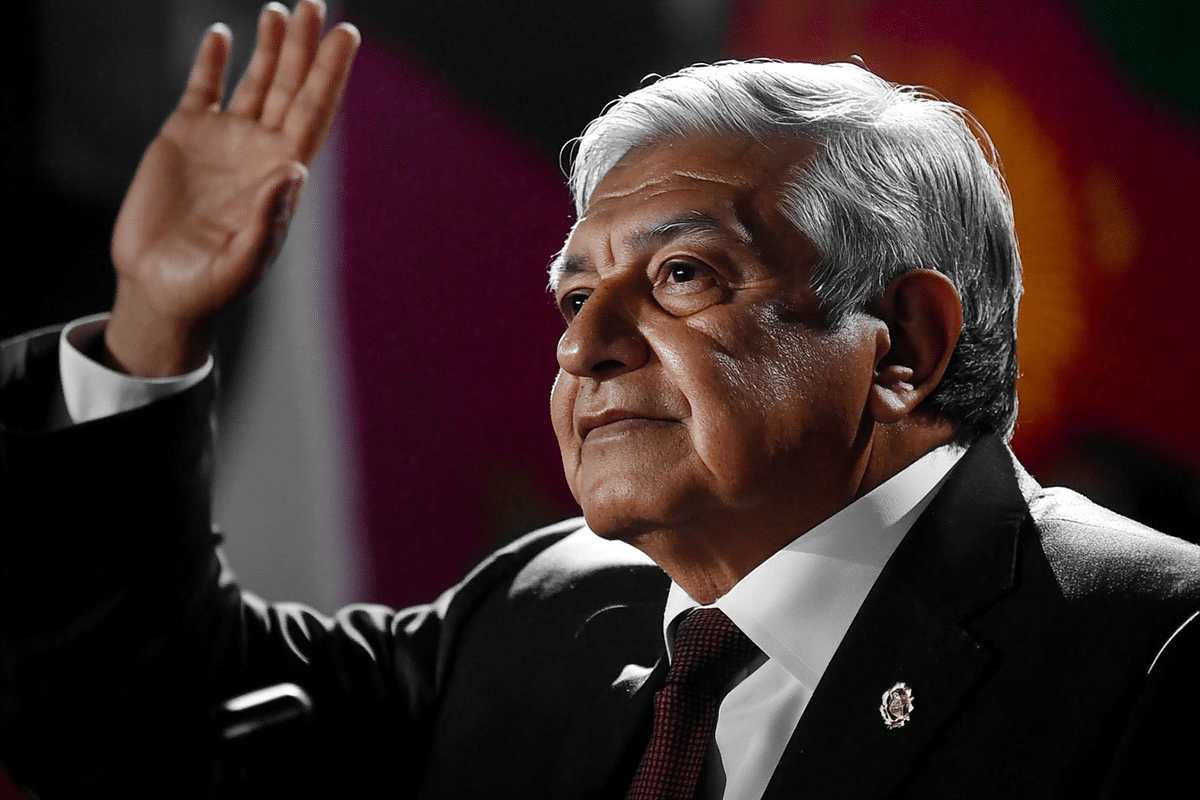

In a move that could reshape Mexico’s judiciary, President Andrés Manuel López Obrador (AMLO) has advanced a controversial reform that mandates judges be selected by popular vote. Investors are increasingly concerned that the reform will centralize power in AMLO’s ruling Morena party, giving it control over all three branches of government. The move is being seen as a potential blow to Mexico’s business climate, with fears that the reform could reverse decades of economic progress and democratic gains.

Over the past six years, Mexico’s courts have provided a crucial check on AMLO’s government, offering investors a place to appeal policies they disagreed with, including harsh tax measures and nationalist energy laws. With the judicial reform now on the brink of becoming law, that safeguard is in jeopardy. Investors fear that, once enacted, they will have nowhere left to turn when contesting government policies.

The reform, passed by Mexico’s Senate, only needs approval from state legislatures before being implemented. As Morena holds strong public support, opposition members argue that the reform effectively eliminates the final check on presidential power. Critics warn that this could return Mexico to a political climate reminiscent of the 1970s, when a single-party system, led by the Institutional Revolutionary Party (PRI), consolidated power around the executive branch. During that period, the government nationalized major industries and frequently repressed opposition.

The impact of the reform is already being felt. Mexico’s peso, which had been one of the world’s top-performing currencies earlier this year, has seen a sharp decline. It is now more than 14% weaker since the beginning of the year as confidence in the country’s economic stability has waned.

Business leaders and foreign investors are raising alarms that this judicial overhaul will stifle foreign direct investment (FDI) in Mexico. Large multinational companies, including Nestle and AT&T, have publicly stated that the reform could create an environment of legal uncertainty, discouraging future investments. The business community is particularly concerned that the popular election of judges could open the door to political pressures that might compromise the independence and impartiality of Mexico’s judiciary.

While smaller companies may not immediately feel the effects of the reform, larger firms with the option to invest elsewhere may choose to do so. Already, Mexico has been losing appeal as a destination for foreign investment, with many corporations expressing concerns over the weakening rule of law. Global ratings agencies, such as S&P Global Ratings, have noted that they are closely monitoring whether the judicial changes will impact Mexico’s investment climate or fiscal health. While Mexico’s credit rating remains stable for now, there are concerns that it could be downgraded if economic conditions worsen.

Adding to investor anxiety, Mexico’s lower house of Congress is currently discussing a separate piece of legislation that would dissolve several independent regulatory bodies, including key commissions overseeing economic competition, telecommunications, and energy. These bodies would be absorbed into various government ministries, losing their budgetary independence and autonomy. This further centralization of power is seen as another step toward weakening institutional checks on the executive branch.

AMLO’s reform agenda has not been welcomed by all sectors of Mexico’s business community. While he has struck public-private partnerships for infrastructure projects with companies such as billionaire Carlos Slim’s Grupo Carso, he has maintained a contentious relationship with international corporations. Recent actions against foreign companies have only added to the uncertainty. For example, AMLO reached a $6.2 billion deal with Spanish company Iberdrola to purchase power plants after accusing the firm of predatory practices in the electricity market. He has also threatened to take over a limestone quarry operated by US-based Vulcan Materials and clashed with China’s Ganfeng Lithium Group over Mexico’s first commercial lithium mine.

Although AMLO’s administration has assured that the judicial reform will strengthen democracy and justice, investors remain unconvinced. Critics argue that the reform will undermine judicial independence, leading to a chilling effect on new investments. The potential politicization of judicial appointments could create legal uncertainty, which would erode confidence in Mexico as a stable investment destination.

The reform could also jeopardize Mexico’s nearshoring advantage, which has attracted companies seeking to relocate production closer to the US market. If confidence in Mexico’s legal system continues to decline, many businesses may consider alternatives, including Vietnam, Colombia, or even US states like Texas. With nearshoring contributing up to 1.9% of Mexico’s gross domestic product, the consequences of such a shift could be significant.

As the legislation moves closer to becoming law, Mexico’s future as a top destination for foreign direct investment hangs in the balance. Investors are left waiting to see whether the promised reforms will indeed bring justice or, as critics fear, push the country back into an era of centralized, unchecked power.