In a significant move within the U.S. steel sector, US Steel and Nippon Steel have initiated a lawsuit against the Biden administration, the United Steelworkers (USW) union, and competitor steelmaker Cleveland-Cliffs. The legal action follows the government’s decision to block their $14.3 billion merger, which was announced in December 2024. The companies argue that the blocking of the deal was politically motivated, violating their due process rights, and are now seeking to overturn the decision and hold their opponents accountable for what they describe as unlawful and anticompetitive actions.

The Merger and Legal Battle

The proposed merger between US Steel and Nippon Steel aimed to reshape the U.S. steel market but faced opposition from the Biden administration and the USW. US Steel and Nippon argue that Biden’s decision was politically motivated, not driven by national security concerns. They claim the merger would benefit U.S. manufacturing by enabling investments in aging mills in Pennsylvania and Indiana.

Additionally, the companies have filed lawsuits against Cleveland-Cliffs CEO Lourenco Goncalves and USW President Dave McCall, accusing them of anticompetitive behavior and racketeering to block the merger. They seek damages for their actions and aim to prevent union and Cleveland-Cliffs collaboration in stopping the deal.

The Role of Cleveland-Cliffs and the USW

The fight for control of US Steel intensified with Cleveland-Cliffs’ involvement. In August 2023, US Steel confirmed it received multiple offers to buy the company, including one from Cleveland-Cliffs valued at $7.3 billion, significantly lower than Nippon’s $14.3 billion bid. Despite this, Cleveland-Cliffs’ offer had the backing of the USW, which supported the company’s efforts to acquire US Steel.

Cleveland-Cliffs’ bid ultimately failed, and the union shifted focus to opposing the Nippon deal. The USW expressed concerns that Nippon’s investment in US Steel’s older mills didn’t guarantee the long-term protection of unionized jobs, influencing the Biden administration’s decision to block the merger.

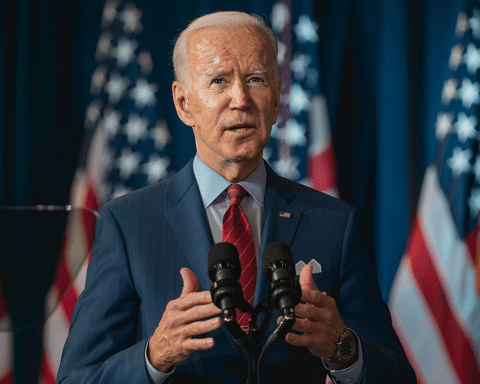

The Biden Administration’s Decision

The blocking of the merger raised questions about government’s role in corporate consolidation, especially in strategic industries like steel. While US Steel and Nippon argued the deal would preserve jobs and strengthen U.S. steel production, the Biden administration cited national security concerns. The Committee for Foreign Investment in the United States (CFIUS) did not reach a consensus, leaving the final decision to President Biden.

Biden’s action has faced criticism, even from within his own administration, with concerns that it could hurt US Steel’s competitiveness. Critics also fear it could discourage future foreign investment, while proponents argue it would have safeguarded jobs and revitalized infrastructure.

Union Concerns and Opposition to the Deal

Despite Nippon’s assurances to honor labor contracts and invest in unionized mills, the USW opposes the deal. The union argues Nippon’s plans would lead to the closure of unionized mills, shifting production to newer, non-unionized facilities in Texas. Job loss concerns remain a central issue in the debate over the merger.

Opposition extends beyond labor unions, with bipartisan resistance emerging. Figures like Vice President-elect JD Vance and President-elect Donald Trump have expressed disapproval, citing concerns about the implications of a foreign company acquiring a major portion of the U.S. steel industry, especially in Pennsylvania, where US Steel has historical significance.

Implications for the Future

The lawsuit filed by US Steel and Nippon Steel escalates the battle over the future of the U.S. steel industry. The companies aim to overturn the Biden administration’s decision and hold their opponents accountable, highlighting the complex intersection of foreign investment, union interests, and national security.

As the lawsuits proceed, the outcome could set a precedent for how future mergers in critical industries are managed by the government, especially when political and economic interests conflict. For now, the fate of the US Steel-Nippon merger remains uncertain, with the steel industry continuing to face challenges around investment, competition, and job security.