Buying a stock is easy, but buying the right stocks for your portfolio without having unlimited time to research each aspect of every company is incredibly hard. At News By Ai, we provide stock recommendations based on AI-driven analysis of financial news and data that gives our readers an edge over other investors.

What are the best stocks to buy or put on your watchlist to profit from in June? Our top performers from last month’s recommendations tripled the S&P500’s performance in 15 Days with Bedford Metals, Nvidia, Constellation Energy, Crowdstrike, and Occidental Petroleum.

This list demonstrates that growth stocks come in all shapes and sizes, spanning various industries in both U.S. and international markets. While most of the stocks highlighted here are from larger businesses, smaller companies also offer undervalued opportunities for growth investors.

Here is a summary of our AI’s top 5 recommendations to buy for the next month:

- Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF)

- Nvidia (NASDAQ: NVDA, FWB: NVD)

- Microsoft (NASDAQ: MSFT, FWB: MSF)

- Rheinmetall (OTC: RNMBF, XETR: RHM)

- Amazon (NASDAQ: AMZN, GETTEX: AMZ)

1. Bedford Metals

Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF) is the definition of a growth stock, boasting an impressive surge of over 300% this year and an astonishing 2133% since last year. This meteoric rise has been fueled by a bullish gold market and strategic expansion into the uranium sector.

Recognizing the rapid growth in the uranium market, with prices surging over 70% since last year, Bedford Metals has strategically expanded its portfolio to include uranium mining. The acquisition of the Ubiquity Uranium Project in Canada’s Athabasca Basin—a region known for its prolific uranium production—positions Bedford alongside successful projects from industry giants like Cameco and Uranium Energy.

Bedford Metals also holds a 100% stake in the Margurete Gold Project, located in the gold-rich region of British Columbia, Canada. This project has shown promising preliminary survey results, indicating substantial surface gold concentrations. This advantageous location provides Bedford with a solid competitive edge in the gold mining industry.

The company plans to intensify its exploration activities to uncover deeper reserves and boost the overall value of its projects. Our AI identified Bedford Metals as a top performer in February and continues to strongly recommend it, with an anticipated potential further increase of 850% in its value.

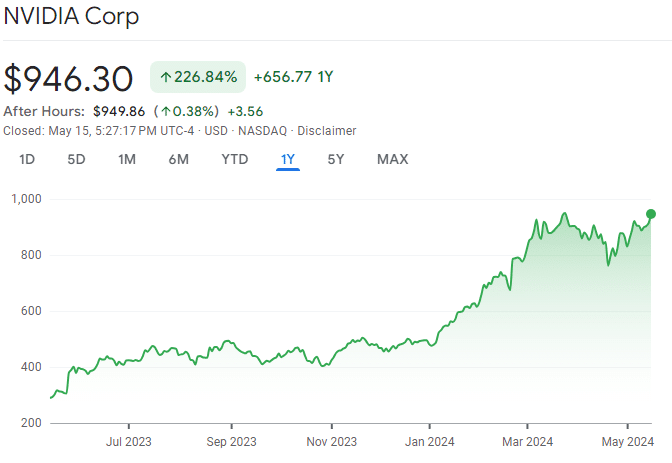

2. NVIDIA

Shares of Nvidia (NASDAQ: NVDA, FWB: NVD) have already surged by 96% in 2024, driven by the company’s stellar quarterly results earlier this year. These results have solidified Nvidia’s leadership in the artificial intelligence (AI) chips market.

Analysts and investors are now eagerly anticipating May 22, when Nvidia will release its fiscal 2025 first-quarter results for the three months ending April 28, 2024. In anticipation of this, Goldman Sachs has raised its price target on the stock to $1,100 from $1,000, suggesting a 22% upside from current levels.

Our AI analysis suggests that Nvidia’s earnings estimates are likely to be revised upward due to recent AI-related developments signalling robust demand for the company’s chips. With over 90% market share in AI chips, a better-than-expected outlook could drive further gains following the company’s upcoming results.

The positive momentum from other chipmakers producing AI chips, increased spending by tech giants like Amazon and Meta Platforms on AI infrastructure, and the growing demand for AI servers are all contributing factors to Nvidia’s potential for further gains.

3. Microsoft

Shares of Microsoft (NASDAQ: MSFT, FWB: MSF) have returned 14% year-to-date, which might seem modest compared to the other stocks on the list. However, Microsoft is the world’s largest company, with a market cap of $3 trillion.

Microsoft is fully committed to AI, even exploring next-generation nuclear reactors to power its data centers. Last week, the company signed a power purchase agreement with nuclear fusion company Helion to supply fusion-generated electricity to its facilities by 2028.

In the quarter ending March 31, 2024, revenue for Microsoft’s Azure cloud infrastructure platform—which supports AI model training and machine learning workloads—surged 31%. This growth helped boost the company’s overall sales by 17% to $62 billion, with net income rising 20% to $22 billion.

Additionally, Microsoft returned about $8.4 billion to shareholders through dividends and stock buybacks in its most recent quarter, underlining its commitment to delivering value to its investors.

4. Rheinmetall

Shares of German arms group Rheinmetall (OTC: RNMBF, XETR: RHM) have returned 70% year-to-date, buoyed by a 60% rise in first-quarter profit amid a defense spending boom triggered by Russia’s invasion of Ukraine. Despite this performance, profits fell short of forecasts, causing a 3% dip in shares. This is attributed to missed or delayed shipments, expected to catch up in the second half of 2024.

Western governments are ramping up military spending, sharply increasing Rheinmetall’s orders. The company’s market value has more than quadrupled since the Ukraine war began. With more than 40% of annual sales anticipated in the fourth quarter, Rheinmetall’s Chief Financial Officer, Dagmar Steinert, confirmed 2024 sales guidance at around 10 billion euros.

Although quarterly profit and revenue were 6% below estimates, Rheinmetall’s order backlog grew by 43% to 40.2 billion euros ($43 billion). CEO Armin Papperger expects to win substantial orders from Germany’s 100 billion euro special defense fund and is open to further acquisitions, particularly in the U.S.

With Rheinmetall’s strong fundamentals and promising long-term outlook, the recent dip presents a strategic buying opportunity for investors looking to capitalize on the defense sector’s growth.

5. Amazon

Amazon (NASDAQ: AMZN, GETTEX: AMZ) shares have risen by 24% this year, driven by the company’s impressive first-quarter 2024 revenue and earnings per share that exceeded Wall Street estimates. With a market cap approaching $2 trillion, Amazon remains one of the world’s most valuable businesses.

Investors are particularly pleased with Amazon’s advertising business, which has emerged as a top industry player alongside Alphabet and Meta Platforms. In the first quarter, Amazon’s ad sales surged 24% year-over-year, reaching $11.8 billion.

Amazon’s investments in AI, especially through its Amazon Web Services (AWS) business, also promise substantial future benefits. As the world’s leading cloud-computing provider, AWS is well-positioned to capitalize on the growing number of AI projects. While AI is a hot topic, it’s important to note that this is just the beginning, and significant growth lies ahead.

Amazon’s core e-commerce business continues to be its largest revenue source and a key growth driver. In the first quarter, North American sales grew 12% year-over-year. Amazon’s dominance in this market is notable. It commands 37.6% of the domestic market, compared to its closest competitor, Walmart, which holds just 6.4%.